Duke Energy 2014 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

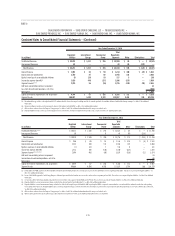

Year Ended December 31, 2014

(in millions)

Regulated

Utilities

International

Energy

Commercial

Power

Total

Reportable

Segments Other Eliminations Total

Unaffi liated Revenues $ 22,228 $ 1,417 $ 255 $ 23,900 $ 25 $ — $ 23,925

Intersegment Revenues 43 — — 43 80 (123) —

Total Revenues $ 22,271 $ 1,417 $ 255 $ 23,943 $ 105 $ (123) $ 23,925

Interest Expense $ 1,093 $ 93 $ 58 $ 1,244 $ 400 $ (22) $ 1,622

Depreciation and amortization 2,759 97 92 2,948 118 — 3,066

Equity in earnings of unconsolidated affi liates (3) 120 10 127 3 — 130

Income tax expense (benefi t)(a) 1,628 449 (171) 1,906 (237) — 1,669

Segment income(b)(c)(d) 2,795 55 (55) 2,795 (334) (10) 2,451

Add back noncontrolling interest component 14

Loss from discontinued operations, net of tax (576)

Net income $ 1,889

Capital investments expenditures and acquisitions $ 4,744 $ 67 $ 555 $ 5,366 $ 162 $ — $ 5,528

Segment Assets 106,657 5,132 6,278 118,067 2,453 189 120,709

(a) International Energy includes a tax adjustment of $373 million related to deferred tax impact resulting from the decision to repatriate all cumulative historical undistributed foreign earnings. See Note 22 for additional

information.

(b) Commercial Power recorded a pretax impairment charge of $94 million related to OVEC. See Note 11 for additional information.

(c) Other includes costs to achieve the Progress Energy merger. See Notes 2 and 25 for additional information about the merger and related costs.

(d) Regulated Utilities includes an increase in the litigation reserve related to the criminal investigation of the Dan River coal ash spill. See Note 5 for additional information.

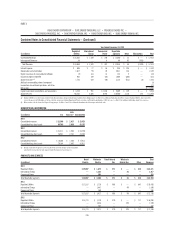

Year Ended December 31, 2013

(in millions)

Regulated

Utilities

International

Energy

Commercial

Power

Total

Reportable

Segments Other Eliminations Total

Unaffi liated Revenues(a)(b)(c) $ 20,871 $ 1,546 $ 254 $ 22,671 $ 85 $ — $ 22,756

Intersegment Revenues 39 — 6 45 90 (135) —

Total Revenues $ 20,910 $ 1,546 $ 260 $ 22,716 $ 175 $ (135) $ 22,756

Interest Expense $ 986 $ 86 $ 61 $ 1,133 $ 416 $ (6) $ 1,543

Depreciation and amortization 2,323 100 110 2,533 135 — 2,668

Equity in earnings of unconsolidated affi liates (1) 110 7 116 6 — 122

Income tax expense (benefi t) 1,522 166 (148) 1,540 (335) — 1,205

Segment income(a)(b)(c)(d)(e)(f)(g) 2,504 408 (88) 2,824 (238) (12) 2,574

Add back noncontrolling interest component 16

Income from discontinued operations, net of tax 86

Net income $ 2,676

Capital investments expenditures and acquisitions $ 5,049 $ 67 $ 268 $ 5,384 $ 223 $ — $ 5,607

Segment Assets 99,884 4,998 6,955 111,837 2,754 188 114,779

(a) In May 2013, the PUCO approved a Duke Energy Ohio settlement agreement that provides for a net annual increase in electric distribution revenues beginning in May 2013. This rate increase impacts Regulated Utilities. See

Note 4 for additional information.

(b) In June 2013, NCUC approved a Duke Energy Progress settlement agreement that included an increase in rates in the fi rst year beginning in June 2013. This rate increase impacts Regulated Utilities. See Note 4 for additional

information.

(c) In September 2013, Duke Energy Carolinas implemented revised customer rates approved by the NCUC and the PSCSC. These rate increases impact Regulated Utilities. See Note 4 for additional information.

(d) Regulated Utilities recorded an impairment charge related to Duke Energy Florida’s Crystal River Unit 3. See Note 4 for additional information.

(e) Regulated Utilities recorded an impairment charge related to the letter Duke Energy Progress fi led with the NRC requesting the NRC to suspend its review activities associated with the combined construction and operating

license (COL) at the Harris site. Regulated Utilities also recorded an impairment charge related to the write-off of the wholesale portion of the Levy investments at Duke Energy Florida in accordance with the 2013 Settlement.

See Note 4 for additional information.

(f) Other includes costs to achieve the Progress Energy merger. See Notes 2 and 25 for additional information about the merger and related costs.

(g) Other includes gain from the sale of Duke Energy’s ownership interest in DukeNet. See Note 12 for additional information on the sale of DukeNet.