Duke Energy 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

PART II

are estimated by applying an average revenue per kilowatt-hour (kWh) or per

thousand cubic feet (Mcf) for all customer classes to the number of estimated

kWh or Mcf delivered but not billed. Unbilled wholesale energy revenues are

calculated by applying the contractual rate per megawatt-hour (MWh) to the

number of estimated MWh delivered but not yet billed. Unbilled wholesale

demand revenues are calculated by applying the contractual rate per megawatt

(MW) to the MW volume delivered but not yet billed. The amount of unbilled

revenues can vary signifi cantly from period to period as a result of numerous

factors, including seasonality, weather, customer usage patterns, customer mix

and the average price in effect for customer classes.

Pension and Other Post-Retirement Benefi ts

The calculation of pension expense, other post-retirement benefi t expense

and net pension and other post-retirement assets or liabilities require the use

of assumptions and election of permissible accounting alternatives. Changes

in assumptions can result in different expense and reported asset or liability

amounts, and future actual experience can differ from the assumptions. Duke

Energy believes the most critical assumptions for pension and other post-

retirement benefi ts are the expected long-term rate of return on plan assets

and the assumed discount rate. Additionally, the health care cost trend rate

assumption is critical to Duke Energy’s estimate of other post-retirement

benefi ts.

Duke Energy has historically utilized the Society of Actuaries’ (SOA)

published mortality data in developing a best estimate of mortality as part of

the calculation of the pension obligation (qualifi ed and non-qualifi ed) and other

post-retirement benefi t obligation. On October 27, 2014, the SOA published

updated mortality tables for U.S. plans (RP-2014) and an updated improvement

scale, which both refl ect improved longevity. Based on an evaluation of the

mortality experience of Duke Energy’s pension plan participants, the updated

SOA study of mortality tables and recent additional studies of mortality

improvement, Duke Energy adopted an adjusted version of the SOA’s new RP-

2014 mortality tables with an updated generational improvement scale (BB-2D)

previously published by the SOA for purposes of measuring its U.S. pension

(qualifi ed and non-qualifi ed) and other post-retirement benefi t obligations as

of December 31, 2014. The change to the mortality assumption increased Duke

Energy’s pension obligation (qualifi ed and non-qualifi ed) and other post-

retirement benefi t obligation by $201 million and $7 million, respectively, as of

December 31, 2014.

Duke Energy elects to amortize net actuarial gains or losses in excess

of the corridor of 10 percent of the greater of the market-related value of plan

assets or plan projected benefi t obligation, into net pension or other post-

retirement benefi t expense over the average remaining service period of active

covered employees. Prior service cost or credit, which represents the effect on

plan liabilities due to plan amendments, is amortized over the average remaining

service period of active covered employees.

Duke Energy maintains non-contributory defi ned benefi t retirement

plans. The plans cover most U.S. employees using a cash balance formula.

Under a cash balance formula, a plan participant accumulates a retirement

benefi t consisting of pay credits based upon a percentage of current eligible

earnings based on age and years of service and current interest credits. Certain

employees are covered under plans that use a fi nal average earnings formula.

Duke Energy provides some health care and life insurance benefi ts

for retired employees on a contributory and non-contributory basis. Certain

employees are eligible for these benefi ts if they have met age and service

requirements at retirement, as defi ned in the plans.

As of December 31, 2014, Duke Energy assumes pension and other post-

retirement plan assets will generate a long-term rate of return of 6.50 percent.

The expected long-term rate of return was developed using a weighted average

calculation of expected returns based primarily on future expected returns across

asset classes considering the use of active asset managers, where applicable.

Equity securities are held for their higher expected returns. Debt securities are

primarily held to hedge the pension liability. Hedge funds, real estate and other

global securities are held for diversifi cation. Investments within asset classes

are to be diversifi ed to achieve broad market participation and reduce the

impact of individual managers on investments. In 2013, Duke Energy adopted

a de-risking investment strategy for its pension assets. As the funded status of

the plans increase, over time the targeted allocation to return seeking assets will

be reduced and the targeted allocation to fi xed-income assets will be increased

to better manage Duke Energy’s pension liability and reduced funded status

volatility. Based on the current funded status of the plans, the asset allocation

for the Duke Energy pension plans has been adjusted to 65 percent fi xed-income

assets and 35 percent return-seeking assets and the asset allocation for the

Progress Energy pension plans has been adjusted to 60 percent fi xed-income

assets and 40 percent return-seeking assets. Duke Energy regularly reviews

its actual asset allocation and periodically rebalances its investments to the

targeted allocations when considered appropriate.

The assets for Duke Energy’s pension and other post-retirement plans are

maintained in a master trust. Duke Energy also invests other post-retirement

assets in the Duke Energy Corporation Employee Benefi ts Trust (VEBA I). The

investment objective of VEBA I is to achieve suffi cient returns, subject to a

prudent level of portfolio risk, for the purpose of promoting the security of plan

benefi ts for participants. VEBA I is passively managed.

Duke Energy discounted its future U.S. pension and other post-retirement

obligations using a rate of 4.1 percent as of December 31, 2014. Discount

rates used to measure benefi t plan obligations for fi nancial reporting purposes

refl ect rates at which pension benefi ts could be effectively settled. As of

December 31, 2014, Duke Energy determined its discount rate for U.S. pension

and other post-retirement obligations using a bond selection-settlement portfolio

approach. This approach develops a discount rate by selecting a portfolio of high

quality corporate bonds that generate suffi cient cash fl ow to match the timing

of projected benefi t payments. The selected bond portfolio is derived from a

universe of non-callable corporate bonds rated Aa quality or higher. After the

bond portfolio is selected, a single interest rate is determined that equates the

present value of the plan’s projected benefi t payments discounted at this rate

with the market value of the bonds selected.

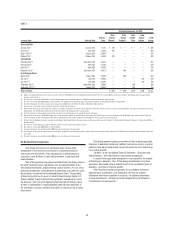

Future changes in plan asset returns, assumed discount rates and

various other factors related to the participants in Duke Energy’s pension and

post-retirement plans will impact future pension expense and liabilities. Duke

Energy cannot predict with certainty what these factors will be in the future. The

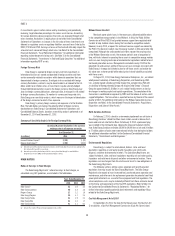

following table presents the approximate effect on Duke Energy’s 2014 pretax

pension expense, pretax other post-retirement expense, pension obligation and

other post-retirement benefi t obligation if a 0.25 percent change in rates were

to occur.

Qualifi ed and Non-

Qualifi ed Pension Plans Other Post-Retirement Plans

(in millions) +0.25% -0.25% +0.25% -0.25%

Effect on 2014 pretax pension and other post-retirement expense

Expected long-term rate of return $ (19) $ 19 $ (1) $ 1

Discount rate (17) 16 (2) 2

Effect on pension and other post-retirement benefi t obligation at December 31, 2014

Discount rate $ (198) $ 203 $ (20) $ 21