Duke Energy 2014 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

150

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

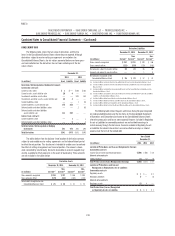

Combined Notes to Consolidated Financial Statements – (Continued)

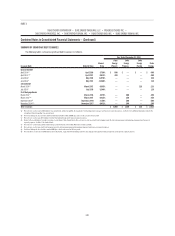

December 31, 2013

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Emission allowances $ 63 $ 1 $ 21 $ 3 $ 18 $ 20 $ 21

Renewable energy certifi cates 82 16 64 64 — 2 —

Gas, coal and power contracts 180 — — — — 156 24

Wind development rights 86 — — — — — —

Other 76 — — — — — —

Total gross carrying amounts 487 17 85 67 18 178 45

Accumulated amortization – gas, coal and power contracts (73) — — — — (60) (13)

Accumulated amortization – wind development rights (12) — — — — — —

Accumulated amortization – other (24) — — — — — —

Total accumulated amortization (109) — — — — (60) (13)

Total intangible assets, net $ 378 $ 17 $ 85 $ 67 $ 18 $ 118 $ 32

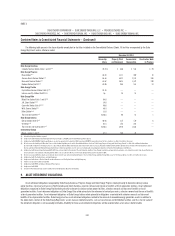

Amortization Expense

The following table presents amortization expense for gas, coal and power

contracts, wind development rights and other intangible assets.

December 31,

(in millions) 2014 2013 2012

Duke Energy $6 $13 $14

Duke Energy Ohio 2812

Duke Energy Indiana 111

The table below shows the expected amortization expense for the next fi ve

years for intangible assets as of December 31, 2014. The expected amortization

expense includes estimates of emission allowances consumption and estimates

of consumption of commodities such as gas and coal under existing contracts,

as well as estimated amortization related to the wind development projects.

The amortization amounts discussed below are estimates and actual amounts

may differ from these estimates due to such factors as changes in consumption

patterns, sales or impairments of emission allowances or other intangible

assets, delays in the in-service dates of wind assets, additional intangible

acquisitions and other events.

(in millions) 2015 2016 2017 2018 2019

Duke Energy $11 $8 $7 $7 $7

Duke Energy Ohio 2 1 1 1 1

Duke Energy Indiana 5 3 2 2 2

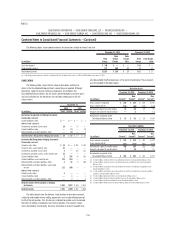

12. INVESTMENTS IN UNCONSOLIDATED AFFILIATES

EQUITY METHOD INVESTMENTS

Investments in domestic and international affi liates that are not controlled

by Duke Energy, but over which it has signifi cant infl uence, are accounted for

using the equity method. As of December 31, 2014 and 2013, the carrying

amount of investments in affi liates with carrying amounts greater than zero

approximated the amount of underlying equity in net assets.

The following table presents Duke Energy’s investments in unconsolidated affi liates accounted for under the equity method, as well as the respective equity in

earnings, by segment.

Years Ended December 31,

2014 2013 2012

(in millions) Investments Equity in earnings Investments Equity in earnings Equity in earnings

Regulated Utilities $ 3 $ (3) $ 4 $ (1) $ (5)

International Energy 69 120 82 110 134

Commercial Power 258 10 252 7 14

Other 28 3 52 6 5

Total $ 358 $ 130 $ 390 $ 122 $ 148

During the years ended December 31, 2014, 2013 and 2012, Duke Energy

received distributions from equity investments of $154 million, $144 million and

$183 million, respectively, which are included in Other assets within Cash Flows

from Operating Activities on the Consolidated Statements of Cash Flows.

Signifi cant investments in affi liates accounted for under the equity

method are discussed below.

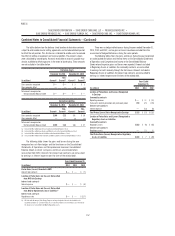

International Energy

Duke Energy owns a 25 percent indirect interest in NMC, which owns and

operates a methanol and MTBE business in Jubail, Saudi Arabia.