Duke Energy 2014 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

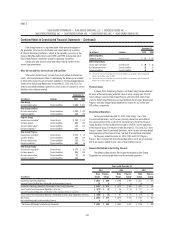

The following table presents the Disposal Group’s carrying values in the

Consolidated Balance Sheets’ major classes of Assets held for sale.

December 31, 2014

(in millions) Duke Energy

Duke Energy

Ohio

Current assets $ 364 $ 316

Investments and other assets 52 46

Property, plant and equipment 2,590 2,559

Total assets held for sale $ 3,006 $ 2,921

Current liabilities $ 262 $ 246

Deferred credits and other liabilities 35 34

Total liabilities associated with assets held for sale $ 297 $ 280

Duke Energy Ohio may continue to have transactions with the Disposal

Group after the divestiture is complete depending on when the transaction

closes. Duke Energy Ohio has a power purchase agreement with the Disposal

Group, which extends through May 2015, for a portion of its standard service

offer (SSO) supply requirement. In addition, for a period of up to 12 months,

Duke Energy may provide transition services to Dynegy. Duke Energy will be

reimbursed for transition services provided. The continuing cash fl ows are

not expected to be material and are not considered direct cash fl ows. These

arrangements do not allow Duke Energy or Duke Energy Ohio to signifi cantly

infl uence the operations of the Disposal Group once the sale is complete.

See Notes 4 and 5 for a discussion of contingencies related to the Disposal

Group that will be retained by Duke Energy Ohio subsequent to the sale.

Vermillion Generating Station

On January 12, 2012, after receiving approvals from the FERC and IURC on

August 12, 2011 and December 28, 2011, respectively, Duke Energy Vermillion II,

LLC (Duke Energy Vermillion), an indirect wholly owned subsidiary of Duke Energy

Ohio, completed the sale of its ownership interest in Vermillion Generating Station

(Vermillion) to Duke Energy Indiana and Wabash Valley Power Association, Inc.

(WVPA). Upon closing of the sale, Duke Energy Indiana held a 62.5 percent

interest in Vermillion. Duke Energy Ohio received net proceeds of $82 million, of

which $68 million was paid by Duke Energy Indiana. Following the transaction,

Duke Energy Indiana retired Gallagher Units 1 and 3 effective February 1, 2012.

As Duke Energy Indiana is an affi liate of Duke Energy Vermillion, the

transaction was accounted for as a transfer between entities under common

control with no gain or loss recorded and did not have a signifi cant impact to

Duke Energy Ohio’s or Duke Energy Indiana’s results of operations. Proceeds

received from Duke Energy Indiana are included in Net proceeds from the sales

of other assets on Duke Energy Ohio’s Consolidated Statements of Cash Flows.

Cash paid to Duke Energy Ohio is included in Capital expenditures on Duke

Energy Indiana’s Consolidated Statements of Cash Flows. Duke Energy Ohio

and Duke Energy Indiana recognized non-cash equity transfers of $28 million

and $26 million, respectively, in their Consolidated Statements of Common

Stockholder’s Equity on the transaction representing the difference between cash

exchanged and the net book value of Vermillion. These amounts are not refl ected

in Duke Energy’s Consolidated Statements of Cash Flows or Consolidated

Statements of Equity as the transaction is eliminated in consolidation.

Proceeds from WVPA are included in Net proceeds from the sales of other

assets on Duke Energy Ohio’s Consolidated Statements of Cash Flows and Net

proceeds from the sales of equity investments and other assets, and sales of

and collections on notes receivable on Duke Energy’s Consolidated Statements

of Cash Flows. The sale of the proportionate share of Vermillion to WVPA did not

result in a signifi cant gain or loss upon close of the transaction.

SALES OF OTHER ASSETS

During 2012, Duke Energy received proceeds of $187 million from the sale

of non-core business assets within the Commercial Power segment for which no

material gain or loss was recognized.

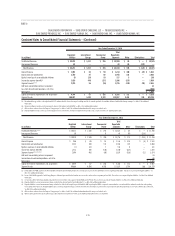

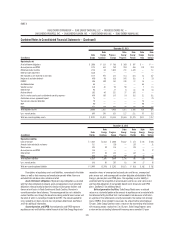

3. BUSINESS SEGMENTS

Duke Energy evaluates segment performance based on segment income.

Segment income is defi ned as income from continuing operations net of income

attributable to noncontrolling interests. Segment income, as discussed below,

includes intercompany revenues and expenses that are eliminated in the

Consolidated Financial Statements. Certain governance costs are allocated

to each segment. In addition, direct interest expense and income taxes are

included in segment income.

Operating segments are determined based on information used by the

chief operating decision maker in deciding how to allocate resources and

evaluate the performance.

Products and services are sold between affi liate companies and

reportable segments of Duke Energy at cost. Segment assets as presented in the

tables that follow exclude all intercompany assets.

DUKE ENERGY

Duke Energy has the following reportable operating segments: Regulated

Utilities, International Energy and Commercial Power.

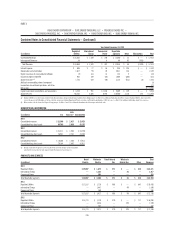

Regulated Utilities conducts operations primarily through Duke Energy

Carolinas, Duke Energy Progress, Duke Energy Florida, Duke Energy Indiana,

and the regulated transmission and distribution operations of Duke Energy

Ohio. These electric and natural gas operations are subject to the rules

and regulations of the FERC, NCUC, PSCSC, FPSC, PUCO, IURC and KPSC.

Substantially all of Regulated Utilities’ operations are regulated and, accordingly,

these operations qualify for regulatory accounting treatment.

International Energy principally operates and manages power generation

facilities and engages in sales and marketing of electric power, natural gas

and natural gas liquids outside the U.S. Its activities principally target power

generation in Latin America. Additionally, International Energy owns a 25

percent interest in National Methanol Company (NMC), a large regional producer

of methyl tertiary butyl ether (MTBE) located in Saudi Arabia. The investment in

NMC is accounted for under the equity method of accounting.

Commercial Power builds, develops and operates renewable generation

and energy transmission projects throughout the continental U.S. As discussed

in Note 2, Duke Energy entered into an agreement to sell Commercial Power’s

nonregulated Midwest generation business to Dynegy in a transaction that

is expected to close during the second quarter of 2015. As a result of this

divestiture, the results of operations of the nonregulated Midwest generation

business have been reclassifi ed to Discontinued Operations on the Consolidated

Statements of Operations. Certain costs such as interest and general and

administrative expenses previously allocated to the Disposal Group were not

reclassifi ed to discontinued operations.

The remainder of Duke Energy’s operations is presented as Other. While

it is not an operating segment, Other primarily includes unallocated corporate

interest expense, certain unallocated corporate costs, Bison Insurance Company

Limited (Bison), Duke Energy’s wholly owned, captive insurance subsidiary,

and contributions to the Duke Energy Foundation. On December 31, 2013, Duke

Energy sold its interest in DukeNet Communications Holdings, LLC (DukeNet) to

Time Warner Cable, Inc.