Duke Energy 2014 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

187

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

21. EMPLOYEE BENEFIT PLANS

DEFINED BENEFIT RETIREMENT PLANS

Duke Energy maintains, and the Subsidiary Registrants participate in,

qualifi ed, non-contributory defi ned benefi t retirement plans. The plans cover

most U.S. employees using a cash balance formula. Under a cash balance

formula, a plan participant accumulates a retirement benefi t consisting of

pay credits based upon a percentage of current eligible earnings based on age

and/or years of service and interest credits. Certain employees are covered

under plans that use a fi nal average earnings formula. Under these average

earnings formulas, a plan participant accumulates a retirement benefi t equal

to the sum of percentages of their (i) highest three- or four-year average

earnings, (ii) highest three- or four-year average earnings in excess of covered

compensation per year of participation (maximum of 35 years), and/or

(iii) highest three- or four-year average earnings times years of participation in

excess of 35 years. Duke Energy also maintains, and the Subsidiary Registrants

participate in, non-qualifi ed, non-contributory defi ned benefi t retirement plans

which cover certain executives. As of January 1, 2014, the qualifi ed and non-

qualifi ed non-contributory defi ned benefi t plans are closed to new and rehired

non-union and certain unionized employees.

Duke Energy uses a December 31 measurement date for its defi ned

benefi t retirement plan assets and obligations.

Net periodic benefi t costs disclosed in the tables below represent the cost

of the respective benefi t plan for the periods presented. However, portions of the

net periodic benefi t costs disclosed in the tables below have been capitalized as

a component of property, plant and equipment. Amounts presented in the tables

below for the Subsidiary Registrants represent the amounts of pension and

other post-retirement benefi t cost allocated by Duke Energy for employees of

the Subsidiary Registrants. Additionally, the Subsidiary Registrants are allocated

their proportionate share of pension and post-retirement benefi t cost for

employees of Duke Energy’s shared services affi liate that provide support to the

Subsidiary Registrants. These allocated amounts are included in the governance

and shared service costs discussed in Note 13.

Duke Energy’s policy is to fund amounts on an actuarial basis to provide

assets suffi cient to meet benefi t payments to be paid to plan participants. The

following table includes information related to the Duke Energy Registrants’

contributions to its U.S. qualifi ed defi ned benefi t pension plans.

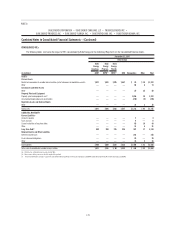

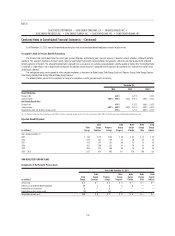

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Anticipated Contributions:

2015 $ 302 $ 91 $ 83 $ 42 $ 40 $ 8 $ 19

Contributions Made:

2014 $ — $ — $ — $ — $ — $ — $ —

2013 250 — 250 63 133 — —

2012 304 —346 141 128 — —

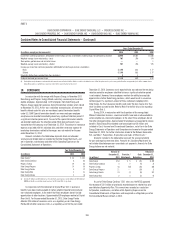

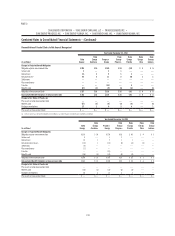

QUALIFIED PENSION PLANS

Components of Net Periodic Pension Costs

Year Ended December 31, 2014

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Service cost $ 135 $ 41 $ 40 $ 21 $ 20 $ 4 $ 9

Interest cost on projected benefi t obligation 344 85 112 54 57 20 29

Expected return on plan assets (511) (132) (173) (85) (85) (27) (41)

Amortization of actuarial loss 150 36 68 32 32 4 13

Amortization of prior service credit (15) (8) (3) (2) (1) — —

Other 82311—1

Net periodic pension costs $ 111 $ 24 $ 47 $ 21 $ 24 $ 1 $ 11