Duke Energy 2014 Annual Report Download - page 226

Download and view the complete annual report

Please find page 226 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

206

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

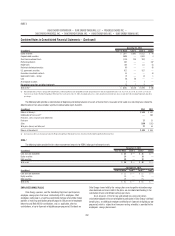

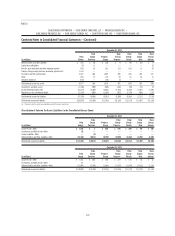

Valuation allowances have been established for certain foreign and state NOL carryforwards and state income tax credits that reduce deferred tax assets to an

amount that will be realized on a more-likely-than-not basis. The net change in the total valuation allowance is included in Tax differential on foreign earnings and

State income tax, net of federal income tax effect in the above tables.

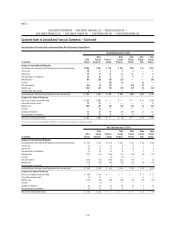

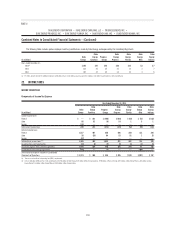

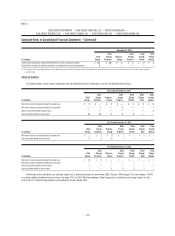

DEFERRED TAXES

Net Deferred Income Tax Liability Components

December 31, 2014

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Deferred credits and other liabilities $ 188 $ 53 $ 108 $ 28 $ 78 $ (8) $ 12

Capital lease obligations 63 10 — — — — 2

Pension, post-retirement and other employee benefi ts 546 4 188 96 93 17 43

Progress Energy merger purchase accounting adjustments(a) 1,124 — — — — — —

Tax credits and NOL carryforwards 3,540 157 980 91 252 38 260

Investments and other assets —— — ——14—

Other — 12 — 55 — 35 11

Valuation allowance (184) — (13) (1) — — —

Total deferred income tax assets 5,277 236 1,263 269 423 96 328

Investments and other assets (1,625) (1,051) (427) (232) (245) — (4)

Accelerated depreciation rates (11,715) (4,046) (3,284) (2,030) (1,252) (1,660) (1,603)

Regulatory assets and deferred debits (3,694) (953) (1,602) (809) (792) (141) (106)

Other (44) — (151) — (246) — —

Total deferred income tax liabilities (17,078) (6,050) (5,464) (3,071) (2,535) (1,801) (1,713)

Net deferred income tax liabilities $(11,801) $(5,814) $(4,201) $(2,802) $(2,112) $(1,705) $(1,385)

(a) Primarily related to capital lease obligations and debt fair value adjustments.

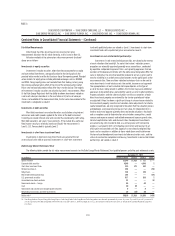

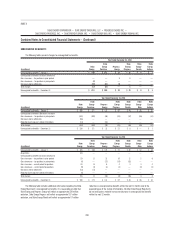

On July 23, 2013, HB 998 was signed into law. HB 998 reduces the North

Carolina corporate income tax rate from a statutory 6.9 to 6.0 percent in January

2014 with a further reduction to 5.0 percent in January 2015. Duke Energy

recorded a net reduction of approximately $145 million to its North Carolina

deferred tax liability in the third quarter of 2013. The signifi cant majority of

this deferred tax liability reduction was offset by recording a regulatory liability

pending NCUC determination of the disposition of the amounts related to Duke

Energy Carolinas and Duke Energy Progress. The impact of HB 998 did not

have a signifi cant impact on the fi nancial position, results of operation, or cash

fl ows of Duke Energy, Duke Energy Carolinas, Progress Energy or Duke Energy

Progress.

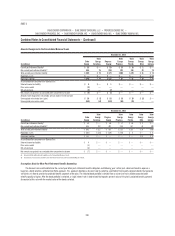

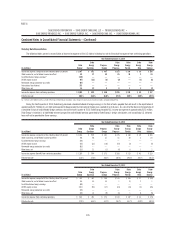

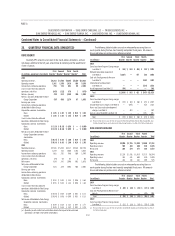

The following table presents the expiration of tax credits and NOL carryforwards.

December 31, 2014

(in millions) Amount

Expiration

Year

Investment tax credits $ 581 2029 — 2034

Alternative minimum tax credits 1,093 Indefi nite

Federal NOL carryforwards 749 2030 — 2033

State NOL carryforwards and credits(a) 162 2015 — 2034

Foreign NOL carryforwards(b) 117 2015 — 2033

Foreign Tax Credits 838 2024

Total tax credits and NOL carryforwards $ 3,540

(a) A valuation allowance of $79 million has been recorded on the state Net Operating Loss carryforwards, as presented in the Net Deferred Income Tax Liability Components table.

(b) A valuation allowance of $105 million has been recorded on the foreign Net Operating Loss carryforwards, as presented in the Net Deferred Income Tax Liability Components table.