Duke Energy 2014 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264

|

|

139

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

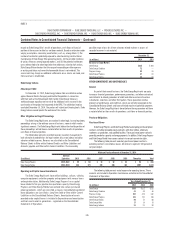

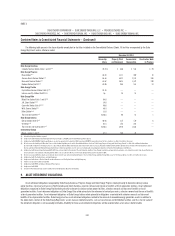

Maturities and Call Options

The following table shows the annual maturities of long-term debt for the next fi ve years and thereafter. Amounts presented exclude short-term notes payable

and commercial paper and money pool borrowings for the Subsidiary Registrants.

December 31, 2014

(in millions)

Duke

Energy(a)

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

2015 $ 2,793 $ 507 $ 1,507 $ 945 $ 562 $ 157 $ 5

2016 2,980 756 614 302 12 57 480

2017 2,452 116 940 453 487 3 3

2018 3,207 1,505 515 3 512 28 153

2019 2,810 5 1,418 606 12 552 62

Thereafter 23,803 5,502 9,760 3,892 3,275 969 3,088

Total long-term debt, including current maturities $ 38,045 $ 8,391 $ 14,754 $ 6,201 $ 4,860 $ 1,766 $ 3,791

(a) Excludes $1,975 million in purchase accounting adjustments related to the merger with Progress Energy. See Note 2 for additional information.

The Duke Energy Registrants have the ability under certain debt facilities

to call and repay the obligation prior to its scheduled maturity. Therefore, the

actual timing of future cash repayments could be materially different than as

presented above.

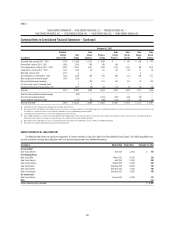

Short-Term Obligations Classifi ed as Long-Term Debt

Tax-exempt bonds that may be put to the Duke Energy Registrants at

the option of the holder and certain commercial paper issuances and money

pool borrowings are classifi ed as Long-Term Debt on the Consolidated Balance

Sheets. These tax-exempt bonds, commercial paper issuances and money

pool borrowings, which are short-term obligations by nature, are classifi ed as

long term due to Duke Energy’s intent and ability to utilize such borrowings as

long-term fi nancing. As Duke Energy’s Master Credit Facility and other bilateral

letter of credit agreements have non-cancelable terms in excess of one year as

of the balance sheet date, Duke Energy has the ability to refi nance these short-

term obligations on a long-term basis. The following tables show short-term

obligations classifi ed as long-term debt.

December 31, 2014

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Duke

Energy

Ohio

Duke

Energy

Indiana

Tax-exempt bonds $ 347 $ 35 $ 27 $ 285

Commercial paper 475 300 25 150

Secured debt(a) 200 — — —

Total $ 1,022 $ 335 $ 52 $ 435

December 31, 2013

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Duke

Energy

Ohio

Duke

Energy

Indiana

Tax-exempt bonds $ 471 $ 75 $ 111 $ 285

Commercial paper 450 300 — 150

Secured debt(a) 200 — — —

Total $ 1,121 $ 375 $ 111 $ 435

(a) Instrument has a term of less than one year with the right to extend the maturity date for additional one-year periods with a fi nal maturity date no later than December 2026.