Duke Energy 2014 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

202

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

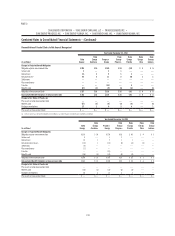

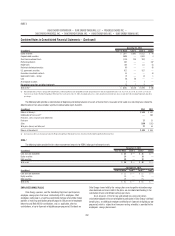

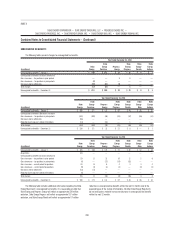

(in millions)

December 31, 2013

Total Fair Value Level 1 Level 2 Level 3

Equity securities $ 2,877 $1,801 $1,022 $ 54

Corporate debt securities 2,604 — 2,601 3

Short-term investment funds 1,158 254 904 —

Partnership interests 307 — — 307

Hedge funds 164 — 111 53

Real estate limited partnerships 95 — — 95

U.S. government securities 927 — 927 —

Guarantees investment contracts 33 — — 33

Governments bonds – foreign 19 — 18 1

Cash 58 58 — —

Asset backed securities 7— 7—

Net pending transactions and other investments 12 7 5 —

Total assets(a) $ 8,261 $2,120 $5,595 $ 546

(a) Duke Energy Carolinas, Progress Energy, Duke Energy Progress, Duke Energy Florida, Duke Energy Ohio and Duke Energy Indiana were allocated approximately 28 percent, 35 percent, 16 percent, 16 percent, 5 percent and

8 percent, respectively, of the Duke Energy Master Retirement Trust assets at December 31, 2013. Accordingly, all Level 1, 2 and 3 amounts included in the table above are allocable to the Subsidiary Registrants using these

percentages.

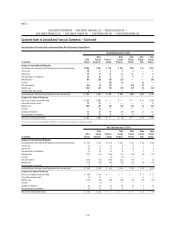

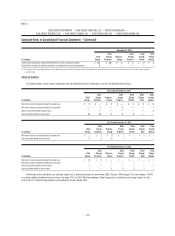

The following table provides a reconciliation of beginning and ending balances of assets of master trusts measured at fair value on a recurring basis where the

determination of fair value includes signifi cant unobservable inputs (Level 3).

(in millions) 2014 2013

Balance at January 1 $ 546 $ 352

Combination of trust assets(a) —288

Purchases, sales, issuances and settlements

Purchases 17 25

Sales (164) (152)

Total gains (losses) and other, net 37 33

Balance at December 31 $ 436 $ 546

(a) As of January 1, 2013, assets previously held in the Progress Energy Master Retirement Trust were transferred into the Duke Energy Master Retirement Trust.

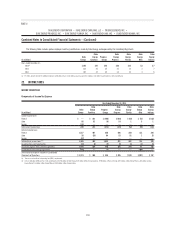

VEBA I

The following tables provide the fair value measurement amounts for VEBA I other post-retirement assets.

December 31, 2014

(in millions) Total Fair Value Level 1 Level 2 Level 3

Cash and cash equivalents $21 $— $21 $—

Equity securities 14 — 14 —

Debt securities 13 — 13 —

Total assets $48 $— $48 $—

December 31, 2013

(in millions) Total Fair Value Level 1 Level 2 Level 3

Cash and cash equivalents $21 $— $21 $—

Equity securities 15 — 15 —

Debt securities 15 — 15 —

Total assets $51 $— $51 $—

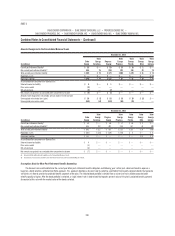

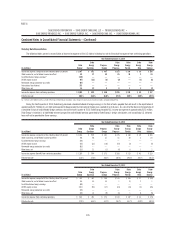

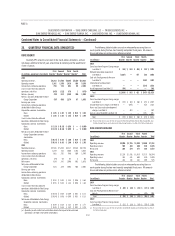

EMPLOYEE SAVINGS PLANS

Duke Energy sponsors, and the Subsidiary Registrants participate in,

employee savings plans that cover substantially all U.S. employees. Most

employees participate in a matching contribution formula where Duke Energy

provides a matching contribution generally equal to 100 percent of employee

before-tax and Roth 401(k) contributions, and, as applicable, after-tax

contributions, of up to 6 percent of eligible pay per pay period. Dividends on

Duke Energy shares held by the savings plans are charged to retained earnings

when declared and shares held in the plans are considered outstanding in the

calculation of basic and diluted earnings per share.

As of January 1, 2014, for new and rehired non-union and certain

unionized employees who are not eligible to participate in Duke Energy’s defi ned

benefi t plans, an additional employer contribution of 4 percent of eligible pay per

pay period, which is subject to a three-year vesting schedule, is provided to the

employee’s savings plan account.