Duke Energy 2014 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

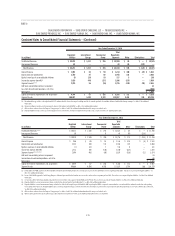

December 31, 2013

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Regulatory Assets

Asset retirement obligations $ 1,608 $ 123 $ 786 $ 389 $ 397 $ — $ —

Accrued pension and OPEB 1,723 347 750 269 438 120 219

Retired generation facilities 1,748 68 1,619 241 1,378 — 61

Debt fair value adjustment 1,338 — — — — — —

Net regulatory asset related to income taxes 1,115 555 331 113 218 72 157

Hedge costs and other deferrals 450 98 318 165 153 5 29

DSM/EE 306 140 152 140 12 14 —

Grid Modernization 65 — — — — 65 —

Vacation accrual 210 82 55 50 — 7 13

Deferred fuel 94 — 37 6 31 14 43

Nuclear deferral 262 40 222 77 145 — —

Post in-service carrying costs and deferred operating expenses 459 150 137 19 118 21 151

Gasifi cation services agreement buyout 75 — — — — — 75

Transmission expansion obligation 70 — — — — 74 —

MGP 90 — — — — 90 —

Other 473 219 101 42 60 46 87

Total regulatory assets 10,086 1,822 4,508 1,511 2,950 528 835

Less: current portion 895 295 353 127 221 57 118

Total non-current regulatory assets $ 9,191 $1,527 $4,155 $ 1,384 $2,729 $ 471 $717

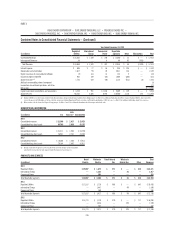

December 31, 2013

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Regulatory Liabilities

Costs of removal $ 5,308 $2,423 $ 2,008 $1,637 $ 371 $ 241 $ 645

Amounts to be refunded to customers 151 — 120 — 120 — 31

Storm reserve 145 20 125 — 125 — —

Accrued pension and OPEB 138 — — — — 21 77

Deferred fuel 177 45 132 — 132 — —

Other 346 153 114 99 14 27 45

Total regulatory liabilities 6,265 2,641 2,499 1,736 762 289 798

Less: current portion 316 65 207 63 144 27 16

Total non-current regulatory liabilities $ 5,949 $2,576 $ 2,292 $1,673 $ 618 $ 262 $ 782

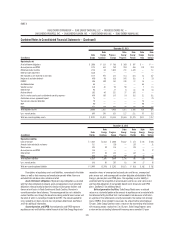

Descriptions of regulatory assets and liabilities, summarized in the tables

above, as well as their recovery and amortization periods follow. Items are

excluded from rate base unless otherwise noted.

Asset retirement obligations. Represents legal obligations associated

with the future retirement of property, plant and equipment. Asset retirement

obligations relate primarily to decommissioning nuclear power facilities and

closure of ash basins in North Carolina and South Carolina. No return is

currently earned on these balances. The recovery period for costs related to

nuclear facilities runs through the decommissioning period of each nuclear unit,

the latest of which is currently estimated to be 2097. The recovery period for

costs related to ash basin closures has not yet been determined. See Notes 1

and 9 for additional information.

Accrued pension and OPEB. Accrued pension and OPEB represent

regulatory assets and liabilities related to each of the Duke Energy Registrants’

respective shares of unrecognized actuarial gains and losses, unrecognized

prior service cost, and unrecognized transition obligation attributable to Duke

Energy’s pension plans and OPEB plans. The regulatory asset or liability is

amortized with the recognition of actuarial gains and losses, prior service cost,

and transition obligations to net periodic benefi t costs for pension and OPEB

plans. See Note 21 for additional detail.

Retired generation facilities. Duke Energy Florida earns a reduced

return on a substantial portion of the amount of regulatory asset associated with

the retirement of Crystal River Unit 3 not included in rate base and a full return

on a portion of the retired plant currently recovered in the nuclear cost recovery

clause (NCRC). Once included in base rates the amount will be amortized over

20 years. Duke Energy Carolinas earns a return on the outstanding retail balance

with recovery periods ranging from 5 to 10 years. Duke Energy Progress earns

a return on the outstanding balance with recovery over a period of 10 years