Duke Energy 2014 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

149

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

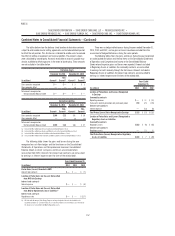

11. GOODWILL AND INTANGIBLE ASSETS

GOODWILL

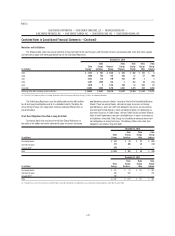

The following tables present goodwill by reportable operating segment for

Duke Energy and Duke Energy Ohio.

Duke Energy

(in millions)

Regulated

Utilities

International

Energy

Commercial

Power Total

Balance at December 31, 2013

Goodwill $ 15,950 $ 326 $ 935 $17,211

Accumulated impairment charges — — (871) (871)

Balance at December 31, 2013,

net of accumulated impairment

charges 15,950 326 64 16,340

Foreign exchange and other changes — (19) — (19)

Balance at December 31, 2014

Goodwill 15,950 307 935 17,192

Accumulated impairment charges — — (871) (871)

Balance at December 31, 2014,

net of accumulated impairment

charges $ 15,950 $ 307 $ 64 $16,321

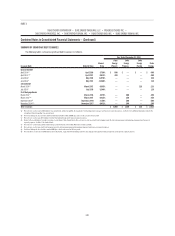

Duke Energy Ohio

(in millions)

Regulated

Utilities

Commercial

Power Total

Balance at December 31, 2013

Goodwill $1,136 $ 1,188 $ 2,324

Accumulated impairment charges (216) (1,188) (1,404)

Balance at December 31, 2013, net of

accumulated impairment charges 920 — 920

Balance at December 31, 2014

Goodwill 1,136 1,188 2,324

Accumulated impairment charges (216) (1,188) (1,404)

Balance at December 31, 2014,

net of accumulated impairment charges $ 920 $ — $ 920

Progress Energy

Progress Energy’s Goodwill is included in the Regulated Utilities operating

segment and there are no accumulated impairment charges.

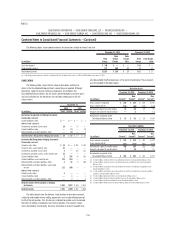

Impairment Testing

Duke Energy, Duke Energy Ohio and Progress Energy are required to

perform an annual goodwill impairment test as of the same date each year and,

accordingly, performs its annual impairment testing of goodwill as of August 31.

Duke Energy, Duke Energy Ohio and Progress Energy update their test between

annual tests if events or circumstances occur that would more likely than not

reduce the fair value of a reporting unit below its carrying value. As the fair

value of Duke Energy, Duke Energy Ohio and Progress Energy’s reporting units

exceeded their respective carrying values at the date of the annual impairment

analysis, no impairment charges were recorded in 2014.

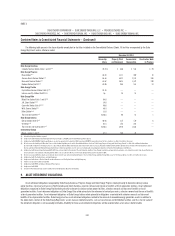

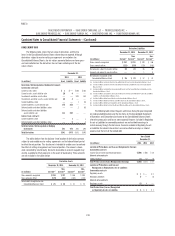

INTANGIBLE ASSETS

The following tables show the carrying amount and accumulated amortization of intangible assets within Other on the Consolidated Balance Sheets of the Duke

Energy Registrants at December 31, 2014 and 2013.

December 31, 2014

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio(a)

Duke

Energy

Indiana

Emission allowances $23 $1 $7 $3 $4 $— $16

Renewable energy certifi cates 97 25 69 69 — 3 —

Gas, coal and power contracts 24 — — — — — 24

Wind development rights 97 — — — — — —

Other 76 — — — — — —

Total gross carrying amounts 317 26 76 72 4 3 40

Accumulated amortization – gas, coal and power contracts (15) — — — — — (15)

Accumulated amortization – wind development rights (14) — — — — — —

Accumulated amortization – other (25) — — — — — —

Total accumulated amortization (54) — — — — — (15)

Total intangible assets, net $ 263 $26 $76 $72 $ 4 $ 3 $ 25

(a) During 2014, Duke Energy Ohio reduced the carrying amount of OVEC to zero. A charge of $94 million is recorded in Impairment Charges on Duke Energy Ohio’s Consolidated Statement of Operations. In addition, Duke Energy

Ohio has emission allowances and renewable energy certifi cates that have been reclassifi ed to Assets Held For Sale pending the sale of the Disposal Group. See Note 17 for further information.