Duke Energy 2014 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

201

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

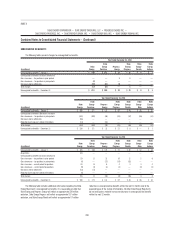

Fair Value Measurements

Duke Energy classifi es recurring and non-recurring fair value

measurements based on the fair value hierarchy as discussed in Note 16.

Valuation methods of the primary fair value measurements disclosed

above are as follows:

Investments in equity securities

Investments in equity securities, other than those accounted for as equity

and cost method investments, are typically valued at the closing price in the

principal active market as of the last business day of the reporting period. Principal

active markets for equity prices include published exchanges such as NASDAQ

and NYSE. Foreign equity prices are translated from their trading currency using

the currency exchange rate in effect at the close of the principal active market.

Prices have not been adjusted to refl ect after-hours market activity. The majority

of investments in equity securities are valued using Level 1 measurements. When

(i) the Duke Energy Registrants lack the ability to redeem investments valued on

a net asset value per share basis in the near future or (ii) net asset value per

share is not available at the measurement date, the fair value measurement of the

investment is categorized as Level 3.

Investments in debt securities

Most debt investments are valued based on a calculation using interest

rate curves and credit spreads applied to the terms of the debt instrument

(maturity and coupon interest rate) and consider the counterparty credit rating.

Most debt valuations are Level 2 measurements. If the market for a particular

fi xed income security is relatively inactive or illiquid, the measurement is

Level 3. U.S. Treasury debt is typically Level 2.

Investments in short-term investment funds

Investments in short-term investment funds are valued at the net

asset value of units held at year end. Investments in short-term investment

funds with published prices are valued as Level 1. Investments in short-term

investment funds with unpublished prices are valued as Level 2.

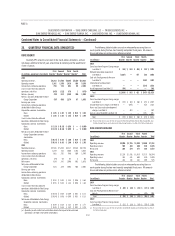

Investments in real estate limited partnerships

Investments in real estate limited partnerships are valued by the trustee

at each valuation date (monthly). As part of the trustee’s valuation process,

properties are externally appraised generally on an annual basis, conducted

by reputable, independent appraisal fi rms, and signed by appraisers that are

members of the Appraisal Institute, with the professional designation MAI. Fair

value is defi ned as the price that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market participants at the

measurement date. There are three valuation techniques that can be used to

value investments in real estate assets: the market, income or cost approach.

The appropriateness of each valuation technique depends on the type of

asset or business being valued. In addition, the trustee may cause additional

appraisals to be performed as warranted by specifi c asset or market conditions.

Property valuations and the salient valuation-sensitive assumptions of each

direct investment property are reviewed by the trustee quarterly and values

are adjusted if there has been a signifi cant change in circumstances related to

the investment property since the last valuation. Value adjustments for interim

capital expenditures are only recognized to the extent that the valuation process

acknowledges a corresponding increase in fair value. An independent fi rm is

hired to review and approve quarterly direct real estate valuations. Key inputs

and assumptions used to determine fair value includes among others, rental

revenue and expense amounts and related revenue and expense growth rates,

terminal capitalization rates and discount rates. Development investments

are valued using cost incurred to date as a primary input until substantive

progress is achieved in terms of mitigating construction and leasing risk at

which point a discounted cash fl ow approach is more heavily weighted. Key

inputs and assumptions in addition to those noted above used to determine

the fair value of development investments include construction costs, and the

status of construction completion and leasing. Investments in real estate limited

partnerships are valued as Level 3.

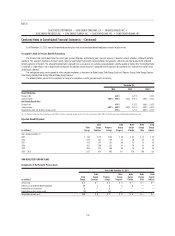

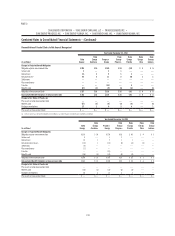

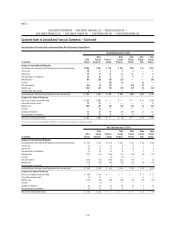

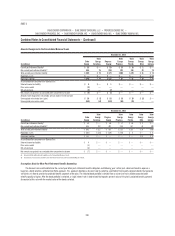

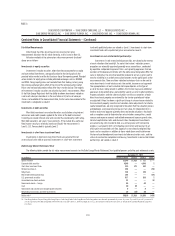

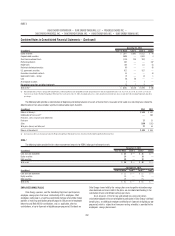

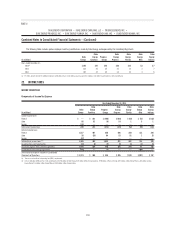

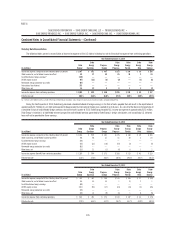

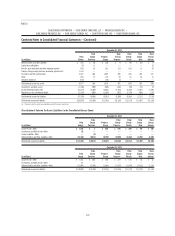

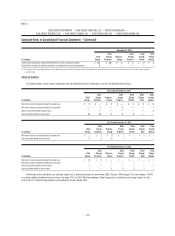

Duke Energy Master Retirement Trust

The following tables provide the fair value measurement amounts for the Duke Energy Master Retirement Trust qualifi ed pension and other post-retirement assets.

December 31, 2014

(in millions) Total Fair Value Level 1 Level 2 Level 3

Equity securities $2,346 $1,625 $ 721 $ —

Corporate debt securities 4,349 — 4,348 1

Short-term investment funds 333 171 162 —

Partnership interests 298 — — 298

Hedge funds 146 — 146 —

Real estate limited partnerships 104 — — 104

U.S. government securities 917 — 916 1

Guaranteed investment contracts 32 — — 32

Governments bonds – foreign 44 — 44 —

Cash 30 30 — —

Government and commercial mortgage backed securities 9— 9—

Net pending transactions and other investments 10 (10) 20 —

Total assets(a) $8,618 $1,816 $6,366 $436

(a) Duke Energy Carolinas, Progress Energy, Duke Energy Progress, Duke Energy Florida, Duke Energy Ohio and Duke Energy Indiana were allocated approximately 28 percent, 31 percent, 15 percent, 16 percent, 5 percent and 8

percent, respectively, of the Duke Energy Master Retirement Trust assets at December 31, 2014. Accordingly, all Level 1, 2 and 3 amounts included in the table above are allocable to the Subsidiary Registrants using these

percentages.