Duke Energy 2014 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

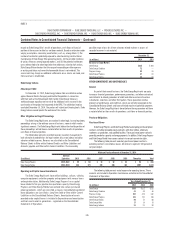

criteria for surface impoundments, groundwater monitoring and protection

procedures and other operational and reporting procedures to ensure the safe

disposal and management of CCR. In addition to the requirements of the federal

CCR regulation, CCR landfi lls and surface impoundments will continue to be

independently regulated by most states. Duke Energy records an asset retirement

obligation when it has a legal obligation to incur retirement costs associated

with the retirement of a long-lived asset and the obligation can be reasonably

estimated. Once the rule is effective in 2015, additional asset retirement obligation

amounts will be recorded at the Duke registrants. Cost recovery for future

expenditures will be pursued through the normal ratemaking process with state

utility commissions, which permit recovery of necessary and prudently incurred

costs associated with Duke Energy’s regulated operations. At this time, Duke

Energy is evaluating the CCR regulation and developing cost estimates that will

largely be dependent upon compliance alternatives selected to meet requirements

of the regulations. For further discussion of asset retirement obligations see Note 9.

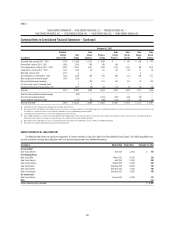

Litigation

Duke Energy

Ash Basin Shareholder Derivative Litigation

Five shareholder derivative lawsuits have been fi led in Delaware Chancery

Court relating to the release at Dan River and to the management of Duke

Energy’s ash basins. On October 31, 2014, the fi ve lawsuits were consolidated

in a single proceeding titled “In Re Duke Energy Corporation Coal Ash

Derivative Litigation.” On December 2, 2014, plaintiffs fi led a Corrected Verifi ed

Consolidated Shareholder Derivative Complaint (Consolidated Complaint).

The Consolidated Complaint names as defendants several current and

former Duke Energy offi cers and directors (collectively, the “Duke Energy

Defendants”). Duke Energy is named as a nominal defendant.

The Consolidated Complaint alleges the Duke Energy Defendants breached

their fi duciary duties to the company by failing to adequately oversee Duke

Energy’s ash basins and that these breaches of fi duciary duty may have

contributed to the incident at Dan River and continued thereafter. The lawsuit

also asserts claims against the Duke Energy Defendants for corporate waste

(relating to the money Duke Energy has spent and will spend as a result of

the fi nes, penalties, and coal ash removal) and unjust enrichment (relating to

the compensation and director remuneration that was received despite these

alleged breaches of fi duciary duty). The lawsuit seeks both injunctive relief

against Duke Energy and restitution from the Duke Energy Defendants. On

January 21, 2015, the Duke Energy Defendants fi led a Motion to Stay and an

alternative Motion to Dismiss.

On May 28, 2014, Duke Energy received a shareholder litigation demand

letter sent on behalf of shareholder Mitchell Pinsly. The letter alleges that the

members of the Board of Directors and certain offi cers breached their fi duciary

duties by allowing the company to illegally dispose of and store coal ash

pollutants. The letter demands that the Board of Directors take action to recover

damages associated with those breaches of fi duciary duty; otherwise, the

attorney will fi le a shareholder derivative action. By letter dated July 3, 2014,

counsel for the shareholder was informed that the Board of Directors appointed

a Demand Review Committee to evaluate the allegations in the Demand Letter.

It is not possible to predict whether Duke Energy will incur any liability or

to estimate the damages, if any, it might incur in connection with these matters.

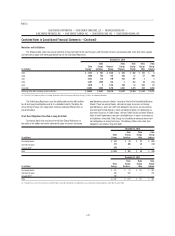

Progress Energy Merger Shareholder Litigation

Duke Energy, the eleven members of the Board of Directors who were

also members of the pre-merger Board of Directors (Legacy Duke Energy

Directors) and certain Duke Energy offi cers are defendants in a purported

securities class action lawsuit (Nieman v. Duke Energy Corporation, et al). This

lawsuit consolidates three lawsuits originally fi led in July 2012, and is pending

in the United States District Court for the Western District of North Carolina.

The plaintiffs allege federal Securities Act and Exchange Act claims based on

allegations of materially false and misleading representations and omissions in

the Registration Statement fi led on July 7, 2011, and purportedly incorporated

into other documents, all in connection with the post-merger change in Chief

Executive Offi cer (CEO). On August 15, 2014, the parties reached an agreement

in principle to settle the litigation for an amount which, net of the expected

proceeds of insurance policies, is not anticipated to have a material effect on

the results of operations, cash fl ows or fi nancial position of Duke Energy. On

December 2, 2014, the parties executed a Memorandum of Understanding

relating to the settlement which will be submitted to the court for approval.

On May 31, 2013, the Delaware Chancery Court consolidated four

shareholder derivative lawsuits fi led in 2012. The Court also appointed a lead

plaintiff and counsel for plaintiffs and designated the case as In Re Duke Energy

Corporation Derivative Litigation. The lawsuit names as defendants the Legacy

Duke Energy Directors. Duke Energy is named as a nominal defendant. The case

alleges claims for breach of fi duciary duties of loyalty and care in connection

with the post-merger change in CEO. The case is stayed pending resolution of

the Nieman v. Duke Energy Corporation, et al. case in North Carolina.

Two shareholder Derivative Complaints, fi led in 2012 in federal district

court in Delaware, were consolidated as Tansey v. Rogers, et al. The case

alleges claims for breach of fi duciary duty and waste of corporate assets, as

well as claims under Section 14(a) and 20(a) of the Exchange Act. Duke Energy

is named as a nominal defendant. Pursuant to an Order entered on September

2, 2014, the court administratively closed this consolidated derivative action.

The parties fi led a status report with the court on December 1, 2014, and will

continue to do so every six months thereafter until the Nieman v. Duke Energy

Corporation, et al. case in North Carolina has been resolved.

On August 3, 2012, Duke Energy was served with a shareholder Derivative

Complaint, which was transferred to the North Carolina Business Court (Krieger

v. Johnson, et al.). The lawsuit names as defendants William D. Johnson and the

Legacy Duke Energy Directors. Duke Energy is named as a nominal defendant.

The lawsuit alleges claims for breach of fi duciary duty in granting excessive

compensation to Mr. Johnson. On April 30, 2014, the North Carolina Business

Court granted the Legacy Duke Energy Directors’ motion to dismiss the lawsuit.

It is not possible to estimate the maximum exposure of loss that may

occur in connection with these lawsuits.

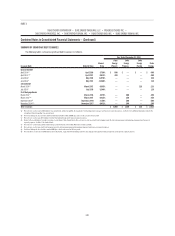

Price Reporting Cases

A total of fi ve lawsuits were fi led against Duke Energy affi liates and

other energy companies and remain pending in a consolidated, single federal

court proceeding in Nevada. Each of these lawsuits contain similar claims

that defendants allegedly manipulated natural gas markets by various means,

including providing false information to natural gas trade publications and

entering into unlawful arrangements and agreements in violation of the antitrust

laws of the respective states. Plaintiffs seek damages in unspecifi ed amounts.

On July 18, 2011, the judge granted a defendant’s motion for summary

judgment in two of the remaining fi ve cases to which Duke Energy affi liates are

a party. The U.S. Court of Appeals for the Ninth Circuit subsequently reversed

the lower court’s decision. On July 1, 2014, the U.S. Supreme Court granted the

defendants’, including Duke Energy, petition for certiorari. Oral argument was

held on January 12, 2015.

It is not possible to predict whether Duke Energy will incur any liability or

to estimate the damages, if any, it might incur in connection with the remaining