Duke Energy 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

PART II

DISPOSITION OF THE NONREGULATED MIDWEST GENERATION BUSINESS

On August 21, 2014, Duke Energy entered into a purchase sale agreement

(PSA) to sell its nonregulated Midwest generation business and Duke Energy

Retail Sales LLC (Disposal Group) to Dynegy Inc. (Dynegy) for approximately $2.8

billion in cash subject to adjustments at closing for changes in working capital

and capital expenditures. The completion of the transaction, conditioned on

approval by Federal Energy Regulatory Commissions (FERC), is expected by the

end of the second quarter of 2015.

For additional information on the details of this transaction including

regulatory conditions and accounting implications, see Note 2 to the

Consolidated Financial Statements, “Acquisitions, Dispositions and Sales of

Other Assets.”

2014 FINANCIAL RESULTS

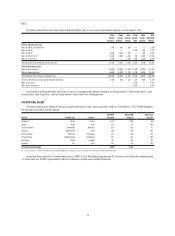

The following table summarizes adjusted earnings and net income

attributable to Duke Energy.

Years Ended December 31,

2014 2013 2012

(in millions,

except per

share amounts) Amount

Per

diluted

share Amount

Per

diluted

share Amount

Per

diluted

share

Adjusted

earnings(a) $ 3,218 $ 4.55 $ 3,080 $ 4.36 $ 2,489 $ 4.33

Net income

attributable to

Duke Energy $ 1,883 $ 2.66 $ 2,665 $ 3.76 $ 1,768 $ 3.07

(a) See Results of Operations below for Duke Energy’s defi nition of adjusted earnings and adjusted earnings

per diluted share as well as a reconciliation of this non-GAAP fi nancial measure to net income attributable

to Duke Energy and net income attributable to Duke Energy per diluted share.

Adjusted earnings increased from 2013 to 2014 primarily due to the

impact of the revised rates and favorable weather, partially offset by higher

depreciation and amortization expense. Adjusted earnings increased from

2012 to 2013 primarily due to the inclusion of a full year of Progress Energy

results in 2013, the impact of the revised rates, net of higher depreciation and

amortization expense and lower allowance for funds used during construction

(AFUDC).

See “Results of Operations” below for a detailed discussion of the

consolidated results of operations, as well as a detailed discussion of fi nancial

results for each of Duke Energy’s reportable business segments, as well as

Other.

2014 AREAS OF FOCUS AND ACCOMPLISHMENTS

In 2014, Duke Energy focused on achieving fi nancial objectives, completing

important strategic initiatives, including the agreement to sell the nonregulated

Midwest Generation business and completion of a strategic review of the

international business, advancing a platform of growth initiatives, operational

excellence, and the strengthening of coal ash management practices and plans

to accelerate basin closure strategies resulting from the Dan River coal ash spill.

Sale of the Midwest Generation Business. In 2014, Duke Energy

entered into a PSA to sell the Disposal Group to Dynegy for approximately

$2.8 billion. This decision supports Duke Energy’s strategy to focus investments

on businesses with more predictable and less volatile earnings.

International Energy Operations. Duke Energy completed the strategic

review of the international operations. As a result of the review, Duke Energy

determined it is in the shareholders’ best interest, at the present time, to

continue to own, operate and create value through portfolio optimization and

effi ciency in the international operations. In addition, Duke Energy declared a

taxable dividend of historical foreign earnings in the form of notes payable that

will result in the repatriation of approximately $2.7 billion of cash held and

expected to be generated by International Energy over a period of up to eight

years. The cash will help support the dividend and growth in the investment

portfolio of the domestic businesses.

Growth Initiatives. In 2014, Duke Energy announced new growth

initiatives representing a total investment of approximately $8 billion. These

initiatives include:

• Duke Energy Indiana proposed transmission and distribution

infrastructure improvement totaling $1.9 billion.

• Duke Energy Florida proposed approximately $1.8 billion investment

in three new generation projects, a combined-cycle plant in Citrus

County, an uprate plan at the Hines Energy Complex (Hines) facility and

acquisition of the Osprey plant from Calpine Corporation (Calpine).

• Duke Energy Progress proposed the acquisition of North Carolina Eastern

Municipal Power Agency’s (NCEMPA) ownership interest in some of

Duke Energy Progress’s existing nuclear and coal generation and the

acquisition of solar projects in eastern North Carolinas for a total

amount of approximately $1.2 billion.

• Duke Energy Carolinas proposed construction of a combined-cycle

natural gas plant at the William States Lee generation facility at a cost

of approximately $600 million.

• Commercial Power proposed construction of the Atlantic Coast Pipeline

for a total investment of approximately $2 billion.

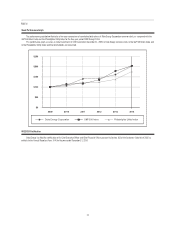

Operational Excellence of the Nuclear Fleet. Duke Energy’s nuclear

fl eet set a company record for total electricity production and demonstrated a

combined capacity factor at approximately 93 percent, the 16th consecutive year

above 90 percent on this plant reliability measure.

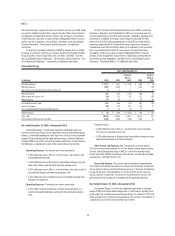

Deliver Merger Benefi ts. Duke Energy continues to focus on realizing

benefi ts of the merger with Progress Energy. Duke Energy is on-track to achieve

the $687 million of guaranteed savings for customers in the Carolinas over

fi ve years. After two and a half years, Duke Energy Carolinas and Duke Energy

Progress have generated over 60 percent of the guaranteed fuel and joint

dispatch savings. In total 85 percent of the guaranteed benefi t has been locked-

in or delivered to Duke Energy’s customers in the Carolinas.

Dan River Coal Ash Spill and Other Coal Ash Management. Duke

Energy has improved coal ash practices and accelerated plans to close its

ash basins. Comprehensive engineering reviews were completed at each of

the ash basins, and a central internal organization was formed to manage

all coal combustion products. Duke Energy also established an independent

national Coal Ash Management Advisory Board to help guide company strategy.

Excavation plans have been fi led for four high priority sites identifi ed in

connection with North Carolina coal ash management enacted in 2014 — Dan

River, Asheville, Riverbend and L.V. Sutton combined cycle facility (Sutton).

Excavation plans have also been fi led for the W.S. Lee site in South Carolina, and

work is progressing on closure plans for the other ten North Carolina sites.

On February 20, 2015, Duke Energy Carolinas, Duke Energy Progress and

Duke Energy Business Services LLC (DEBS), a wholly owned subsidiary of Duke

Energy, each entered into a Memorandum of Plea Agreement (Plea Agreements)

in connection with an investigation initiated by the USDOJ. The Plea Agreements

are subject to the approval of the United States District Court for the Eastern

District of North Carolina and, if approved, will end the grand jury investigation

related to the Dan River ash basin release and the management of coal ash

basins at 14 plants in North Carolina with coal ash basins.