Duke Energy 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

PART II

Under the Plea Agreements, the USDOJ charged DEBS and Duke Energy

Progress with four misdemeanor CWA violations related to violations at Duke

Energy Progress’ H.F. Lee Steam Electric Plant, Cape Fear Steam Electric Plant

and Asheville Steam Electric Generating Plant. The United States Department

Of Justice charged Duke Energy Carolinas and DEBS with fi ve misdemeanor

Clean Water Act violations related to violations at Duke Energy Carolinas’ Dan

River Steam Station and Riverbend Steam Station. DEBS, Duke Energy Carolinas

and Duke Energy Progress also agreed (i) to a fi ve-year probation period, (ii) to

pay a total of approximately $68 million in fi nes and restitution and $34 million

for community service and mitigation (the Payments), and (iii) to establish

environmental compliance plans subject to the oversight of a court-appointed

monitor paid for by the companies for the duration of the probation period (iii) for

Duke Energy Carolinas and Duke Energy Progress each to maintain $250 million

under their Master Credit Facility as security to meet their obligations under

the Pleas Agreements, in addition to certain other conditions set out in the Plea

Agreements. Payments under the Plea Agreements will be borne by shareholders

and are not tax deductible. Duke Energy Corporation has agreed to issue a

guarantee of all payments and performance due from the Companies, including

but not limited to payments for fi nes, restitution, community service, mitigation

and the funding of, and obligations under, the environmental compliance plans.

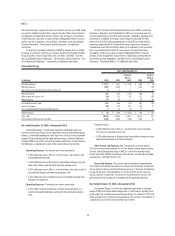

As a result of the Plea Agreements, Duke Energy Carolinas and Duke Energy

Progress recognized charges of $72 million and $30 million, respectively, in the

fourth quarter of 2014. The amounts are recorded in Operation, maintenance and

other on the Consolidated Statements of Operations and Comprehensive Income.

Duke Energy Objectives – 2015 and Beyond

Duke Energy is committed to creating value and trust, while transforming

our energy future. Primary objectives for 2015 are:

• Growing and adapting the business and achieving fi nancial objectives,

including delivering on the 2015 adjusted diluted earnings per share

(EPS) guidance range of $4.55 to $4.75, and advancing viable future

growth opportunities for regulated and nonregulated businesses

• Excelling in safety, operational performance and environmental

stewardship

• Developing and engaging employees, while strengthening leadership

• Improving the lives of our customers and the vitality of our communities

Complete the Sale of the Nonregulated Midwest Generation

Business. In January 2015, FERC requested additional information regarding the

proposed sale of the nonregulated Midwest Generation business. The parties to

the transaction responded to FERC on February 6, 2015, and the comment period

expired on February 23, 2015. FERC approval is the fi nal regulatory approval

required to close the transaction, which is expected by the end of the second

quarter of 2015.

Proceeds from the sale are expected to be deployed to recapitalize Duke

Energy in a balanced manner, with a combination of an accelerated share

repurchase and reductions in holding company debt. However, this plan could

change depending on circumstances at the time of closing.

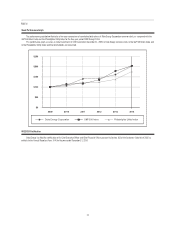

Growth Initiatives. Duke Energy will continue to pursue regulatory,

state and federal approval of the growth projects. These projects will support

long-term adjusted earnings growth of 4 to 6 percent and support Duke Energy’s

ability to continue providing its customers affordable, reliable energy from an

increasingly diverse generation portfolio.

In the Regulated Utilities business, Duke Energy does not anticipate any

signifi cant base rate cases through 2017. Growth is expected to be supported

by retail and wholesale load growth and signifi cant investments. Duke Energy

expects to invest between $4 billion and $5 billion annually in Regulated

business growth projects. Many of these projects will be recovered through riders

such as transmission and distribution expenditures in Indiana and Ohio, as well

as the Crystal River Unit 3 rider in Florida and energy effi ciency riders in the

Carolinas. The regulated wholesale business is expected to grow in 2015.

The Commercial Power renewables business is a signifi cant component

of the Duke Energy growth strategy. Renewable projects enable Duke Energy

to respond to customer interest in clean tech while increasing diversity in the

generation portfolio. The portfolio of wind and solar is expected to continue

growing as between $1 billion and $2 billion is deployed over the next three

years. Additionally, investments in the Atlantic Coast pipeline adds approximately

$1 billion of capital spending through 2017.

Continue the Coal Ash Management Strategy. In December 2014, U.S.

Environmental Protection Agency (EPA) fi nalized the Resource Conservation and

Recovery Act (RCRA) related to coal combustion residuals (CCR) associated

with the generation of electricity from coal. The rules classify coal ash as

nonhazardous waste and provide guidelines related to the disposal of coal ash.

Duke Energy will continue the compliance strategy with the North Carolina Coal

Ash Management Act of 2014 (Coal Ash Act) and complete an evaluation of

the provisions for this rule. Duke Energy will update ash management plans

to comply with all state and federal regulations and begin excavation or other

compliance work once plans and permits are approved.

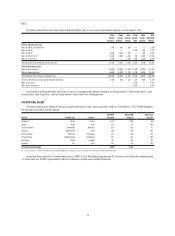

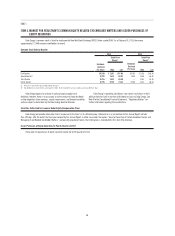

Results of Operations

In this section, Duke Energy provides analysis and discussion of earnings

and factors affecting earnings on both a GAAP and non-GAAP basis.

Management evaluates fi nancial performance in part based on the

non-GAAP fi nancial measures, adjusted earnings and adjusted diluted EPS.

These items are measured as income from continuing operations net of income

(loss) attributable to noncontrolling interests, adjusted for the dollar and per

share impact of mark-to-market impacts of economic hedges in the Commercial

Power segment and special items including the operating results of the Disposal

Group classifi ed as discontinued operations for GAAP purposes. Special items

represent certain charges and credits, which management believes will not be

recurring on a regular basis, although it is reasonably possible such charges

and credits could recur. As result of the agreement in August 2014 to sell the

Disposal Group to Dynegy, the operating results of the Disposal Group are

classifi ed as discontinued operations, including a portion of the mark-to-market

adjustments associated with derivative contracts. Management believes that

including the operating results of the Disposal Group classifi ed as discontinued

operations better refl ects its fi nancial performance and therefore has included

these results in adjusted earnings and adjusted diluted EPS. Derivative contracts

are used in Duke Energy’s hedging of a portion of the economic value of its

generation assets in the Commercial Power segment. The mark-to-market

impact of derivative contracts is recognized in GAAP earnings immediately and,

if associated with the Disposal Group, classifi ed as discontinued operations,

as such derivative contracts do not qualify for hedge accounting or regulatory

treatment. The economic value of generation assets is subject to fl uctuations

in fair value due to market price volatility of input and output commodities

(e.g., coal, electricity, natural gas). Economic hedging involves both purchases

and sales of those input and output commodities related to generation assets.

Operations of the generation assets are accounted for under the accrual method.

Management believes excluding impacts of mark-to-market changes of the

derivative contracts from adjusted earnings until settlement better matches the

fi nancial impacts of the derivative contract with the portion of economic value of

the underlying hedged asset. Management believes the presentation of adjusted

earnings and adjusted diluted EPS provides useful information to investors, as it

provides them an additional relevant comparison of Duke Energy’s performance

across periods. Management uses these non-GAAP fi nancial measures for

planning and forecasting and for reporting results to the Duke Energy Board of

Directors (Board of Directors), employees, shareholders, analysts and investors

concerning Duke Energy’s fi nancial performance. Adjusted diluted EPS is also