Duke Energy 2014 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates

In preparing fi nancial statements that conform to generally accepted

accounting principles (GAAP) in the U.S., the Duke Energy Registrants must

make estimates and assumptions that affect the reported amounts of assets

and liabilities, the reported amounts of revenues and expenses, and the

disclosure of contingent assets and liabilities at the date of the fi nancial

statements. Actual results could differ from those estimates.

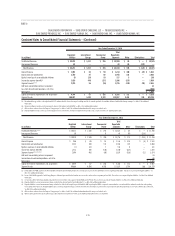

Regulatory Accounting

The majority of the Duke Energy Registrants’ operations are subject to

price regulation for the sale of electricity and gas by state utility commissions

or FERC. When prices are set on the basis of specifi c costs of the regulated

operations and an effective franchise is in place such that suffi cient gas or

electric services can be sold to recover those costs, the Duke Energy Registrants

apply regulatory accounting. Regulatory accounting changes the timing of the

recognition of costs or revenues relative to a company that does not apply

regulatory accounting. As a result, Regulatory assets and Regulatory liabilities

are recognized on the Consolidated Balance Sheets. Regulatory assets and

liabilities are amortized consistent with the treatment of the related cost in the

ratemaking process. See Note 4 for further information.

Regulated Fuel Costs and Purchased Power

The Duke Energy Registrants utilize cost-tracking mechanisms, commonly

referred to as fuel adjustment clauses. These clauses allow for the recovery

of fuel and fuel-related costs and portions of purchased power costs through

surcharges on customer rates. The difference between the costs incurred

and the surcharge revenues is recorded as an adjustment to Fuel Operating

Revenues – Regulated electric on the Consolidated Statements of Operations

with an offsetting impact on regulatory assets or liabilities.

Cash and Cash Equivalents

All highly liquid investments with maturities of three months or less

at the date of acquisition are considered cash equivalents. At December 31,

2014, $1,680 million of Duke Energy’s total cash and cash equivalents is

held by entities domiciled in foreign jurisdictions. During the fourth quarter of

2014, Duke Energy declared a taxable dividend of historical foreign earnings in

the form of notes payable that will result in the repatriation of approximately

$2.7 billion in cash held and expected to be generated by International Energy

over a period of up to 8 years. See Note 22 to the Consolidated Financial

Statements, “Income Taxes,” for additional information.

Restricted Cash

The Duke Energy Registrants have restricted cash related primarily

to collateral assets, escrow deposits and variable interest entities (VIEs).

Restricted cash balances are refl ected in Other within Current Assets and in

Other within Investments and Other Assets on the Consolidated Balance Sheets.

At December 31, 2014 and 2013, Duke Energy had restricted cash totaling

$298 million and $307 million, respectively.

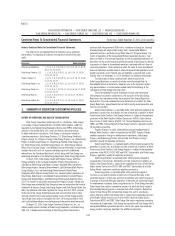

Inventory

Inventory is used for operations and is recorded primarily using the

average cost method. Inventory related to regulated operations is valued at

historical cost. Inventory related to nonregulated operations is valued at the

lower of cost or market. Materials and supplies are recorded as inventory when

purchased and subsequently charged to expense or capitalized to property, plant

and equipment when installed. Reserves are established for excess and obsolete

inventory. The components of inventory are presented in the tables below.

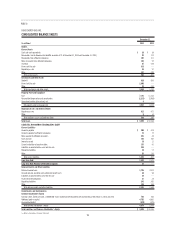

December 31, 2014

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Materials and supplies $ 2,102 $ 719 $ 981 $ 676 $ 305 $ 67 $ 258

Coal held for electric generation 997 362 329 150 178 21 275

Oil, gas and other fuel held for electric generation 360 43 280 140 140 9 4

Total inventory $ 3,459 $ 1,124 $ 1,590 $ 966 $ 623 $ 97 $ 537

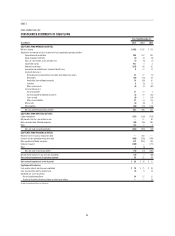

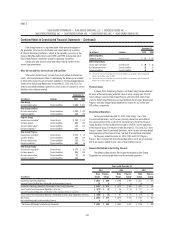

December 31, 2013

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Materials and supplies $ 1,901 $ 654 $ 854 $ 567 $ 287 $ 117 $ 193

Coal held for electric generation 1,018 374 334 187 147 65 238

Oil, gas and other fuel held for electric generation 331 37 236 99 137 47 3

Total inventory $ 3,250 $ 1,065 $ 1,424 $ 853 $ 571 $ 229 $ 434