Duke Energy 2014 Annual Report Download - page 231

Download and view the complete annual report

Please find page 231 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

211

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

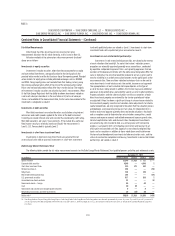

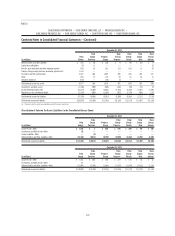

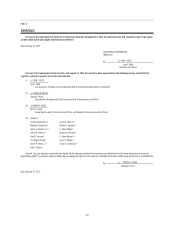

25. QUARTERLY FINANCIAL DATA (UNAUDITED)

DUKE ENERGY

Quarterly EPS amounts are meant to be stand-alone calculations and are

not always additive to the full-year amount due to rounding and the weighting of

share issuances.

(in millions, except per share data)

First

Quarter(a)

Second

Quarter(a)

Third

Quarter(a)

Fourth

Quarter(a) Total

2014

Operating revenues $6,263 $5,708 $6,395 $5,559 $23,925

Operating income 1,362 1,289 1,619 988 5,258

Income from continuing operations 750 725 891 99 2,465

(Loss) income from discontinued

operations, net of tax (843) (112) 378 1 (576)

Net loss (income) (93) 613 1,269 100 1,889

Net loss (income) attributable to Duke

Energy Corporation (97) 609 1,274 97 1,883

Earnings per share:

Income from continuing operations

attributable to Duke Energy

Corporation common shareholders

Basic $ 1.05 $ 1.02 $ 1.25 $ 0.14 $ 3.46

Diluted $ 1.05 $ 1.02 $ 1.25 $ 0.14 $ 3.46

(Loss) income from discontinued

operations attributable to Duke Energy

Corporation common shareholders

Basic $ (1.19) $ (0.16) $ 0.55 $ — $ (0.80)

Diluted $ (1.19) $ (0.16) $ 0.55 $ — $ (0.80)

Net (loss) income attributable to Duke

Energy Corporation common

shareholders

Basic $ (0.14) $ 0.86 $ 1.80 $ 0.14 $ 2.66

Diluted $ (0.14) $ 0.86 $ 1.80 $ 0.14 $ 2.66

2013

Operating revenues $5,536 $5,393 $6,217 $5,610 $22,756

Operating income 1,259 742 1,660 1,193 4,854

Income from continuing operations 663 292 946 689 2,590

(Loss) income from discontinued

operations, net of tax (29) 50 62 3 86

Net income 634 342 1,008 692 2,676

Net income attributable to Duke

Energy Corporation 634 339 1,004 688 2,665

Earnings per share:

Income from continuing operations

attributable to Duke Energy

Corporation common shareholders

Basic $ 0.93 $ 0.40 $ 1.33 $ 0.96 $ 3.64

Diluted $ 0.93 $ 0.40 $ 1.33 $ 0.96 $ 3.63

(Loss) income from discontinued

operations attributable to Duke Energy

Corporation common shareholders

Basic $ (0.04) $ 0.08 $ 0.09 $ 0.01 $ 0.13

Diluted $ (0.04) $ 0.08 $ 0.09 $ 0.01 $ 0.13

Net income attributable to Duke Energy

Corporation common shareholders

Basic $ 0.89 $ 0.48 $ 1.42 $ 0.97 $ 3.77

Diluted $ 0.89 $ 0.48 $ 1.42 $ 0.97 $ 3.76

(a) Operating results refl ect reclassifi cations due to the impact of discontinued

operations (see Note 2 for further information).

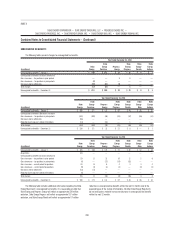

The following table includes unusual or infrequently occurring items in

each quarter during the two most recently completed fi scal years. All amounts

discussed below are pretax unless otherwise noted.

(in millions)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter Total

2014

Costs to achieve Progress Energy merger

(see Note 2) $ (55) $ (61) $ (56) $ (33) $ (205)

Midwest Generation Impairment

(see Note 2) (1,287) — 477 (39) (849)

Coal ash Plea Agreements Reserve

(see Note 5) — — — (102) (102)

International Tax Adjustment

(see Note 22) — — — (373) (373)

Asset Impairment (see Note 11) (94) — — — (94)

Total $(1,436) $ (61) $ 421 $ (547) $(1,623)

2013(a)

Costs to achieve Progress Energy merger

(see Note 2) $ (55) $ (82) $ (88) $ (72) $ (297)

Crystal River Unit 3 charges (see Note 4) — (295) — (57) (352)

Harris and Levy nuclear development

charges (see Note 4) — (87) — — (87)

Gain on sale of DukeNet (see Note 12) — — — 105 105

Total $ (55) $ (464) $ (88) $ (24) $ (631)

(a) Revised retail rates became effective in January for Duke Energy Florida, May for Duke Energy Ohio, June

for Duke Energy Progress and September for Duke Energy Carolinas (see Note 4 for further information).

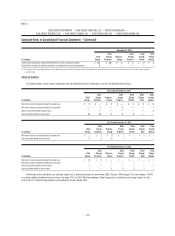

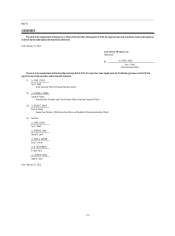

DUKE ENERGY CAROLINAS

(in millions)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter Total

2014

Operating revenues $2,000 $1,755 $1,938 $1,658 $7,351

Operating income 509 438 630 318 1,895

Net income 286 270 377 139 1,072

2013

Operating revenues $1,729 $1,591 $1,919 $1,715 $6,954

Operating income 434 351 604 420 1,809

Net income 244 181 342 209 976

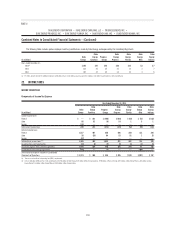

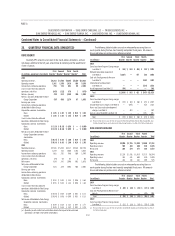

The following table includes unusual or infrequently occurring items in

each quarter during the two most recently completed fi scal years. All amounts

discussed below are pretax unless otherwise noted.

(in millions)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter Total

2014

Costs to achieve Progress Energy merger

(see Note 2) $ (29) $ (38) $ (25) $ (17) $ (109)

Coal ash Plea Agreements Reserve (see

Note 5) — — — (72) (72)

Total $ (29) $ (38) $ (25) $ (89) $ (181)

2013(a)

Costs to achieve Progress Energy merger

(see Note 2) $ (22) $ (35) $ (34) $ (29) $ (120)

(a) Revised retail rates became effective in September in both North Carolina and South Carolina (see Note 4

for further information).