Duke Energy 2014 Annual Report Download - page 232

Download and view the complete annual report

Please find page 232 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

212

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

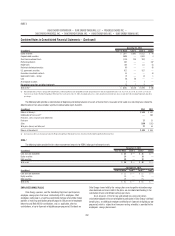

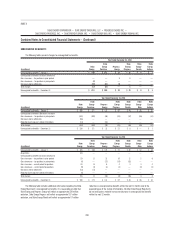

PROGRESS ENERGY

(in millions)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter Total

2014

Operating revenues $2,541 $2,421 $2,863 $2,341 $10,166

Operating income 477 488 665 388 2,018

Income from continuing operations 204 207 330 139 880

Net income 203 202 330 139 874

Net income attributable to Parent 202 202 329 136 869

2013

Operating revenues $2,186 $2,281 $2,766 $2,300 $ 9,533

Operating income 430 114 671 403 1,618

Income (loss) from continuing

operations 154 (13) 328 190 659

Net income (loss) 154 (17) 342 196 675

Net income (loss) attributable to Parent 153 (17) 341 195 672

The following table includes unusual or infrequently occurring items in

each quarter during the two most recently completed fi scal years. All amounts

discussed below are pretax unless otherwise noted.

(in millions)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter Total

2014

Costs to achieve the merger with Duke

Energy (see Note 2) $(19) $ (12) $ (21) $ (13) $ (65)

Coal ash Plea Agreements

Reserve (see Note 5) — — — (30) (30)

Total $(19) $ (12) $ (21) $ (43) $ (95)

2013(a)

Costs to achieve the merger with Duke

Energy (see Note 2) $(19) $ (33) $ (42) $ (28) $ (122)

Crystal River Unit 3 charges

(see Note 4) — (295) — (57) (352)

Harris and Levy nuclear development

charges (see Note 4) — (87) — — (87)

Total $ (19) $ (415) $ (42) $ (85) $ (561)

(a) Revised retail rates became effective in January in Florida and June in North Carolina (see Note 4 for

further information).

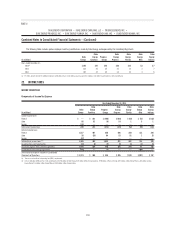

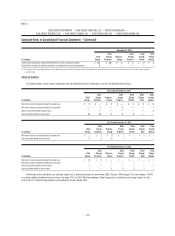

DUKE ENERGY PROGRESS

(in millions)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter Total

2014

Operating revenues $1,422 $1,191 $1,367 $1,196 $ 5,176

Operating income 258 212 285 180 935

Net income 133 101 157 76 467

2013

Operating revenues $1,216 $1,135 $1,430 $1,211 $ 4,992

Operating income 212 166 303 251 932

Net income 110 77 175 138 500

The following table includes unusual or infrequently occurring items

in each quarter during the two most recently completed fiscal years. All

amounts discussed below are pretax unless otherwise noted.

(in millions)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter Total

2014

Costs to achieve the merger with Duke

Energy (see Note 2) $ (14) $ (3) $ (15) $ (10) $ (42)

Coal ash Plea Agreements Reserve

(see Note 5) — — — (30) (30)

Total $ (14) $ (3) $ (15) $ (40) $ (72)

2013(a)

Costs to achieve the merger with Duke

Energy (see Note 2) $ (11) $ (22) $ (32) $ (19) $ (84)

Harris nuclear development charges

(see Note 4) $ — $ (22) $ — $ — $ (22)

Total $ (11) $ (44) $ (32) $ (19) $ (106)

(a) Revised retail rates became effective in June in North Carolina (see Note 4 for further information).

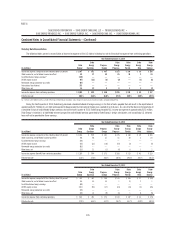

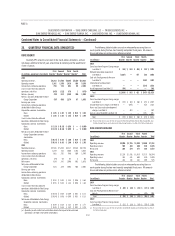

DUKE ENERGY FLORIDA

(in millions)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter Total

2014

Operating revenues $1,116 $1,225 $1,491 $1,143 $4,975

Operating income 219 276 378 205 1,078

Net income 108 142 205 93 548

2013

Operating revenues $ 968 $1,142 $1,332 $1,085 $4,527

Operating income (loss) 221 (53) 369 151 688

Net income (loss) 110 (57) 197 75 325

The following table includes unusual or infrequently occurring items in

each quarter during the two most recently completed fi scal years. All amounts

discussed below are pretax unless otherwise noted.

(in millions)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter Total

2014

Costs to achieve the merger with Duke

Energy (see Note 2) $ (5) $ (9) $ (6) $ (3) $ (23)

2013(a)

Costs to achieve the merger with Duke

Energy (see Note 2) $ (8) $ (11) $ (10) $ (9) $ (38)

Crystal River Unit 3 charges (see Note 4) — (295) — (57) (352)

Levy nuclear development charges

(see Note 4) — (65) — — (65)

Total $ (8) $ (371) $ (10) $ (66) $ (455)

(a) Revised retail rates became effective in January (see Note 4 for further information).