Duke Energy 2014 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

acceptance of voluntary severance benefi ts is determined by management

based on the facts and circumstances of the benefi ts being offered. See Note 19

for further information.

Guarantees

Liabilities are recognized at the time of issuance or material modifi cation

of a guarantee for the estimated fair value of the obligation it assumes. Fair

value is estimated using a probability-weighted approach. The obligation is

reduced over the term of the guarantee or related contract in a systematic and

rational method as risk is reduced. Any additional contingent loss for guarantee

contracts subsequent to the initial recognition of a liability is accounted for and

recognized at the time a loss is probable and can be reasonably estimated. See

Note 7 for further information.

Stock-Based Compensation

Stock-based compensation represents costs related to stock-based

awards granted to employees and Duke Energy Board of Directors (Board of

Directors) members. Duke Energy recognizes stock-based compensation based

upon the estimated fair value of awards, net of estimated forfeitures at the date

of issuance. The recognition period for these costs begin at either the applicable

service inception date or grant date and continues throughout the requisite

service period, or for certain share-based awards until the employee becomes

retirement eligible, if earlier. Compensation cost is recognized as expense or

capitalized as a component of property, plant and equipment. See Note 20 for

further information.

Income Taxes

Duke Energy and its subsidiaries fi le a consolidated federal income

tax return and other state and foreign jurisdictional returns. The Subsidiary

Registrants entered into a tax-sharing agreement with Duke Energy. Income

taxes recorded represent amounts the Subsidiary Registrants would incur

as separate C-Corporations. Deferred income taxes have been provided for

temporary differences between GAAP and tax bases of assets and liabilities

because the differences create taxable or tax-deductible amounts for future

periods. Deferred taxes are not provided on translation gains and losses when

earnings of a foreign operation are expected to be indefi nitely reinvested.

Investment tax credits (ITC) associated with regulated operations are deferred

and amortized as a reduction of income tax expense over the estimated useful

lives of the related properties.

Positions taken or expected to be taken on tax returns, including the

decision to exclude certain income or transactions from a return, are recognized

in the fi nancial statements when it is more likely than not the tax position can

be sustained based solely on the technical merits of the position. The largest

amount of tax benefi t that is greater than 50 percent likely of being effectively

settled is recorded. Management considers a tax position effectively settled

when: (i) the taxing authority has completed its examination procedures,

including all appeals and administrative reviews; (ii) the Duke Energy

Registrants do not intend to appeal or litigate the tax position included in the

completed examination; and (iii) it is remote the taxing authority would examine

or re-examine the tax position. The amount of a tax return position that is not

recognized in the fi nancial statements is disclosed as an unrecognized tax

benefi t. If these unrecognized tax benefi ts are later recognized, then there will be

a decrease in income taxes payable, an income tax refund or a swap between

deferred and current taxes payable. If the portion of tax benefi ts that has been

recognized changes and those tax benefi ts are subsequently unrecognized, then

the previously recognized tax benefi ts may impact the fi nancial statements

through increasing income taxes payable, reducing income tax refunds

receivable changing deferred taxes. Changes in assumptions on tax benefi ts

may also impact interest expense or interest income and may result in the

recognition of tax penalties.

Tax-related interest and penalties are recorded in Interest Expense and

Other Income and Expenses, net, in the Consolidated Statements of Operations.

See Note 22 for further information.

Accounting for Renewable Energy Tax Credits and Cash Grants

When Duke Energy receives ITC or cash grants on wind or solar facilities,

it reduces the basis of the property recorded on the Consolidated Balance

Sheets by the amount of the ITC or cash grant and, therefore, the ITC or grant

benefi t is recognized through reduced depreciation expense. Additionally, certain

tax credits and government grants received provide for initial tax depreciable

base in excess of the book carrying value equal to one half of the ITC or

government grant. Deferred tax benefi ts are recorded as a reduction to income

tax expense in the period that the basis difference is created.

Excise Taxes

Certain excise taxes levied by state or local governments are required to

be paid even if not collected from the customer. These taxes are recognized on a

gross basis. Otherwise, the taxes are accounted for net. Excise taxes accounted

for on a gross basis as both operating revenues and property and other taxes in

the Consolidated Statements of Operations were as follows.

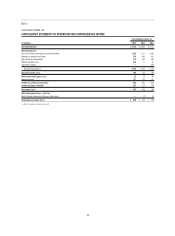

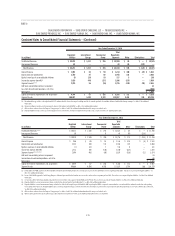

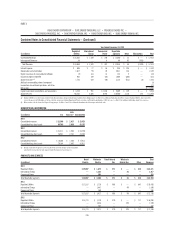

Years Ended December 31,

(in millions) 2014 2013 2012

Duke Energy $ 498 $ 602 $ 466

Duke Energy Carolinas 94 164 161

Progress Energy 263 304 317

Duke Energy Progress 56 115 113

Duke Energy Florida 207 189 205

Duke Energy Ohio 103 105 102

Duke Energy Indiana 38 29 33

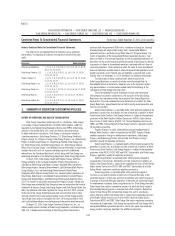

During the third quarter of 2014, the North Carolina gross receipts tax was

terminated due to the North Carolina Tax Simplifi cation and Rate Reduction Act.

The North Carolina gross receipts tax is no longer imposed effective July 1, 2014.

On July 23, 2013, North Carolina House Bill 998 (HB 998) was signed

into law. HB 998 repealed the utility franchise tax effective July 1, 2014. The

utility franchise tax was 3.22 percent gross receipts tax on sales of electricity.

The result of this change in law will be an annual reduction in excise taxes

of approximately $160 million for Duke Energy Carolinas and approximately

$110 million for Duke Energy Progress. HB 998 also increases sales tax on

electricity from 3 to 7 percent effective July 1, 2014. HB 998 requires the NCUC

to adjust retail electric rates for the elimination of the utility franchise tax,

changes due to the increase in sales tax on electricity, and the resulting change

in liability of utility companies under the general franchise tax.

Foreign Currency Translation

The local currencies of most of Duke Energy’s foreign operations have

been determined to be their functional currencies. However, certain foreign

operations’ functional currency has been determined to be the U.S. dollar, based

on an assessment of the economic circumstances of the foreign operation.

Assets and liabilities of foreign operations whose functional currency is not