Duke Energy 2014 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

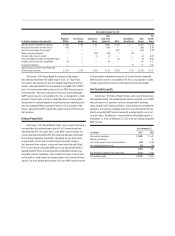

Year Ended December 31, 2012

(in millions, except per share amounts)

Regulated

Utilities

International

Energy

Commercial

Power

Total

Reportable

Segments Other

Eliminations/

Discontinued

Duke

Energy

Per

Diluted

Share

Adjusted segment income/Adjusted earnings $2,086 $ 439 $ 93 $2,618 $(129) $ — $2,489 $ 4.33

Edwardsport impairment and other charges (402) — — (402) — — (402) (0.70)

Costs to achieve Progress Energy merger — — — — (397) — (397) (0.70)

Midwest generation operations — — (149) (149) 9 140 — —

Economic hedges (mark-to-market) — — (3) (3) — — (3) (0.01)

Democratic National Convention Host Committee support — — — — (6) — (6) (0.01)

Employee severance and offi ce consolidation 60 — — 60 — — 60 0.11

Discontinued operations — — — — — 27 27 0.05

Segment income (loss)/Net Income Attributable

to Duke Energy Corporation $1,744 $ 439 $ (59) $2,124 $(523) $ 167 $1,768 $ 3.07

Duke Energy’s 2014 Annual Report also references Duke Energy’s

forecasted adjusted diluted EPS outlook range of $4.55 - $4.75 per share.

The materials also reference the long-term targeted range of growth of 4 to 6

percent in adjusted diluted EPS (on a compound annual growth rate (“CAGR”)

basis). Due to the forward-looking nature of this non-GAAP fi nancial measure

for future periods, information to reconcile it to the most directly comparable

GAAP fi nancial measure is not available at this time, as management is unable

to project all special items or mark-to-market adjustments for future periods.

Irrespective of discontinued operations accounting treatment, operating results

from the nonregulated Midwest generation business will be included in Duke

Energy’s adjusted diluted EPS and adjusted segment income until the close of

the transaction.

Dividend Payout Ratio

Duke Energy’s 2014 Annual Report includes a discussion of Duke Energy’s

anticipated long-term dividend payout ratio of 65 to 70 percent based upon

adjusted diluted EPS. This payout ratio is a non-GAAP fi nancial measure as it

is based upon forecasted diluted EPS from continuing operations attributable

to Duke Energy Corporation shareholders, adjusted for the per-share impact

of special items and the mark-to-market impacts of economic hedges in

the Commercial Power segment, as discussed above under Adjusted Diluted

EPS. The most directly comparable GAAP measure for adjusted diluted EPS is

reported diluted EPS from continuing operations attributable to Duke Energy

Corporation common shareholders, which includes the impact of special items

and the mark-to-market impacts of economic hedges in the Commercial Power

segment. Due to the forward-looking nature of this non-GAAP fi nancial measure

for future periods, information to reconcile it to the most directly comparable

GAAP fi nancial measure is not available at this time, as management is unable

to project special items or mark-to-market adjustments for future periods.

Total Available Liquidity

Duke Energy’s 2014 Annual Report includes a discussion of Duke Energy’s

total available liquidity. The available liquidity balance presented is a non-GAAP

fi nancial measure as it represents cash and cash equivalents (excluding

certain amounts held in foreign jurisdictions and cash otherwise unavailable for

operations) and remaining availability under the master credit facility. The most

directly comparable GAAP fi nancial measure for available liquidity is cash and

cash equivalents. The following is a reconciliation of total available liquidity as

of December 31, 2014 and December 31, 2013, to the most directly comparable

GAAP measure:

As of December 31,

(in millions) 2014 2013

Cash and cash equivalents $ 2,036 $ 1,501

Short-term investments — 44

Less: Certain amounts held in foreign jurisdictions (442) (1,139)

Less: Unavailable domestic cash (34) (24)

1,560 382

Plus: Remaining availability under master credit 3,793 5,248

Total available liquidity $ 5,353 $ 5,630