Duke Energy 2014 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

182

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

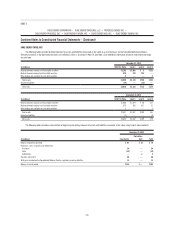

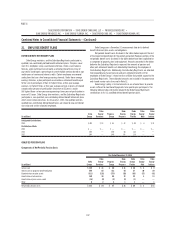

December 31, 2013

Duke Energy

(in millions) Renewables Other Total

Duke

Energy

Ohio

Duke

Energy

Indiana

Receivables $ — $ — $ — $ 114 $ 143

Investments in equity method unconsolidated affi liates 153 60 213 — —

Intangibles —969696—

Investments and other assets — 4 4 — —

Total assets 153 160 313 210 143

Other current liabilities — 3 3 — —

Deferred credits and other liabilities — 15 15 — —

Total liabilities — 18 18 — —

Net assets $ 153 $ 142 $ 295 $ 210 $ 143

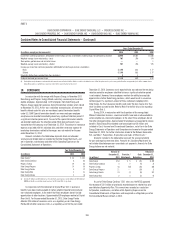

The Duke Energy Registrants are not aware of any situations where the

maximum exposure to loss signifi cantly exceeds the carrying values shown

above except for the power purchase agreement with OVEC, which is discussed

below, and various guarantees, some of which are refl ected in the table above

as Deferred credits and other liabilities. For more information on various

guarantees, refer to Note 7, “Guarantees and Indemnifi cations.”

Renewables

Duke Energy has investments in various renewable energy project entities.

Some of these entities are VIEs due to long-term fi xed price power purchase

agreements. These fi xed price agreements effectively transfer commodity price

risk to the buyer of the power. Duke Energy does not consolidate these VIEs

because power to direct and control key activities is shared jointly by Duke

Energy and other owners.

Other

At December 31, 2013, the most signifi cant of the Other non-consolidated

VIEs was Duke Energy Ohio’s 9 percent ownership interest in OVEC. Through its

ownership interest in OVEC, Duke Energy Ohio has a contractual arrangement

to buy power from OVEC’s power plants through June 2040. The initial carrying

value of this contract was recorded as an intangible asset when Duke Energy

acquired Cinergy in April 2006. Proceeds from the sale of power by OVEC to its

power purchase agreement counterparties are designed to be suffi cient to meet

its operating expenses, fi xed costs, debt amortization and interest expense, as

well as earn a return on equity. Accordingly, the value of this contract is subject

to variability due to fl uctuations in power prices and changes in OVEC’s costs of

business, including costs associated with its 2,256 MW of coal-fi red generation

capacity. Proposed environmental rulemaking could increase the costs of OVEC,

which would be passed through to Duke Energy Ohio. In 2014, Duke Energy

recorded a $94 million impairment related to OVEC.

CRC

See discussion under Consolidated VIEs for additional information related

to CRC.

Amounts included in Receivables in the above table for Duke Energy

Ohio and Duke Energy Indiana refl ect their retained interest in receivables

sold to CRC. These subordinated notes held by Duke Energy Ohio and Duke

Energy Indiana are stated at fair value. Carrying values of retained interests are

determined by allocating carrying value of the receivables between assets sold

and interests retained based on relative fair value. The allocated bases of the

subordinated notes are not materially different than their face value because (i)

the receivables generally turnover in less than two months, (ii) credit losses are

reasonably predictable due to the broad customer base and lack of signifi cant

concentration, and (iii) the equity in CRC is subordinate to all retained interests

and thus would absorb losses fi rst. The hypothetical effect on fair value of the

retained interests assuming both a 10 percent and a 20 percent unfavorable

variation in credit losses or discount rates is not material due to the short

turnover of receivables and historically low credit loss history. Interest accrues

to Duke Energy Ohio and Duke Energy Indiana on the retained interests using the

acceptable yield method. This method generally approximates the stated rate

on the notes since the allocated basis and the face value are nearly equivalent.

An impairment charge is recorded against the carrying value of both retained

interests and purchased benefi cial interest whenever it is determined that an

other-than-temporary impairment has occurred.

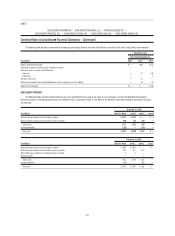

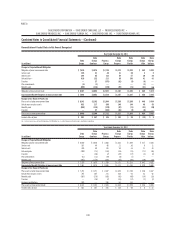

Key assumptions used in estimating fair value are detailed in the following table.

Duke Energy Ohio Duke Energy Indiana

2014 2013 2014 2013

Anticipated credit loss ratio 0.6% 0.6% 0.3% 0.3%

Discount rate 1.2% 1.2% 1.2% 1.2%

Receivable turnover rate 12.8% 12.8% 10.5% 10.3%