Duke Energy 2014 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

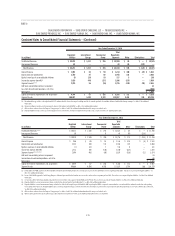

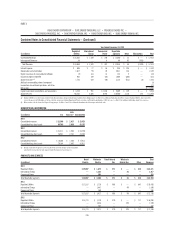

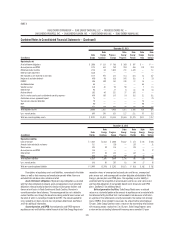

Combined Notes to Consolidated Financial Statements – (Continued)

the Lee Nuclear Station COL application. These design changes set the schedule

for completion of the NRC COL application review and issuance of the Lee COL.

Receipt of the Lee Nuclear Station COL is currently expected by mid-2016.

Duke Energy Progress

2012 North Carolina Rate Case

On May 30, 2013, the NCUC approved a settlement agreement related

to Duke Energy Progress’ request for a rate increase. The Public Staff was a

party to the settlement agreement. The settling parties agreed to a two-year

step-in rate increase, with the fi rst year providing for a $147 million, or a 4.5

percent average increase in rates, and the second year providing for rates to

be increased by an additional $31 million, or a 1.0 percent average increase

in rates. The agreement is based upon a return on equity of 10.2 percent and

an equity component of the capital structure of 53 percent. The settlement

agreement (i) allows for the recognition of nuclear outage expenses over

the refueling cycle rather than when the outage occurs, (ii) a $20 million

shareholder contribution to agencies that provide energy assistance to low-

income customers, and (iii) a reduction in the regulatory liability for costs of

removal of $20 million for the fi rst year. The initial rate increase went into effect

on June 1, 2013 and the step-in rate increase went into effect in June 2013.

On July 1, 2013, the NCAG appealed the NCUC’s approval of the rate of

return and capital structure included in the agreement. NC WARN also appealed

various matters in the settlement. On August 20, 2014, the NCSC affi rmed

the NCUC’s order approving Duke Energy Progress’ rate of return and capital

structure concluding the appeal.

L.V. Sutton Combined Cycle Facility

Duke Energy Progress completed construction of a 625 MW combined

cycle natural gas-fi red generating facility at its existing L.V. Sutton Steam

Station (Sutton) in New Hanover County, North Carolina. Sutton began

commercial operations in the fourth quarter of 2013.

Shearon Harris Nuclear Station Expansion

In 2006, Duke Energy Progress selected a site at Harris to evaluate for

possible future nuclear expansion. On February 19, 2008, Duke Energy Progress

fi led its COL application with the NRC for two Westinghouse AP1000 reactors

at Harris, which the NRC docketed for review. On May 2, 2013, Duke Energy

Progress fi led a letter with the NRC requesting the NRC to suspend its review

activities associated with the COL at the Harris site. As a result of the decision

to suspend the COL applications, during the second quarter of 2013, Duke

Energy Progress recorded a pretax impairment charge of $22 million which

represented costs associated with the COL, which were not probable of recovery.

As of December 31, 2014, approximately $48 million is recorded in Regulatory

assets on Duke Energy Progress’ Consolidated Balance Sheets.

Wholesale Depreciation Rates

On April 19, 2013, Duke Energy Progress fi led an application with FERC

for acceptance of changes to generation depreciation rates and in August 2013

fi led for acceptance of additional changes. These changes affect the rates

of Duke Energy Progress’ wholesale power customers that purchase or will

purchase power under formula rates. Certain Duke Energy Progress wholesale

customers fi led interventions and protests. FERC accepted the depreciation

rate changes, subject to refund, and set the matter for settlement and hearing

in a consolidated proceeding. FERC further initiated an action with respect to

the justness and reasonableness of the proposed rate changes. Settlement was

reached in October 2014 for changes to the depreciation rates and conforming

changes to the wholesale formula rates. FERC approved the settlement in

December 2014. The agreement will have no material or adverse impact to the

rates originally proposed by Duke Energy Progress, and Duke Energy Progress

will receive cost recovery for early retired plants previously included in the

depreciation rates.

Duke Energy Florida

FERC Transmission Return on Equity Complaint

On February 12, 2012, Seminole Electric Cooperative, Inc. and Florida

Municipal Power Agency fi led with FERC a complaint against Duke Energy

Florida alleging that the current rate of return on equity in Duke Energy Florida’s

transmission formula rates of 10.8 percent is unjust and unreasonable and

should be reduced to 9.02 percent. The complainants further alleged that

return on equity adjustments should take effect retroactive to January 1, 2010

under the governing transmission formula rate protocols. On May 13, 2013,

the complainants fi led a second complaint alleging that the return on equity

should be reduced to 8.63 percent or 8.84 percent. On June 19, 2014, FERC

issued orders consolidating the two complaints, setting them for settlement

and hearing procedures, setting refund effective dates of February 29, 2012

for the fi rst complaint and May 13, 2013 for the second complaint, and setting

for settlement and hearing the issue of whether return on equity adjustments

should take effect prior to the refund effective date of the fi rst complaint. On

August 12, 2014, the complainants fi led a third complaint alleging that the

return on equity should be 8.69 percent. On December 5, 2014, FERC issued

an order consolidating the third complaint with the fi rst two complaints for

the purposes of settlement, hearing, and decision, and establishing a refund

effective date of August 12, 2014 for the third complaint. The parties are

engaged in settlement discussions. Duke Energy Florida cannot predict the

outcome of this matter.

FPSC Settlement Agreements

On February 22, 2012, the FPSC approved a settlement agreement (the

2012 Settlement) among Duke Energy Florida, the Florida Offi ce of Public

Counsel (OPC) and other customer advocates. The 2012 Settlement was to

continue through the last billing cycle of December 2016. On October 17, 2013,

the FPSC approved a settlement agreement (the 2013 Settlement) between

Duke Energy Florida, OPC, and other customer advocates. The 2013 Settlement

replaces and supplants the 2012 Settlement and substantially resolves issues

related to (i) Crystal River Unit 3, (ii) Levy, (iii) Crystal River 1 and 2 coal units,

and (iv) future generation needs in Florida. Refer to the remaining sections

below for further discussion of these settlement agreements.

Crystal River Unit 3

On February 5, 2013, Duke Energy Florida announced the retirement of

Crystal River Unit 3. On February 20, 2013, Duke Energy Florida fi led with the

NRC a certifi cation of permanent cessation of power operations and permanent

removal of fuel from the reactor vessel. In December 2013, and March 2014,

Duke Energy Florida fi led an updated site-specifi c decommissioning plan with

the NRC and FPSC, respectively. The plan, which was approved by the FPSC in

November 2014, included a decommissioning cost estimate of $1,180 million,

including amounts applicable to joint owners, under the SAFSTOR option. Duke