Duke Energy 2014 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

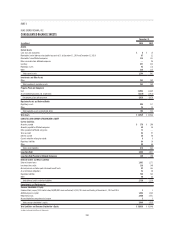

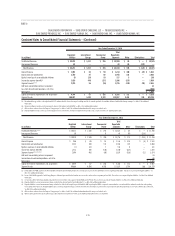

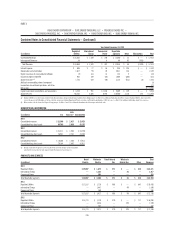

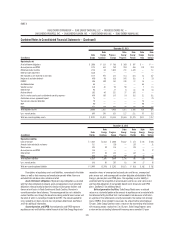

Combined Notes to Consolidated Financial Statements – (Continued)

the U.S. dollar are translated into U.S. dollars at the exchange rates in effect at

period end. Translation adjustments resulting from changes in exchange rates

are included in AOCI. Revenue and expense accounts are translated at average

exchange rates during the year. Remeasurement gains and losses arising from

balances and transactions denominated in currencies other than the local

currency are included in the results of operations when they occur.

Dividend Restrictions and Unappropriated Retained Earnings

Duke Energy does not have any legal, regulatory or other restrictions on

paying common stock dividends to shareholders. However, as further described

in Note 4, due to conditions established by regulators in conjunction with merger

transaction approvals, Duke Energy Carolinas, Duke Energy Progress, Duke

Energy Ohio and Duke Energy Indiana have restrictions on paying dividends or

otherwise advancing funds to Duke Energy. At December 31, 2014 and 2013, an

insignifi cant amount of Duke Energy’s consolidated Retained earnings balance

represents undistributed earnings of equity method investments.

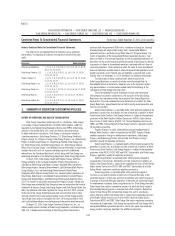

NEW ACCOUNTING STANDARDS

The new accounting standards that were adopted for 2014, 2013 and

2012 had no signifi cant impact on the presentation or results of operations, cash

fl ows or fi nancial position of the Duke Energy Registrants. Disclosures have been

enhanced to provide a discussion and tables on derivative contracts subject to

enforceable master netting agreements and a table of quantitative disclosures

about unobservable inputs. See Notes 14 and 16 for further information.

The following new Accounting Standards Updates (ASUs) have been

issued, but have not yet been adopted by the Duke Energy Registrants, as of

December 31, 2014.

ASC 205 – Reporting Discontinued Operations. In April 2014, the

Financial Accounting Standards Board (FASB) issued revised accounting

guidance for reporting discontinued operations. A discontinued operation would

be either (i) a component of an entity or a group of components of an entity

that represents a separate major line of business or major geographical area

of operations that either has been disposed of or is part of a single coordinated

plan to be classifi ed as held for sale or (ii) a business that, on acquisition,

meets the criteria to be classifi ed as held for sale.

For the Duke Energy Registrants, this guidance is effective on a

prospective basis for interim and annual periods beginning January 1, 2015.

This guidance will also result in increased disclosures for discontinued

operations or disposals of individually signifi cant components that are not

classifi ed as discontinued operations. In general, this guidance is likely to result

in fewer disposals of assets qualifying as discontinued operations.

ASC 606 – Revenue from Contracts with Customers. In May 2014,

the FASB issued revised accounting guidance for revenue recognition from

contracts with customers. The core principle of this guidance is that an entity

should recognize revenue to depict the transfer of promised goods or services

to customers in an amount that refl ects the consideration to which the entity

expects to be entitled in exchange for those goods or services. The amendments

in this update also require disclosure of suffi cient information to allow users

to understand the nature, amount, timing and uncertainty of revenue and cash

fl ows arising from contracts with customers.

For the Duke Energy Registrants, this guidance is effective for interim and

annual periods beginning January 1, 2017. Duke Energy is currently evaluating

the requirements. The ultimate impact of the new standard has not yet been

determined.

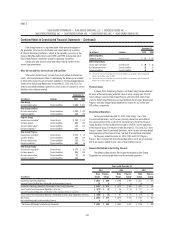

2. ACQUISITIONS, DISPOSITIONS AND SALES OF OTHER

ASSETS

ACQUISITIONS

The Duke Energy Registrants consolidate assets and liabilities from

acquisitions as of the purchase date, and include earnings from acquisitions in

consolidated earnings after the purchase date.

Purchase of NCEMPA’s Generation

On September 5, 2014, Duke Energy Progress executed an agreement

to purchase North Carolina Eastern Municipal Power Agency’s (NCEMPA)

ownership interests in certain generating assets jointly owned with and

operated by Duke Energy Progress. The agreement provides for the acquisition

of a total of approximately 700 megawatts (MW) at Brunswick Nuclear

Station (Brunswick), Shearon Harris Nuclear Station (Harris), Mayo Steam

Station and Roxboro Steam Station. The purchase price for the ownership

interest and fuel and spare parts inventory is approximately $1.2 billion.

Under the agreement, Duke Energy Progress and NCEMPA will enter into a

30-year wholesale power supply agreement to continue meeting the needs

of NCEMPA’s customers. Closing of the transaction is subject to certain

conditions, including state and federal regulatory approvals and legislative

action required prior to completing the transaction. On December 9, 2014,

the FERC approved Duke Energy Progress’ request to purchase NCEMPA’s

interests in the generation assets, approved Duke Energy Progress’ 30-year

wholesale power supply agreement with NCEMPA, and approved Duke Energy

Progress’ inclusion of the acquisition adjustment resulting from the asset

purchase in wholesale power formula rates. The transaction is expected to

close by the end of 2015 or early 2016.

Merger with Progress Energy

On July 2, 2012, Duke Energy completed its merger with Progress Energy,

a North Carolina corporation engaged in the regulated utility business of

generation, transmission and distribution and sale of electricity in portions of

North Carolina, South Carolina and Florida. As a result of the merger, Progress

Energy became a wholly owned subsidiary of Duke Energy.

The merger between Duke Energy and Progress Energy provides increased

scale and diversity with potentially enhanced access to capital over the long

term and a greater ability to undertake the signifi cant construction programs

necessary to respond to increasing environmental regulation, plant retirements

and customer demand growth. Duke Energy’s business risk profi le is expected

to improve over time due to the increased proportion of the business that is

regulated. Additionally, cost savings, effi ciencies and other benefi ts are expected

from the combined operations.