ICICI Bank 2010 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

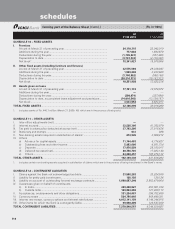

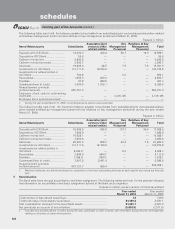

F19

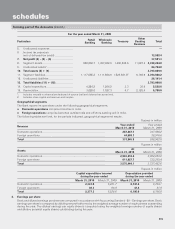

For the year ended March 31, 2009

Particulars Retail

Banking Wholesale

Banking Treasury Other

Banking

Business Total

5. Unallocated expenses ................................ —

6 .Income tax expenses

(net of deferred tax credit) ......................... 13,588.4

7. Net profit (4) – (5) – (6) ............................. 37,581.3

8. Segment assets ......................................... 958,656.7 1,357,062.5 1,400,638.6 11,887.0 3,728,244.8

9. Unallocated assets1 .................................... 64,764.8

10. Total assets (8) + (9) ................................ 3,793,009.6

11. Segment liabilities ...................................... 1,117,555.2 1,111,564.6 1,529,581.826,166.6 3,764,868.2

12. Unallocated liabilities ................................. 28,141.4

13. Total liabilities (11) + (12) ........................ 3,793,009.6

14. Capital expenditure .................................... 4,224.2 1,264.2 3.3 36.9 5,528.6

15. Depreciation ............................................... 3,628.6 1,027.3 4.7 2,125.4 6,786.0

1. Includes tax paid in advance/tax deducted at source (net) and deferred tax asset (net).

2. Includes share capital and reserves and surplus.

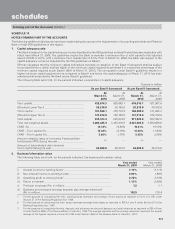

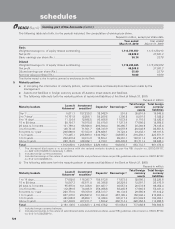

Geographical segments

The Bank reports its operations under the following geographical segments.

z Domestic operations comprise branches in India.

z Foreign operations comprise branches outside India and offshore banking unit in India.

The following tables set forth, for the periods indicated, geographical segmental results.

Rupees in million

Revenue Year ended

March 31, 2010 Year ended

March 31, 2009

Domestic operations ..................................................................................... 287,247.7 347,986.2

Foreign operations ........................................................................................ 44,598.1 38,976.6

Total .............................................................................................................. 331,845.8 386,962.8

Rupees in million

Assets At

March 31, 2010 At

March 31, 2009

Domestic operations ..................................................................................... 2,963,616.4 3,004,203.2

Foreign operations ........................................................................................ 611,827.7 733,259.4

Total .............................................................................................................. 3,575,444.1 3,737,462.6

Rupees in million

Capital expenditure incurred

during the year ended Depreciation provided

during the year ended

March 31, 2010 March 31, 2009 March 31, 2010 March 31, 2009

Domestic operations ...................................... 2,341.0 5,431.7 6,147.6 6,734.1

Foreign operations ......................................... 36.3 96.9 47.4 51.9

Total ............................................................... 2,377.3 5,528.6 6,195.0 6,786.0

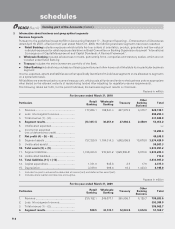

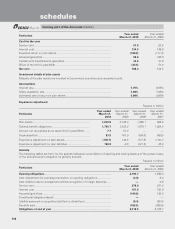

4. Earnings per share

Basic and diluted earnings per share are computed in accordance with Accounting Standard - 20 – Earnings per share. Basic

earnings per share is computed by dividing net profit after tax by the weighted average number of equity shares outstanding

during the year. The diluted earnings per equity share is computed using the weighted average number of equity shares

and dilutive potential equity shares outstanding during the year.

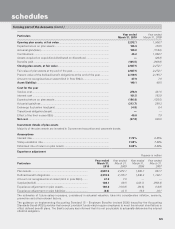

schedules

forming part of the Accounts (Contd.)