ICICI Bank 2010 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F112

Marked-to-market (MTM) on the trading book

In addition to the above, the price risk of the trading book is monitored through a framework of VaR and

cumulative stop loss limits. The trading book includes securities held for statutory liquid ratio maintenance

purposes, all fixed income securities in available for sale and held for trading book, interest rate swaps, and

any other derivatives, which have to be marked to market. The management of price risk of the trading book

is detailed in the Investment Policy.

Hedging policy

Depending on the underlying asset or liability and prevailing market conditions, the Bank enters into hedge

transactions for identified assets or liabilities. The Bank has a policy for undertaking hedge transactions.

These hedges are periodically assessed for hedge effectiveness as per the applicable financial guidelines.

The hedges that meet the effectiveness requirements are accounted for on a basis similar to the underlying

asset/liability.

Frameworks in overseas banking subsidiaries

Frameworks that are broadly similar to the above framework have been established at each of the overseas

banking subsidiaries of the Bank to manage interest rate risk in the banking book. The frameworks are established

considering host country regulatory requirements as applicable.

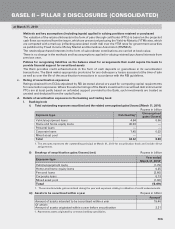

Level of interest rate risk

The following table sets forth, using the balance sheet at March 31, 2010 as the base, one possible prediction

of the net interest income impact of changes in interest rates on interest sensitive positions for the year ending

March 31, 2011, assuming a parallel shift in the yield curve:

Rupees in million

Currency Change in interest rates1

–100 basis points +100 basis points

INR (516.3) 516.3

USD (17.9) 17.9

JPY 4.9 (4.9)

GBP (558.9) 558.9

EURO 21.9 (21.9)

CHF 2.5 (2.5)

CAD (533.3) 533.3

Others (19.9) 19.9

Total (1,617.0) 1,617.0

1. Consolidated figures for ICICI Bank Ltd. and its banking subsidiaries, ICICI Home Finance Company, ICICI Securities and its

subsidiaries.

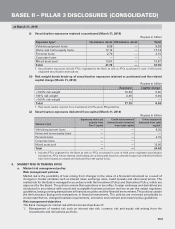

The following table sets forth, using the balance sheet at March 31, 2010 as the base, one possible prediction

of the impact on economic value of equity of changes in interest rates on interest sensitive positions at March

31, 2010, assuming a parallel shift in the yield curve: Rupees in million

Currency Change in interest rates 1,2,3

–100 basis points +100 basis points

INR 19,549.7 (19,549.7)

USD 1,093.0 (1,093.0)

JPY 105.4 (105.4)

GBP (885.2) 885.2

EURO (338.5) 338.5

CHF (12.5) 12.5

CAD (122.4) 122.4

Others 117.4 (117.4)

Total 19,506.9 (19,506.9)

1. The economic value has been computed assuming parallel shifts in the yield curves across all currencies.

2. For INR, coupon and yield of Indian government securities and for other currencies, coupon and yield of currency-wise Libor/

swap rates have been assumed across all time buckets that are closest to the mid point of the time buckets.

3. Consolidated figures for ICICI Bank Ltd. and its banking subsidiaries, ICICI Home Finance Company, ICICI Securities and its

subsidiaries.

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2010