ICICI Bank 2010 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F21

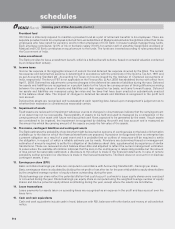

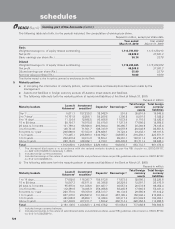

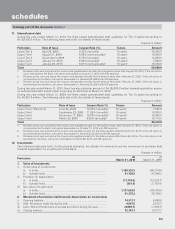

6. Related party transactions

The Bank has transactions with its related parties comprising subsidiaries, associates/joint ventures/other related entities,

key management personnel and relatives of key management personnel.

Subsidiaries

ICICI Bank UK PLC, ICICI Bank Canada, ICICI Bank Eurasia Limited Liability Company, ICICI Prudential Life Insurance Company

Limited1, ICICI Lombard General Insurance Company Limited1, ICICI Prudential Asset Management Company Limited1,

ICICI Securities Limited, ICICI Securities Primary Dealership Limited, ICICI Home Finance Company Limited, ICICI Venture

Funds Management Company Limited, ICICI International Limited, ICICI Trusteeship Services Limited, ICICI Investment

Management Company Limited, ICICI Securities Holdings Inc., ICICI Securities Inc., ICICI Prudential Trust Limited1, ICICI

Wealth Management Inc. (upto December 31, 2009) and ICICI Prudential Pension Funds Management Company Limited2.

1. Jointly controlled entities.

2. For an entity that has been identified as a related party during the year ended March 31, 2010, previous year’s comparative figures

have not been reported.

Associates/joint ventures/other related entities

ICICI Equity Fund1, ICICI Eco-net Internet and Technology Fund1, ICICI Emerging Sectors Fund1, ICICI Strategic Investments

Fund1, ICICI Kinfra Limited1, ICICI West Bengal Infrastructure Development Corporation Limited1, Financial Information

Network and Operations Limited, TCW/ICICI Investment Partners LLC, TSI Ventures (India) Private Limited (upto June 30,

2008), I-Process Services (India) Private Limited, I-Solutions Providers (India) Private Limited, NIIT Institute of Finance, Banking

and Insurance Training Limited, ICICI Venture Value Fund1, Comm Trade Services Limited, Loyalty Solutions & Research

Limited1, Transafe Services Limited1 (upto June 30, 2009), Prize Petroleum Company Limited, ICICI Foundation for Inclusive

Growth, Firstsource Solutions Limited (upto December 31, 2009), I-Ven Biotech Limited1, Rainbow Fund2, Contests2win.

com India Private Limited (upto March 31, 2009), Crossdomain Solutions Private Limited (upto March 31, 2009) and ICICI

Merchant Services Private Limited2.

1. Entities consolidated as per Accounting Standard (AS) 21 on ‘Consolidated Financial Statements’.

2. For entities that have been identified as related parties during the year ended March 31, 2010, previous year’s comparative figures

have not been reported.

Key management personnel

Mr. K. V. Kamath1, Ms. Chanda D. Kochhar, Mr. Sandeep Bakhshi2, Mr. N. S. Kannan2, Mr. K. Ramkumar3, Mr. Sonjoy

Chatterjee, Mr. V. Vaidyanathan1, Ms. Madhabi Puri Buch4.

Relatives of key management personnel

Ms. Rajalakshmi Kamath1, Mr. Ajay Kamath1, Ms. Ajnya Pai1, Mr. Mohan Kamath1, Mr. Deepak Kochhar, Mr. Arjun Kochhar,

Ms. Aarti Kochhar, Mr. Mahesh Advani, Ms. Varuna Karna, Ms. Sunita R. Advani, Ms. Mona Bakhshi2, Mr. Sameer Bakhshi2,

Ms. Rangarajan Kumudalakshmi2, Ms. Aditi Kannan2, Mr. Narayanan Raghunathan2, Mr. Narayanan Rangarajan2, Mr. Narayanan

Krishnamachari2, Ms. Narayanan Sudha2, Mr. R. Shyam3, Ms. R. Suchithra3, Ms. J. Krishnaswamy3, Mr. K. Jayakumar3,

Ms. Ameeta Chatterjee, Mr. Somnath Chatterjee, Mr. Tarak Nath Chatterjee, Ms. Sunaina Chatterjee, Ms. Nandini Chatterjee,

Ms. Jeyashree V.1, Mr. V. Satyamurthy1, Mr. V. Krishnamurthy1, Mr. K. Vembu1, Mr. Dhaval Buch4, Mr. Kamal Puri4,

Ms. Rama Puri4.

1. Transactions reported upto April 30, 2009.

2. Transactions reported with effect from May 1, 2009.

3. Transactions reported with effect from February 1, 2009.

4. Transactions reported upto January 31, 2009.

The following were the significant transactions between the Bank and its related parties for the year ended March 31, 2010.

A specific related party transaction is disclosed as a material related party transaction wherever it exceeds 10% of all related

party transactions in that category.

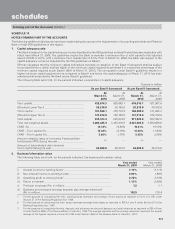

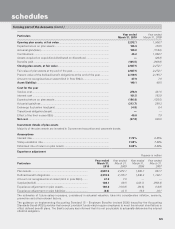

Insurance services

During the year ended March 31, 2010, the Bank paid insurance premium to insurance subsidiaries amounting to

Rs. 1,162.5 million (March 31, 2009: Rs. 1,132.6 million). The material transactions for the year ended March 31, 2010 was

payment of insurance premium to ICICI Lombard General Insurance Company Limited amounting to Rs. 1,057.3 million

(March 31, 2009: Rs. 1,039.9 million).

During the year ended March 31, 2010, the Bank’s insurance claims from the insurance subsidiaries amounted to

Rs. 876.1 million (March 31, 2009: Rs. 965.1 million). The material transaction for the year ended March 31, 2010 was with

ICICI Lombard General Insurance Company Limited amounting to Rs. 823.0 million (March 31, 2009: Rs. 924.1 million).

Fees and commission

During the year ended March 31, 2010, the Bank received fees from its subsidiaries amounting to Rs. 3,793.9 million

(March 31, 2009: Rs. 3,704.8 million), from its associates/joint ventures/other related entities amounting to Rs. 5.3 million

(March 31, 2009: Rs. 142.1 million), from key management personnel amounting to Rs. 0.2 million (March 31, 2009:

Rs. 0.6 million) and from relatives of key management personnel amounting to Rs. 0.1 million (March 31, 2009: Nil).

schedules

forming part of the Accounts (Contd.)