ICICI Bank 2010 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

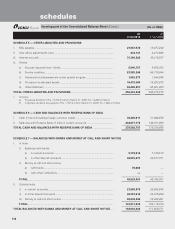

F48

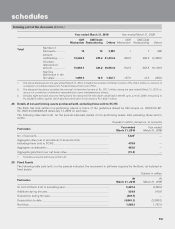

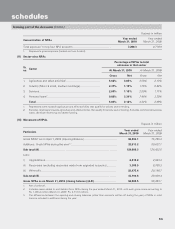

Sr.

No. Name of the subsidiary company Financial year of the

subsidiary ended on

No. of equity shares held by ICICI Bank and/or its nominees in

the subsidiary at March 31, 2010

Extent of

interest

of ICICI

Bank in

capital of

subsidiary

Net aggregate amount of profits/

(losses) of the subsidiary so far as

it concerns the members of ICICI

Bank and is not dealt with in the

accounts of ICICI Bank

1

Net aggregate amount of profits/

(losses) of the subsidiary so far as

it concerns the members of ICICI

Bank dealt with or provided for in

the accounts of ICICI Bank

2

Rupees in ‘000s Rupees in ‘000s

For the

financial

year ended

March 31,

2010

For the

previous

financial

years of the

subsidiary since

it became a

subsidiary

For the

financial

year ended

March 31,

2010

For the previous

financial years

of the subsidiary

since it became a

subsidiary

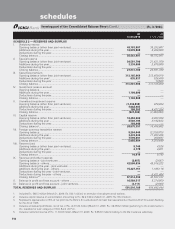

1 ICICI Securities Primary Dealership Limited March 31, 2010 15,634 equity shares of Rs. 100,000 each fully paid up 100.0% 482,371 5,108,145 367,399 5,794,929

2 ICICI Securities Limited March 31, 2010 305,353,500 equity shares of Rs. 2 each fully paid up 100.0% 306,825 1,387,871 920,017 2,596,476

3 ICICI Securities Holdings Inc.

3

March 31, 2010 16,640,000 common stock of USD 1 each fully paid up held by

ICICI Securities Limited — (75,026) (100,737) Nil Nil

4 ICICI Securities Inc.

3

March 31, 2010 11,650,000 common stock of USD 1 each fully paid up held by

ICICI Securities Holdings Inc. — (114,179) (354,916) Nil 15,635

5 ICICI Venture Funds Management Company Limited March 31, 2010 1,000,000 equity shares of Rs. 10 each fully paid up 100.0% 254,878 1,176,703 260,000 2,760,979

6 ICICI International Limited

4

March 31, 2010 90,000 ordinary shares of USD 10 each fully paid up 100.0% 8,715 32,037 Nil 15,782

7 ICICI Home Finance Company Limited March 31, 2010 1,098,750,000 equity shares of Rs. 10 each fully paid up 100.0% 540,983 1,503,130 1,065,788 2,112,887

8 ICICI Trusteeship Services Limited March 31, 2010 50,000 equity shares of Rs. 10 each fully paid up 100.0% 421 2,043 Nil Nil

9 ICICI Investment Management Company Limited March 31, 2010 10,000,700 equity shares of Rs. 10 each fully paid up 100.0% (21,841) 12,114 Nil Nil

10 ICICI Prudential Life Insurance Company Limited March 31, 2010 1,055,310,900 equity shares of Rs. 10 each fully paid up 73.9% 1,906,129 (19,653,651) Nil Nil

11 ICICI Lombard General Insurance Company Limited March 31, 2010 297,552,950 equity shares of Rs.10 each fully paid up 73.7% 585,360 1,538,547 475,677 1,700,996

12 ICICI Bank UK PLC

4

March 31, 2010 545,000,000 ordinary shares of USD 1 each and 50,002 ordinary

shares of 1 GBP each 100.0% 1,757,679 5,205,219 Nil 535,172

13 ICICI Bank Canada

5, 8, 9

December 31, 2009 839,500,000 common shares of Canadian Dollar (CAD) 1 each 100.0% 1,229,531 798,498 Nil Nil

14 ICICI Bank Eurasia Limited Liability Company

#, 6, 9

December 31, 2009 Not Applicable

#

100.0% 106,012 47,729 Nil Nil

15 ICICI Prudential Asset Management Company Limited March 31, 2010 9,002,573 equity shares of Rs. 10 each fully paid up 51.0% 243,313 608,478 409,617 837,860

16 ICICI Prudential Trust Limited March 31, 2010 51,157 equity shares of Rs. 10 each fully paid up 50.8% 754 1,182 767 1,023

17 ICICI Wealth Management Inc.

5, 8, 9

(up to December 31, 2009) December 31, 2009 Not Applicable

8

— Nil Nil Nil Nil

18 ICICI Prudential Pension Funds Management

Company Limited

7

March 31, 2010 11,000,000 equity shares of Rs.10 each fully paid up held by

ICICI Prudential Life Insurance Company Limited — (137) (137) Nil Nil

# The shares in the authorised capital of ICICI Bank Eurasia Limited Liability Company are registered without issue of equity shares due to the legal form of subsidiary.

1. The above companies (other than ICICI Bank UK PLC, ICICI Bank Canada, ICICI Bank Eurasia Limited Liability Company, ICICI Prudential Asset Management Company Limited, ICICI Prudential Trust Limited, ICICI Wealth

Management Inc. and ICICI Prudential Pension Funds Management Company Limited) which were subsidiaries of erstwhile ICICI Limited have become subsidiaries of the Bank consequent to the merger of erstwhile

ICICI Limited with ICICI Bank.

2. The amount received by erstwhile ICICI Limited upto March 29, 2002 as dividend has also been included in the reserves of ICICI Bank.

3. ICICI Securities Holdings Inc. is a wholly owned subsidiary of ICICI Securities Limited. ICICI Securities Inc. is a wholly owned subsidiary of ICICI Securities Holdings Inc.

4. The profits/(losses) of ICICI Bank UK PLC and ICICI International Limited for the year ended March 31, 2010 have been translated into Indian Rupees at the rate of 1 USD = Rs. 47.5134.

5. The profits/(losses) of ICICI Bank Canada and ICICI Wealth Management Inc. for the year ended December 31, 2009 have been translated into Indian Rupees at the rate of 1 CAD = Rs. 43.3147.

6. The profits/(losses) of ICICI Bank Eurasia Limited Liability Company for the year ended December 31, 2009 have been translated into Indian Rupees at the rate of 1 RUB = Rs.1.56307.

7. ICICI Prudential Pension Funds Management Company Limited, a wholly owned subsidiary of ICICI Prudential Life Insurance Company Limited, was incorporated on April 22, 2009.

8. ICICI Wealth Management Inc., a wholly owned subsidiary of ICICI Bank Canada, has been dissolved with effect from December 31, 2009. All assets and liabilities have been taken over by ICICI Bank Canada.

9. The information furnished for ICICI Bank Canada, ICICI Wealth Management Inc. and ICICI Bank Eurasia Limited Liability Company is for the period January 1, 2009 to December 31, 2009, being their financial year.

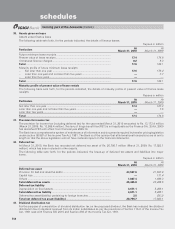

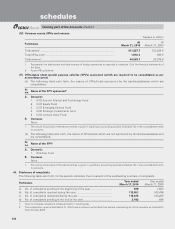

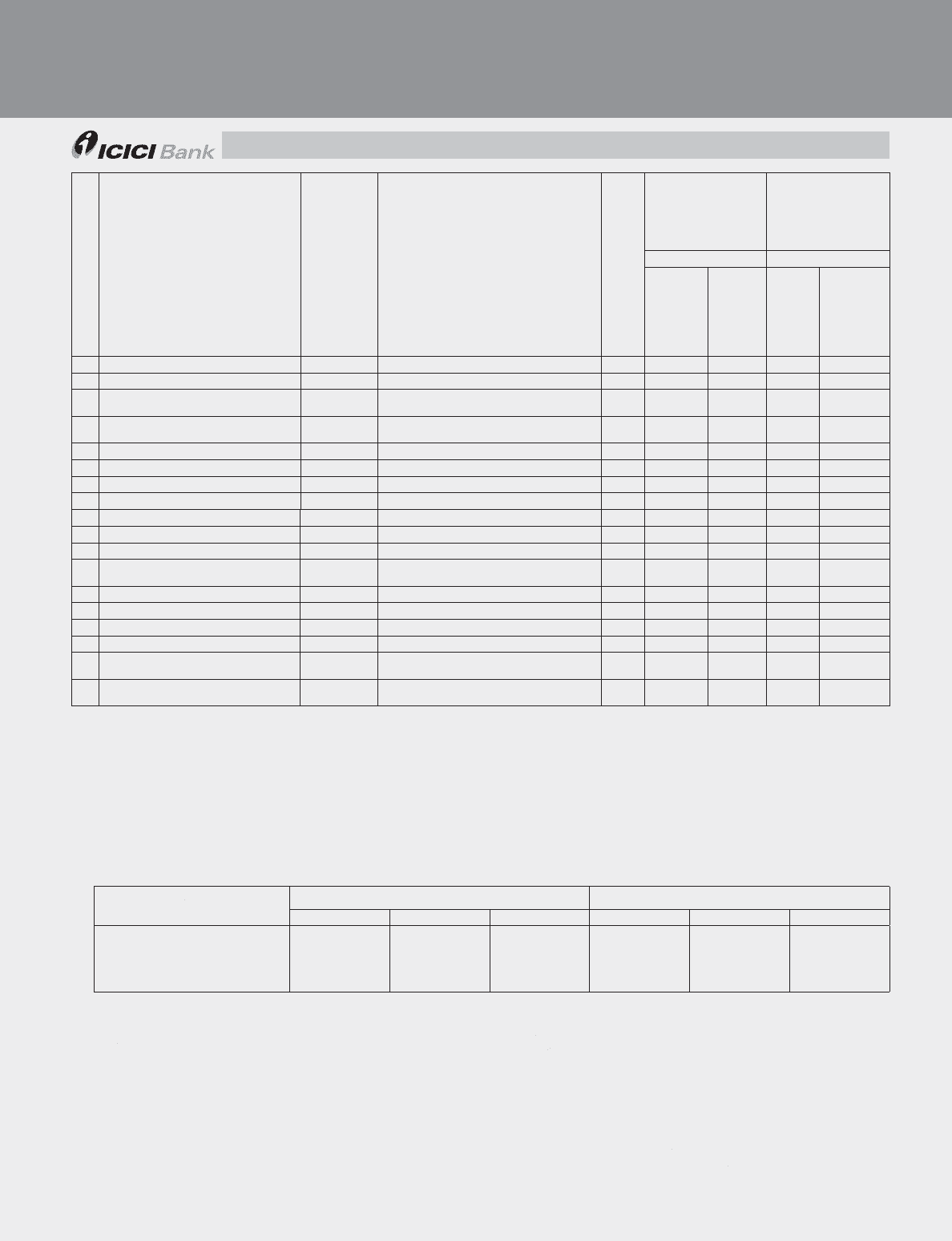

The key financial parameters of the following companies at March 31, 2010 and their movement from December 31, 2009 are given below.

Rupees in ‘000s

Particulars ICICI Bank CanadabICICI Bank Eurasia Limited Liability Companyc

At March 31, 2010 At December 31, 2009 Movement At March 31, 2010 At December 31, 2009 Movement

Fixed assets 135,470 141,326 (5,856) 76,846 80,064 (3,218)

Investments 52,322,559 48,361,509 3,961,050 1,735,243 1,549,544 185,700

Advances 171,735,996 196,832,571 (25,096,575) 8,934,818 10,286,287 (1,351,469)

Borrowingsa 3,314 3,326 (12) 14,266,516 16,301,859 (2,035,343)

a. Since it is not possible to identify the amount borrowed to meet the current liabilities, the amount shown above represents the total borrowings. The borrowings include subordinate debts and excludes

preferred shares.

b. The financial parameters of ICICI Bank Canada have been translated into Indian Rupees at 1 CAD = Rs. 44.1800 at March 31, 2010 and 1 CAD = Rs. 44.3450 at December 31, 2009.

c. The financial parameters of ICICI Bank Eurasia Limited Liability Company have been translated into Indian Rupees at 1 RUB = Rs. 1.52709 at March 31, 2010 and 1 RUB = Rs. 1.5501 at December 31, 2009.

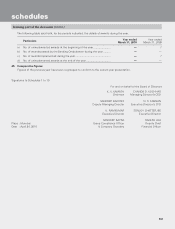

For and on behalf of the Board of Directors

K. V. KAMATH CHANDA D. KOCHHAR SANDEEP BAKHSHI

Chairman Managing Director & CEO Deputy Managing Director

N. S. KANNAN K. RAMKUMAR SONJOY CHATTERJEE

Executive Director & CFO Executive Director Executive Director

SANDEEP BATRA RAKESH JHA

Place : Mumbai Group Compliance Officer & Deputy Chief

Date : April 24, 2010 Company Secretary Financial Officer

section 212

Statement pursuant to Section 212 of the Companies Act, 1956, relating to subsidiary companies