ICICI Bank 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F17

SCHEDULE 19

NOTES FORMING PART OF THE ACCOUNTS

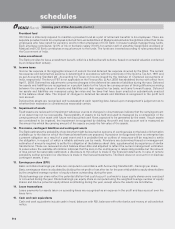

The following additional disclosures have been made taking into account the requirements of accounting standards and Reserve

Bank of India (RBI) guidelines in this regard.

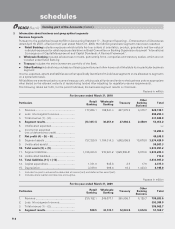

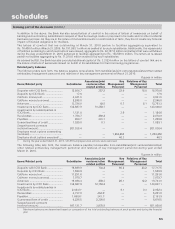

1. Capital adequacy ratio

The Bank is subject to the capital adequacy norms stipulated by the RBI guidelines on Basel II which became applicable with

effect from March 31, 2008. The guidelines require the Bank to maintain a minimum ratio of total capital to risk adjusted

assets (CRAR) of 9.0%, with a minimum Tier I capital ratio of 6.0%. Prior to March 31, 2008, the Bank was subject to the

capital adequacy norms as stipulated by the RBI guidelines on Basel I.

RBI has stipulated that the minimum capital maintained by banks on adoption of the Basel II framework shall be subject

to a prudential floor, which shall be higher of the minimum capital required as per Basel II or a specified percentage of the

minimum capital required as per Basel I (80% at March 31, 2010). The computation under Basel II guidelines results in a

higher minimum capital requirement as compared to Basel I and hence the capital adequacy at March 31, 2010 has been

maintained and reported by the Bank as per Basel II guidelines.

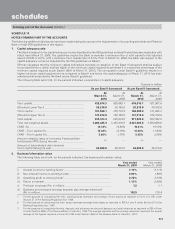

The following table sets forth, for the periods indicated, computation of capital adequacy.

Rupees in million

As per Basel I framework As per Basel Il framework

At

March 31,

2010

At

March 31,

2009

At

March 31,

2010

At

March 31,

2009

Tier I capital ....................................................................... 432,614.3 420,098.1 410,615.1 421,967.6

(Of which Lower Tier I) ...................................................... 28,210.0 30,168.6 28,210.0 30,168.6

Tier II capital ...................................................................... 181,569.1 129,715.9 160,409.9 131,585.3

(Of which Upper Tier II) ..................................................... 137,912.0 109,100.0 137,912.0 109,100.0

Total capital ....................................................................... 614,183.4 549,814.0 571,025.0 553,552.9

Total risk weighted assets ................................................ 3,208,425.4 3,453,378.9 2,941,805.8 3,564,629.9

CRAR (%) .......................................................................... 19.14% 15.92% 19.41% 15.53%

CRAR – Tier I capital (%) ................................................... 13.48% 12.16% 13.96% 11.84%

CRAR – Tier II capital (%) .................................................. 5.66% 3.76% 5.45% 3.69%

Amount raised by issue of Innovative Perpetual Debt

Instruments (IPDI) during the year .................................... ————

Amount of subordinated debt raised as

Tier II capital during the year ............................................. 62,000.0 45,210.0 62,000.0 45,210.0

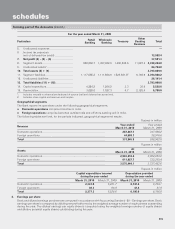

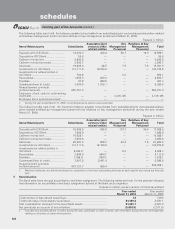

2. Business/information ratios

The following table sets forth, for the periods indicated, the business/information ratios.

Year ended

March 31, 2010 Year ended

March 31, 2009

i) Interest income to working funds1 ............................................................... 7.19% 8.11%

ii) Non-interest income to working funds1 ........................................................ 2.09% 1.98%

iii) Operating profit to working funds1 ............................................................... 2.72% 2.33%

iv) Return on assets2 .......................................................................................... 1.13% 0.98%

v) Profit per employee (Rs. in million) ............................................................... 1.2 1.1

vi) Business per employee (average deposits plus average advances)3

(Rs. in million) ................................................................................................ 102.9 115.4

1. For the purpose of computing the ratio, working funds represent the average of total assets as reported in Form X to RBI under

Section 27 of the Banking Regulation Act, 1949.

2. For the purpose of computing the ratio, assets represent average total assets as reported to RBI in Form X under Section 27 of the

Banking Regulation Act, 1949.

3. For the purpose of computing the ratio, deposits and advances are the total deposits and total advances as reported to RBI in Form

A under Section 42(2) of the Reserve Bank of India Act, 1934. The average deposits and the average advances represent the simple

average of the figures reported in Form A to RBI under Section 42(2) of the Reserve Bank of India Act, 1934.

schedules

forming part of the Accounts (Contd.)