ICICI Bank 2010 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

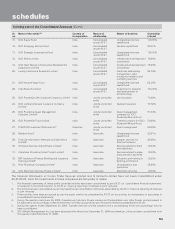

F59

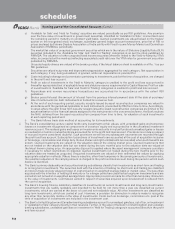

schedules

(Rs. in ‘000s)

forming part of the Consolidated Balance Sheet (Contd.)

At

31.03.2010 At

31.03.2009

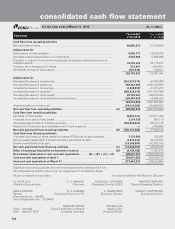

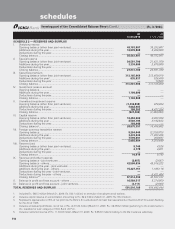

SCHEDULE 8 — INVESTMENTS

I. Investments in India (net of provisions)

i) Government securities .............................................................................................. 732,093,813 682,931,198

ii) Other approved securities ........................................................................................ 45,009 93,405

iii) Shares (includes equity and preference shares)1 ................................................. 42,426,779 29,708,664

iv) Debentures and bonds ............................................................................................. 75,752,082 52,956,402

v) Assets held to cover linked liabilities of life insurance business ...................... 514,692,566 286,139,525

vi) Others (commercial paper, mutual fund units, pass through certificates,

security receipts, certificate of deposits etc.) ...................................................... 337,886,043 216,658,105

TOTAL INVESTMENTS IN INDIA 1,702,896,292 1,268,487,299

II. Investments outside India (net of provisions)

i) Government securities .............................................................................................. 38,707,855 4,525,830

ii) Others ........................................................................................................................... 121,593,693 208,056,900

TOTAL INVESTMENTS OUTSIDE INDIA ...................................................................... 160,301,548 212,582,730

TOTAL INVESTMENTS .............................................................................................................. 1,863,197,840 1,481,070,029

III. Investments in India

Gross value of investments2.............................................................................................. 1,718,296,361 1,290,031,307

Less: Aggregate of provision/depreciation/(appreciation) ......................................... 15,400,069 21,544,008

Net investments................................................................................................................... 1,702,896,292 1,268,487,299

IV. Investments outside India

Gross value of investments ............................................................................................... 164,916,920 234,903,006

Less: Aggregate of provision/depreciation/(appreciation) .......................................... 4,615,372 22,320,276

Net investments ................................................................................................................. 160,301,548 212,582,730

TOTAL INVESTMENTS 1,863,197,840 1,481,070,029

1. Includes acquisition cost of investment in associates of Rs. 524.5 million (March 31, 2009: Rs. 459.2 million).

2. Includes appreciation of Rs. 93,112.5 million (net of depreciation, March 31, 2009: Rs. 36,369.6 million) on investments held to cover

linked liabilities of life insurance business.

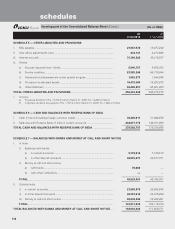

SCHEDULE 9 — ADVANCES (net of provisions)

A. i) Bills purchased and discounted .............................................................................. 47,219,427 40,915,231

ii) Cash credits, overdrafts and loans repayable on demand ................................. 260,401,668 350,610,312

iii) Term loans ................................................................................................................... 1,842,337,233 2,167,574,693

iv) Securitisation, finance lease and hire purchase receivables ............................. 107,822,952 102,204,423

TOTAL ADVANCES ............................................................................................................ 2,257,781,280 2,661,304,659

B. i) Secured by tangible assets [includes advances against book debts] ............. 1,612,468,494 2,009,647,889

ii) Covered by bank/government guarantees ............................................................ 21,202,426 14,815,009

iii) Unsecured .................................................................................................................... 624,110,360 636,841,761

TOTAL ADVANCES 2,257,781,280 2,661,304,659

C. I. Advances in India

i) Priority sector ..................................................................................................... 539,773,871 620,515,976

ii) Public sector ....................................................................................................... 3,201,088 3,494,486

iii) Banks.................................................................................................................... 41,790 252,580

iv) Others .................................................................................................................. 916,388,589 1,112,523,081

TOTAL ADVANCES IN INDIA 1,459,405,338 1,736,786,123

II. Advances outside India

i) Due from banks ................................................................................................. 13,649,907 16,618,624

ii) Due from others

a) Bills purchased and discounted ............................................................ 17,747,632 14,069,137

b) Commercial loans ..................................................................................... 349,421,101 419,791,632

c) Others ......................................................................................................... 417,557,302 474,039,143

TOTAL ADVANCES OUTSIDE INDIA ............................................................................ 798,375,942 924,518,536

TOTAL ADVANCES ............................................................................................................ 2,257,781,280 2,661,304,659