ICICI Bank 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

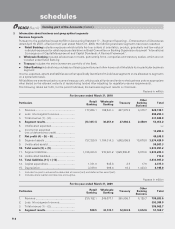

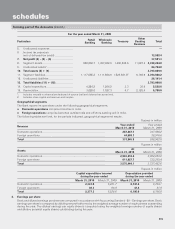

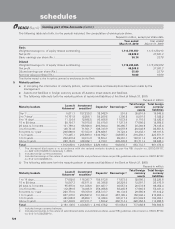

F12

forming part of the Accounts (Contd.)

schedules

SCHEDULE 18

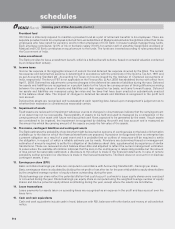

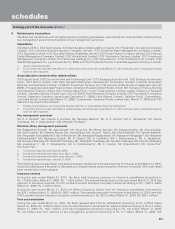

Significant accounting policies

OVERVIEW

ICICI Bank Limited (ICICI Bank or the Bank), incorporated in Vadodara, India is a publicly held banking company engaged in

providing a wide range of banking and financial services including commercial banking and treasury operations. ICICI Bank is

governed by the Banking Regulation Act, 1949.

Basis of preparation

The financial statements have been prepared in accordance with requirements prescribed under the Third Schedule of the

Banking Regulation Act, 1949. The accounting and reporting policies of ICICI Bank used in the preparation of these financial

statements conform to Generally Accepted Accounting Principles in India (Indian GAAP), the guidelines issued by Reserve Bank

of India (RBI) from time to time, the Accounting Standards (AS) issued by the Institute of Chartered Accountants of India (ICAI)

and notified by the Companies (Accounting Standards) Rules, 2006 to the extent applicable and practices generally prevalent

in the banking industry in India. The Bank follows the accrual method of accounting, except where otherwise stated, and the

historical cost convention.

The preparation of financial statements requires the management to make estimates and assumptions considered in the reported

amounts of assets and liabilities (including contingent liabilities) as of the date of the financial statements and the reported income

and expenses during the reporting period. Management believes that the estimates used in the preparation of the financial

statements are prudent and reasonable. Future results could differ from these estimates.

SIGNIFICANT ACCOUNTING POLICIES

1. Revenue recognition

a) Interest income is recognised in the profit and loss account as it accrues except in the case of non-performing assets

(NPAs) where it is recognised upon realisation, as per the income recognition and asset classification norms of RBI.

b) Income from hire purchase operations is accrued by applying the implicit interest rate to outstanding balances.

c) Income from leases is calculated by applying the interest rate implicit in the lease to the net investment outstanding on

the lease over the primary lease period. Leases entered into till March 31, 2001 have been accounted for as operating

leases.

d) Income on discounted instruments is recognised over the tenure of the instrument on a constant yield basis.

e) Dividend is accounted on an accrual basis when the right to receive the dividend is established.

f) Loan processing fee is accounted for upfront when it becomes due.

g) Project appraisal/structuring fee is accounted for on the completion of the agreed service.

h) Arranger fee is accounted for as income when a significant portion of the arrangement/syndication is completed.

i) Commission received on guarantees issued is amortised on a straight-line basis over the period of the guarantee.

j) All other fees are accounted for as and when they become due.

k) Net income arising from sell-down/securitisation of loan assets prior to February 1, 2006 has been recognised upfront

as interest income. With effect from February 1, 2006, net income arising from securitisation of loan assets is amortised

over the life of securities issued or to be issued by the special purpose vehicle/special purpose entity to which the assets

are sold. Net income arising from sale of loan assets through direct assignment with recourse obligation is amortised

over the life of underlying assets sold and net income from sale of loan assets through direct assignment, without any

recourse obligation, is recognised at the time of sale. Net loss arising on account of the sell-down/securitisation and

direct assignment of loan assets is recognised at the time of sale.

l) The Bank deals in bullion business on a consignment basis. The difference between price recovered from customers

and cost of bullion is accounted for at the time of sale to the customers. The Bank also deals in bullion on a borrowing

and lending basis and the interest paid/received is accounted on accrual basis.

2. Investments

Investments are accounted for in accordance with the extant RBI guidelines on investment classification and valuation as

given below.

a) All investments are classified into ‘Held to Maturity’, ‘Available for Sale’ and ‘Held for Trading’. Reclassifications, if

any, in any category are accounted for as per RBI guidelines. Under each classification, the investments are further

categorised as (a) government securities, (b) other approved securities, (c) shares, (d) bonds and debentures, (e)

subsidiaries and joint ventures and (f) others.

b) ‘Held to Maturity’ securities are carried at their acquisition cost or at amortised cost, if acquired at a premium over the

face value. Any premium over the face value of fixed rate and floating rate securities acquired is amortised over the

remaining period to maturity on a constant yield basis and straight line basis respectively.