ICICI Bank 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F26

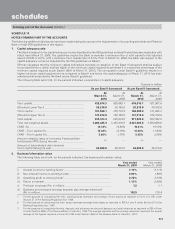

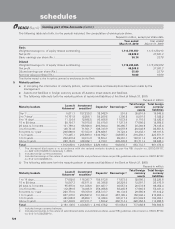

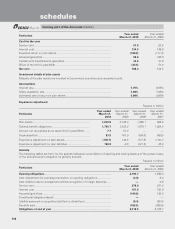

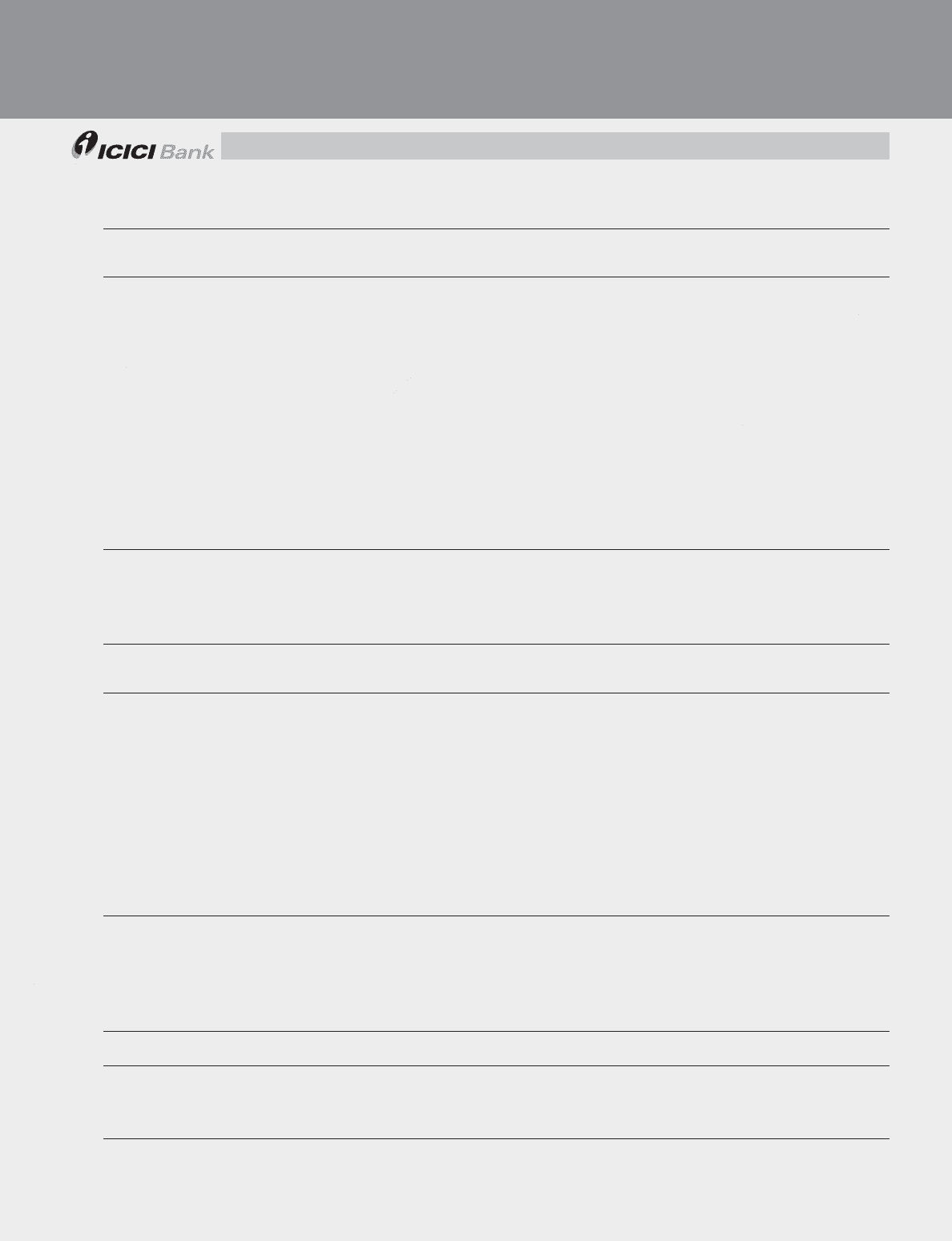

The following table sets forth, the balance payable to/receivable from subsidiaries/joint ventures/associates/other related

entities/key management personnel and relatives of key management personnel at March 31, 2009.

Rupees in million

Items/Related party Subsidiaries Associates/joint

ventures/other

related entities

Key

Management

Personnel

Relatives of Key

Management

Personnel Total

Deposits with ICICI Bank ..................... 12,390.3 434.2 56.7 16.9 12,898.1

Deposits by ICICI Bank ........................ 55.8 — — — 55.8

Call/term money lent ............................ 4,260.5 — — — 4,260.5

Call/term money borrowed .................. 3,544.7 — — — 3,544.7

Advances .............................................. 19,294.0 42.5 7.9 7.5 19,351.9

Investments by ICICI Bank ................... 131,711.6 12,034.2 — — 143,745.8

Investments by related parties in

ICICI Bank ............................................. 794.8 — 9.3 — 804.1

Receivables .......................................... 1,964.3 239.4 — — 2,203.7

Payables ............................................... 67.8 289.5 — — 357.3

Guarantees/lines of credit .................... 3,404.5 1,916.1 — — 5,320.6

Swaps/forward contracts

(notional amount) ................................. 550,751.0 — — — 550,751.0

Employee stock options outstanding

(numbers) ............................................. — — 3,318,125 — 3,318,125

Employee stock options exercised1 ..... — — — — —

1. During the year ended March 31, 2009, no employee stock options were exercised.

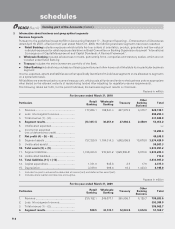

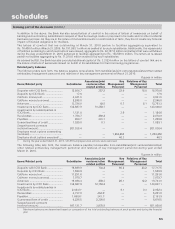

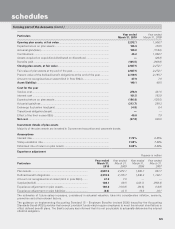

The following table sets forth, the maximum balance payable to/receivable from subsidiaries/joint ventures/associates/

other related entities/key management personnel and relatives of key management personnel during the year ended

March 31, 2009.

Rupees in million

Items/Related party Subsidiaries Associates/joint

ventures/other

related entities

Key

Management

Personnel

Relatives of Key

Management

Personnel Total

Deposits with ICICI Bank ..................... 16,899.9 845.0 119.7 38.0 17,902.6

Deposits by ICICI Bank ........................ 1,589.9 — — — 1,589.9

Call/term money lent ............................ 10,922.1 — — — 10,922.1

Call/term money borrowed .................. 3,690.5 — — — 3,690.5

Advances .............................................. 20,981.4 208.3 63.6 7.6 21,260.9

Investments by ICICI Bank ................... 131,711.6 12,159.2 — — 143,870.8

Investments by related parties in

ICICI Bank ............................................. 2,043.01— 9.3 — 2,052.3

Receivables .......................................... 3,649.0 464.01— — 4,113.0

Payables ............................................... 1,382.61289.51— — 1,672.1

Guarantees/lines of credit .................... 3,407.2 2,441.4 — — 5,848.6

Swaps/forward contracts

(notional amount) ................................. 647,121.7 880.4 — — 648,002.1

1. Maximum balances are determined based on comparison of the total outstanding balances at each quarter end during the financial

year.

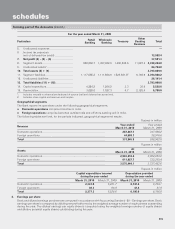

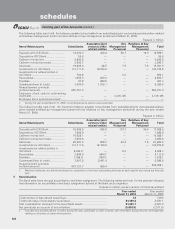

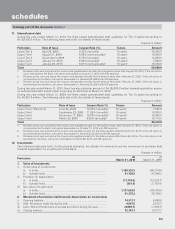

7. Securitisation

The Bank sells loans through securitisation and direct assignment. The following tables set forth, for the periods indicated

the information on securitisation and direct assignment activity of the Bank as an originator.

Rupees in million, except number of loans securitised

Year ended

March 31, 2010 Year ended

March 31, 2009

Total number of loan assets securitised ....................................................... 33 7,053

Total book value of loan assets securitised .................................................. 81,309.4 8,581.1

Sale consideration received for the securitised assets ................................ 81,493.7 8,621.9

Net gain/(loss) on account of securitisation1 ................................................ (5,093.8) (3,211.5)

1. Includes loss booked upfront on sales during the year, gain/(loss) on deal closures, gain amortised during the year and expenses

relating to utilisation of credit enhancement.

schedules

forming part of the Accounts (Contd.)