ICICI Bank 2010 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F69

schedules

forming part of the Consolidated Accounts (Contd.)

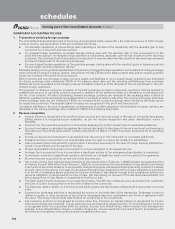

vi. In the case of life and general insurance businesses, investments are made in accordance with the Insurance Act, 1938,

the IRDA (Investment) Regulations, 2000, and various other circulars/notifications issued by the IRDA in this context

from time to time.

In the case of life insurance business, investments are stated at fair value being the last quoted closing price on the

National Stock Exchange (NSE) (in case of securities not listed on NSE, the last quoted closing price on the Bombay

Stock Exchange (BSE) is used). Mutual fund units at the balance sheet date are valued at the previous day’s net asset

values. Equity shares awaiting listing are stated at historical cost subject to provision for diminution, if any, in the

value of such investment determined separately for each individual investment. Unrealised gains/losses arising due

to changes in the fair value of listed equity shares and mutual fund units are taken to ’Fair Value Change Account’ in

the balance sheet.

In the case of general insurance business, all debt securities including government securities and non-convertible

preference shares are considered as ‘Held to Maturity’ and accordingly stated at amortised cost subject to amortisation

of premium or accretion of discount on a straight line basis over the holding/maturity period. Listed equities and

convertible preference shares at the balance sheet date are stated at fair value, being the lowest of last quoted closing

price on NSE or BSE. Investments other than mentioned above are valued at cost.

The general insurance subsidiary assesses at each balance sheet date whether there is any indication that any investment

in equity or units of mutual fund may be impaired. If any such indication exists, the carrying value of such investment

is reduced to its recoverable amount and the impairment loss is recognised in the revenue(s)/profit and loss account.

If at the balance sheet date there is any indication that a previously assessed impairment loss no longer exists, then

such loss is reversed and the investment is restated to that extent.

The total proportion of investments for which subsidiaries have applied accounting policies different from the Bank as

mentioned above, approximate 15.54% of the total investments at March 31, 2010.

14. Provisions/write-offs on loans and other credit facilities

a) All credit exposures, including overdues arising from crystallised derivative contracts, are classified as per RBI guidelines,

into performing and non-performing assets. Further, NPAs are classified into sub-standard, doubtful and loss assets

based on the criteria stipulated by RBI.

In the case of corporate loans, provisions are made for sub-standard and doubtful assets at the rates prescribed by RBI.

Loss assets and the unsecured portion of doubtful assets are provided for/written off as per the extant RBI guidelines.

Provisions on homogeneous retail loans, subject to minimum provisioning requirements of RBI, are assessed at a

portfolio level on the basis of days past due. The Bank holds specific provisions against non-performing loans and

general provision against performing loans. The assessment of incremental specific provisions is made after taking

into consideration existing specific provision. The specific provisions on retail loans held by the Bank are higher than

the minimum regulatory requirements.

b) Provision on assets restructured/rescheduled is made in accordance with the applicable RBI guidelines on restructuring

of advances by Banks.

In respect of non-performing loan accounts subjected to restructuring, the account is upgraded to standard only after

the specified period i.e. a period of one year after the date when first payment of interest or of principal, whichever is

earlier, falls due, subject to satisfactory performance of the account during the period.

c) Amounts recovered against debts written off in earlier years and provisions no longer considered necessary in the

context of the current status of the borrower are recognised in the profit and loss account.

d) In addition to the specific provision on NPAs, the Bank/the Bank’s housing finance subsidiary maintains a general

provision on performing loans. The general provision covers the requirements of the RBI/NHB guidelines.

e) In addition to the provisions required to be held according to the asset classification status, provisions are held for

individual country exposures (other than for home country exposure). The countries are categorised into seven risk

categories namely insignificant, low, moderate, high, very high, restricted and off-credit and provisioning is made on

exposures exceeding 180 days on a graded scale ranging from 0.25% to 100%. For exposures with contractual maturity

of less than 180 days, 25% of the above provision is required to be held. If the country exposure (net) of the Bank

in respect of each country does not exceed 1% of the total funded assets, no provision is required on such country

exposure.

f) In the case of the Bank’s primary dealership subsidiary, the policy of provisioning against NPAs is as per the prudential

norms prescribed by the RBI for non-banking financial companies. As per the policy adopted, the provisions against

sub-standard assets are determined, taking into account management’s perception of the higher risk associated with

the business of the company. Certain NPAs are considered as loss assets and full provision has been made against

such assets.

g) In the case of the Bank’s housing finance subsidiary, loans and other credit facilities are classified as per the NHB

guidelines into performing and non-performing assets. Further, NPAs are classified into sub-standard, doubtful and

loss assets based on criteria stipulated by NHB. Additional provisions are made against specific non-performing assets

over and above what is stated above, if in the opinion of the management, increased provisions are necessary.

h) In the case of the Bank’s overseas banking subsidiaries, loans are stated net of allowance for credit losses. Loans

are classified as impaired when there is no longer reasonable assurance of the timely collection of the full amount of

principal or interest. An allowance for credit losses is maintained at a level that management considers adequate to

absorb identified credit related losses as well as losses that have been incurred but are not yet identifiable.

The total proportion of loans for which subsidiaries have applied accounting policies different from the Bank as

mentioned above, approximate 15.66% of the total loans at March 31, 2010.