ICICI Bank 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis

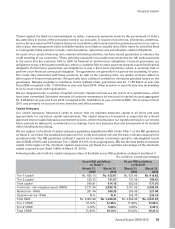

The key changes introduced by RBI under Pillar 1 of the Basel II guidelines during fiscal 2010 are as follows:

zRBI issued a clarification on July 1, 2009 that special reserve (created by banks under Section 36(1) (viii) of

the Income Tax Act, 1961) should be considered net of tax payable, in the Tier-1 capital. Previously special

reserve was considered as accounted in the financial statements.

z RBI in its revised Basel II guidelines issued on February 8, 2010 stipulated that banks are not permitted to use

any external credit assessment for risk weighting securitisation exposures where the assessment is at least

partly based on unfunded support provided by the bank.

z RBI in its revised Basel II guidelines issued on February 8, 2010 issued guidance on assessment of valuation

adjustments on account of illiquidity for illiquid/less liquid positions that are subject to market risk capital

requirements. RBI also stipulated that these valuation adjustments are to be deducted from Tier-1 capital.

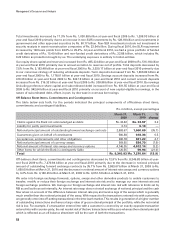

The key reasons for the movement in our capital funds and RWA at the standalone level from year-end fiscal 2009

to year-end fiscal 2010 are as follows:

z Capital funds increased by Rs. 17.48 billion or 3.2% primarily due to issuance of Tier-2 debt capital instruments

and accretion to retained earnings, partly offset by an increase in deductions on account of securitisation

exposures pursuant to revised RBI guidelines on Basel II issued on February 8, 2010 and special reserves

being considered net of tax payable;

– The deductions on account of securitisation (including due to revisions in the RBI guidelines on Basel II)

increased by Rs. 41.60 billion (deducted at 50% each from Tier-1 and Tier-2 capital).

– The RBI stipulation of reckoning special reserves net of tax payable, resulted in an impact (decrease) of

Rs. 8.99 billion.

z Credit risk RWA decreased by Rs. 666.36 billion or 21.1% primarily due to the decrease in loan portfolio and

the increased coverage of external credit ratings on the portfolio;

z Market risk RWA increased by Rs. 14.08 billion or 6.8%; and

z Operational risk RWA increased by Rs. 29.46 billion or 14.3% due to the increase in the average of

previous three years’ gross income adopted in the computation of operational risk RWA as per the basic

indictor approach.

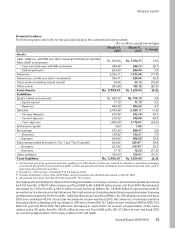

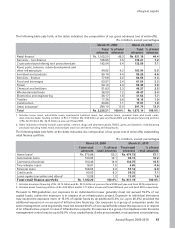

ASSET QUALITY AND COMPOSITION

Loan Concentration

We follow a policy of portfolio diversification and evaluate our total financing in a particular sector in light

of our forecasts of growth and profitability for that sector. Between 2003 and 2006, the banking system as

a whole saw significant expansion of retail credit, with retail loans contributing for a major part of overall

systemic credit growth. Accordingly, during these years, we increased our focus on retail finance portfolio.

In view of high asset prices and the increase in interest rates since the second half of fiscal 2008, we followed

a conscious strategy of moderation of retail disbursements, especially in the unsecured retail loans segment.

Following this trend, our gross loans and advances to retail finance portfolio declined from 58.6% of our

total gross loans and advances at year-end fiscal 2008 to 49.3% at year-end fiscal 2009 and further to 44.4%

at year-end fiscal 2010.

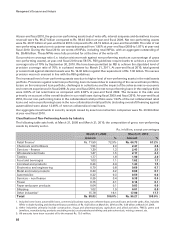

Our Global Credit Risk Management Group monitors all major sectors of the economy and specifically tracks

sectors in which we have loans outstanding. We seek to respond to any economic weakness in an industrial

segment by restricting new exposures to that segment and any growth in an industrial segment by increasing

new exposures to that segment, resulting in active portfolio management.

60