ICICI Bank 2010 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5Annual Report 2009-2010

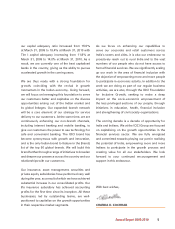

our capital adequacy ratio increased from 15.5%

at March 31, 2009 to 19.4% at March 31, 2010 with

Tier I capital adequacy increasing from 11.8% at

March 31, 2009 to 14.0% at March 31, 2010. As a

result, we are currently one of the best capitalised

banks in the country, giving us the ability to pursue

accelerated growth in the coming years.

We are thus ready with a strong foundation for

growth, coinciding with the revival in growth

momentum in the Indian economy. Going forward,

we will focus on leveraging this foundation to serve

our customers better and capitalise on the diverse

opportunities arising out of the Indian market and

its global linkages. Our expanded branch network

will be a core element of our strategy for service

delivery to our customers. At the same time, we are

continuously enhancing our non-branch channels,

including internet banking and mobile banking, to

give our customers the power to use technology for

safe and convenient banking. The ICICI brand has

become synonymous with growth and innovation,

and is the only Indian brand to feature in the Brandz

list of the top 50 global brands. We will build this

brand further through a range of initiatives to broaden

and deepen our presence across the country and our

relationships with our customers.

Our insurance, asset management, securities and

private equity subsidiaries have performed very well

during the year, as a result of which we have achieved

substantial increase in our consolidated profits. Our

life insurance subsidiary has achieved accounting

profits for the first time since its inception. All these

businesses, led by outstanding teams, are well-

positioned to capitalise on the growth opportunities

in their respective market segments.

As we focus on enhancing our capabilities to

serve our corporate and retail customers across

India’s towns and cities, it is also our endeavour to

proactively reach out to rural India and to the vast

numbers of our people who do not have access to

formal financial services. We are significantly scaling

up our work in the area of financial inclusion with

the objective of empowering more and more people

to participate in economic activity. In addition to the

work we are doing as part of our regular business

activities, we are also, through the ICICI Foundation

for Inclusive Growth, seeking to make a deep

impact on the socio-economic empowerment of

the less privileged sections of our people, through

initiatives in education, health, financial inclusion

and strengthening of civil society organisations.

The coming decade is a decade of opportunity for

India and Indians. We at the ICICI Group are focused

on capitalising on the growth opportunities in the

financial services sector. We are fully energised

and committed towards playing our part in realising

the potential of India, empowering more and more

Indians to participate in the growth process and

creating value for all our stakeholders. We look

forward to your continued encouragement and

support in this endeavour.

With best wishes,

CHANDA D. KOCHHAR