ICICI Bank 2010 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

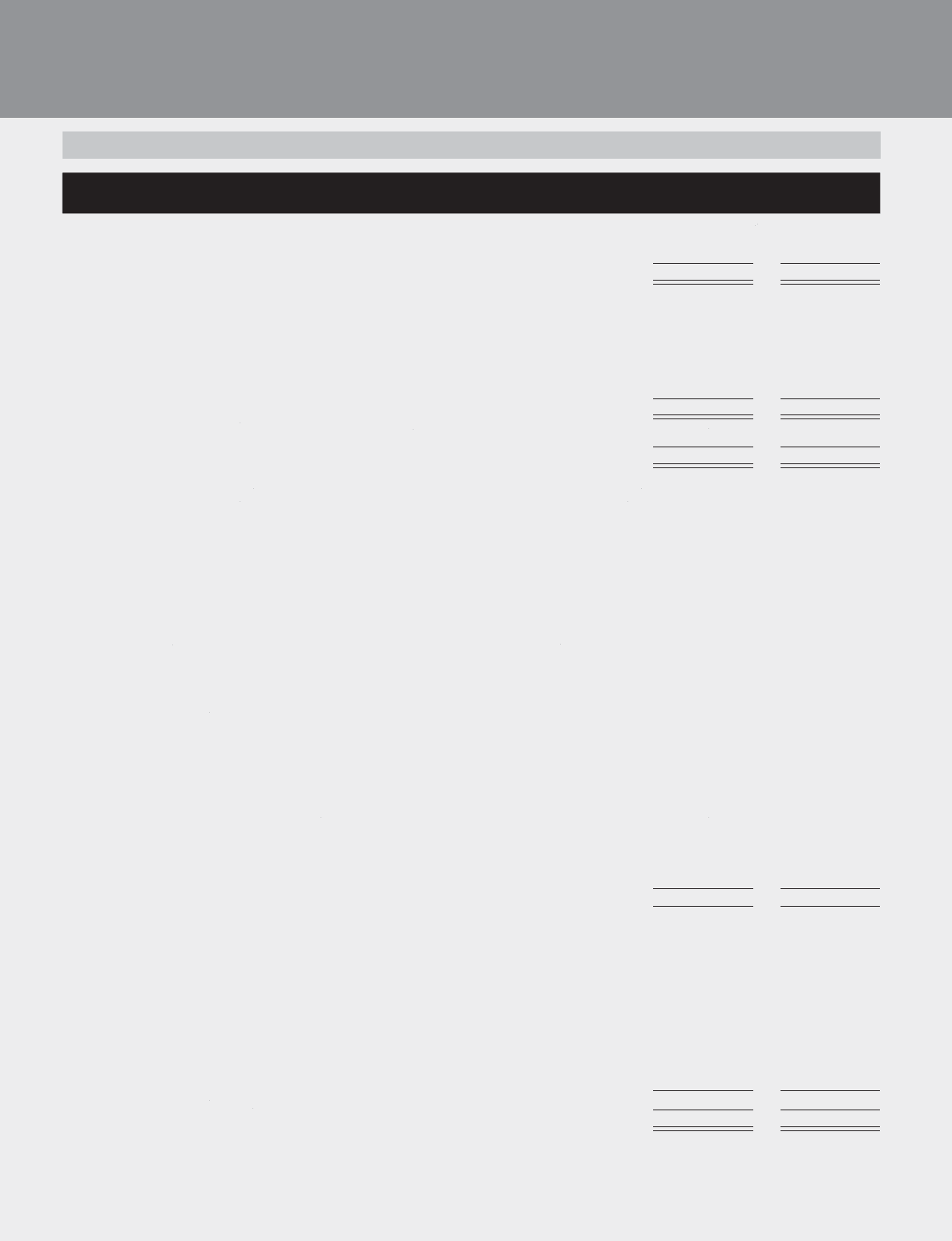

F57

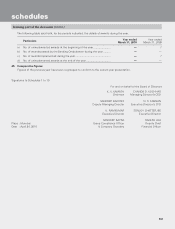

schedules

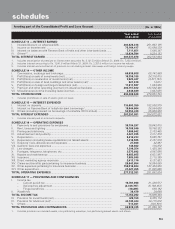

(Rs. in ‘000s)

forming part of the Consolidated Balance Sheet (Contd.)

At

31.03.2010 At

31.03.2009

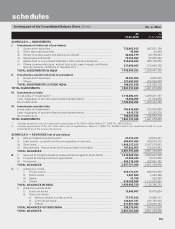

SCHEDULE 2A — MINORITY INTEREST

Opening minority interest ....................................................................................................... 9,105,054 7,311,906

Subsequent increase/(decrease)............................................................................................. 3,598,992 1,793,148

CLOSING MINORITY INTEREST ........................................................................................... 12,704,046 9,105,054

SCHEDULE 3 — DEPOSITS

A. I. Demand deposits

i) From banks .................................................................................................... 14,856,747 7,455,983

ii) From others ................................................................................................... 300,667,768 215,177,801

II. Savings bank deposits .......................................................................................... 622,221,663 515,147,064

III. Term deposits

i) From banks .................................................................................................... 88,149,385 158,017,816

ii) From others ................................................................................................... 1,389,827,397 1,722,758,868

TOTAL DEPOSITS .................................................................................................................. 2,415,722,960 2,618,557,532

B. I. Deposits of branches in India ................................................................................ 1,911,271,065 2,070,226,567

II. Deposits of branches/subsidiaries outside India ................................................... 504,451,895 548,330,965

TOTAL DEPOSITS 2,415,722,960 2,618,557,532

SCHEDULE 4 — BORROWINGS

I. Borrowings in India

i) Reserve Bank of India ............................................................................................ — —

ii) Other banks ............................................................................................................ 60,072,566 64,286,849

iii) Other institutions and agencies

a) Government of India ...................................................................................... 687,491 1,075,400

b) Financial institutions/others ........................................................................... 73,843,875 65,568,161

iv) Borrowings in the form of

a) Deposits ......................................................................................................... 35,459,265 26,693,558

b) Commercial paper ......................................................................................... 16,976,284 15,810,034

c) Bonds and debentures (excluding subordinated debt)

– Debentures and bonds guaranteed by the Government of India ......... 8,355,000 11,755,000

– Borrowings under private placement of bonds carrying maturity

of 1 to 30 years from the date of placement ........................................ 19,087,142 19,036,267

Bonds issued under multiple option/safety bonds series

– Regular interest bonds .......................................................................... 2,924,220 3,278,880

– Deep discount bonds ............................................................................ 2,517,822 4,332,005

– Tax saving bonds ................................................................................... 8,713,170 16,033,862

– Pension bonds ....................................................................................... 59,370 61,805

v) Application money-bonds1 ..................................................................................... 25,000,000 —

vi) Capital instruments

– Innovative Perpetual Debt Instruments (IPDI) (qualifying as Tier I capital) ... 13,010,000 13,010,000

– Hybrid debt capital instruments issued as bonds/debentures (qualifying

as upper Tier II capital) ................................................................................... 97,502,000 63,702,000

– Redeemable Non-Cumulative Preference Shares (RNCPS) ..........................

(Redeemable Non-Cumulative Preference Shares of Rs. 10 million

each issued to preference share holders of erstwhile ICICI Limited on

amalgamation redeemable at par on April 20, 2018) .................................... 3,500,000 3,500,000

– Unsecured redeemable debentures/bonds

(subordinated debt included in Tier II Capital) ............................................... 145,090,481 119,695,582

TOTAL BORROWINGS IN INDIA 512,798,686 427,839,403

II. Borrowings outside India

i) From multilateral/bilateral credit agencies

guaranteed by the Government of India for the equivalent of

Rs. 17,252.7 million (March 31, 2009: Rs. 20,523.1 million) ................................. 18,525,159 22,862,196

ii) From international banks, institutions and consortiums ....................................... 272,340,188 327,853,864

iii) By way of bonds and notes ................................................................................... 285,560,180 304,667,180

iv) Capital instruments

– Innovative Perpetual Debt Instruments (IPDI) (qualifying as Tier I capital) ... 15,199,979 17,158,574

– Hybrid debt capital instruments issued as bonds/debentures (qualifying

as upper Tier II capital) ................................................................................... 40,410,000 45,648,000

– Unsecured redeemable debentures/bonds

(subordinated debt included in Tier II Capital) ............................................... 11,817,445 14,030,789

v) Other borrowings ................................................................................................... 331,582 603,532

TOTAL BORROWINGS OUTSIDE INDIA 644,184,533 732,824,135

TOTAL BORROWINGS 1,156,983,219 1,160,663,538

1. Application money received towards subordinated bonds.

2. Secured borrowings in I above are Rs. 17,811.2 million (March 31, 2009: Rs. 16,738.5 million) and in II above are Rs. Nil.