ICICI Bank 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F16

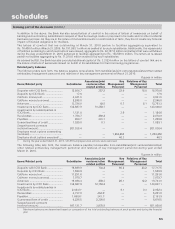

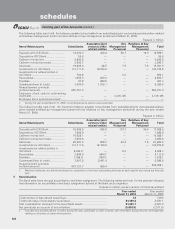

forming part of the Accounts (Contd.)

schedules

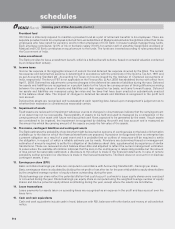

Provident fund

ICICI Bank is statutorily required to maintain a provident fund as a part of retirement benefits to its employees. There are

separate provident funds for employees inducted from erstwhile Bank of Madura and erstwhile Sangli Bank (other than those

employees who have opted for pension), and for other employees of ICICI Bank. In-house trustees manage these funds.

Each employee contributes 12.0% of his or her basic salary (10.0% for certain staff of erstwhile Sangli Bank and Bank of

Madura) and ICICI Bank contributes an equal amount to the funds. The funds are invested according to rules prescribed by

the Government of India.

Leave encashment

The Bank provides for leave encashment benefit, which is a defined benefit scheme, based on actuarial valuation conducted

by an independent actuary.

10. Income taxes

Income tax expense is the aggregate amount of current tax and deferred tax expense incurred by the Bank. The current

tax expense and deferred tax expense is determined in accordance with the provisions of the Income Tax Act, 1961 and

as per Accounting Standard 22 - Accounting for Taxes on Income issued by the Institute of Chartered Accountants of

India, respectively. The levy of FBT is not applicable as the Finance (No. 2) Act, 2009 has abolished the tax with effect from

April 1, 2009. Deferred tax adjustments comprise changes in the deferred tax assets or liabilities during the year. Deferred

tax assets and liabilities are recognised on a prudent basis for the future tax consequences of timing differences arising

between the carrying values of assets and liabilities and their respective tax basis, and carry forward losses. Deferred

tax assets and liabilities are measured using tax rates and tax laws that have been enacted or substantively enacted

at the balance sheet date. The impact of changes in deferred tax assets and liabilities is recognised in the profit and

loss account.

Deferred tax assets are recognised and re-assessed at each reporting date, based upon management’s judgement as to

whether their realisation is considered as reasonably certain.

11. Impairment of assets

Fixed assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount

of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the

carrying amount of an asset with future net discounted cash flows expected to be generated by the asset. If such assets

are considered to be impaired, the impairment is recognised by debiting the profit and loss account and is measured as

the amount by which the carrying amount of the assets exceeds the fair value of the assets.

12. Provisions, contingent liabilities and contingent assets

The Bank estimates the probability of any loss that might be incurred on outcome of contingencies on the basis of information

available up to the date on which the financial statements are prepared. A provision is recognised when an enterprise has

a present obligation as a result of a past event and it is probable that an outflow of resources will be required to settle

the obligation, in respect of which a reliable estimate can be made. Provisions are determined based on management

estimates of amounts required to settle the obligation at the balance sheet date, supplemented by experience of similar

transactions. These are reviewed at each balance sheet date and adjusted to reflect the current management estimates.

In cases where the available information indicates that the loss on the contingency is reasonably possible but the amount

of loss cannot be reasonably estimated, a disclosure to this effect is made in the financial statements. In case of remote

possibility neither provision nor disclosure is made in the financial statements. The Bank does not account for or disclose

contingent assets, if any.

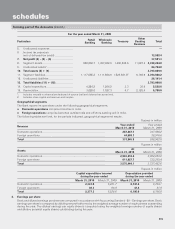

13. Earnings per share (EPS)

Basic and diluted earnings per share are computed in accordance with Accounting Standard-20 – Earnings per share.

Basic earnings per share is calculated by dividing the net profit or loss after tax for the year attributable to equity shareholders

by the weighted average number of equity shares outstanding during the year.

Diluted earnings per share reflect the potential dilution that could occur if contracts to issue equity shares were exercised

or converted during the year. Diluted earnings per equity share is computed using the weighted average number of equity

shares and dilutive potential equity shares outstanding during the year, except where the results are anti-dilutive.

14. Lease transactions

Lease payments for assets taken on operating lease are recognised as an expense in the profit and loss account over the

lease term.

15. Cash and cash equivalents

Cash and cash equivalents include cash in hand, balances with RBI, balances with other banks and money at call and short

notice.