ICICI Bank 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

‘Claims against the Bank not acknowledged as debts’, represents demands made by the government of India’s

tax authorities in excess of the provisions made in our accounts, in respect of income tax, interest tax, wealth tax,

service tax and sales tax/VAT matters. Based on consultation with counsel and favourable decisions in our own or

other cases, the management believes that the liability is not likely to actually arise. Other items for which the Bank

is contingently liable primarily include credit derivatives, repurchase and securitisation-related obligations.

As a part of our project financing and commercial banking activities, we have issued guarantees to enhance the

credit standing of our customers. These generally represent irrevocable assurances that we will make payments

in the event that the customer fails to fulfill its financial or performance obligations. Financial guarantees are

obligations to pay a third party beneficiary where a customer fails to make payment towards a specified financial

obligation. Performance guarantees are obligations to pay a third party beneficiary where a customer fails to

perform a non-financial contractual obligation. The guarantees are generally for a period not exceeding 10 years.

The credit risks associated with these products, as well as the operating risks, are similar to those related to

other types of financial instruments. We generally have collateral available to reimburse potential losses on the

guarantees. Margins available to reimburse losses realised under guarantees was Rs. 11.69 billion at year-end

fiscal 2009 compared to Rs. 17.69 billion at year-end fiscal 2010. Other property or security may also be available

to us to cover losses under guarantees.

We are obligated under a number of capital contracts. Capital contracts are job orders of a capital nature, which

have been committed. Estimated amounts of contracts remaining to be executed on capital account aggregated

Rs. 5.28 billion at year-end fiscal 2010 compared to Rs. 4.46 billion at year-end fiscal 2009. The increase in fiscal

2010 was primarily on account of new branches and office premises.

Capital Adequacy

Our capital adequacy framework seeks to ensure that we maintain adequate capital at all times and plan

appropriately for our future capital requirements. The capital adequacy framework is supported by a Board

approved internal capital adequacy assessment process, which encompasses our capital planning for current and

future periods by taking into consideration our strategic focus and business plan and assessment of all material

risks including stress testing.

We are subject to the Basel II capital adequacy guidelines stipulated by RBI. Under Pillar 1 of the RBI guidelines

on Basel II, we follow the standardised approach for credit and market risk and the basic indicator approach for

operational risk. The RBI guidelines on Basel II require us to maintain a minimum capital to risk-weighted assets

ratio (CRAR) of 9.0% and a minimum Tier-1 CRAR of 6.0% on an ongoing basis. RBI has directed banks to maintain

capital at the higher of the minimum capital required as per Basel II or a specified percentage of the minimum

capital required as per Basel I (80% at March 31, 2010).

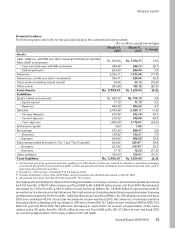

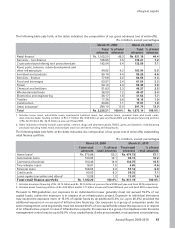

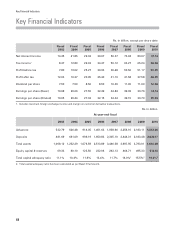

Following table sets forth the capital adequacy ratios of the Bank as per RBI guidelines on Basel I and Basel II.

Rs. in billion, except percentages

As per RBI guidelines

on Basel I As per RBI guidelines

on Basel II

March 31,

2009 March 31,

2010 March 31,

2009 March 31,

2010

Tier-1 capital Rs. 420.10 Rs. 432.61 Rs. 421.96 Rs. 410.62

Tier-2 capital 129.72 181.57 131.59 160.41

Total capital 549.81 614.18 553.55 571.03

Credit risk - risk weighted assets (RWA) 3,171.94 2,899.15 3,151.95 2,485.59

Market risk - RWA 281.44 309.28 206.98 221.06

Operational risk - RWA N.A. N.A. 205.70 235.16

Total RWA Rs. 3,453.38 Rs. 3,208.43 Rs. 3,564.63 Rs. 2,941.81

Tier-1 CRAR 12.16% 13.48% 11.84% 13.96%

Tier-2 CRAR 3.76% 5.66% 3.69% 5.45%

Total CRAR 15.92% 19.14% 15.53% 19.41%

59

Annual Report 2009-2010

khayaal aapka