ICICI Bank 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis

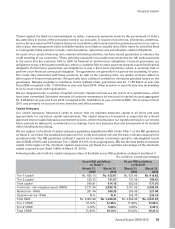

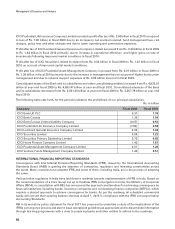

ICICI Prudential Life Insurance Company Limited recorded a profit after tax of Rs. 2.58 billion in fiscal 2010 compared

to loss of Rs. 7.80 billion in fiscal 2009 due to an increase in net premium earned, fund management fees, risk

charges, policy fees and other charges and due to lower operating and commission expenses.

Profit after tax of ICICI Lombard General Insurance Company Limited increased from Rs. 0.24 billion in fiscal 2009

to Rs. 1.44 billion in fiscal 2010 primarily due to increase in operational efficiency and higher gains on sale of

investments following improved market conditions in fiscal 2010.

Profit after tax of ICICI Securities Limited increased from Rs. 0.04 billion in fiscal 2009 to Rs. 1.23 billion in fiscal

2010 on account of improved capital market conditions.

Profit after tax of ICICI Prudential Asset Management Company increased from Rs. 0.01 billion in fiscal 2009 to

Rs. 1.28 billion in fiscal 2010 primarily due to the increase in management fees on account of higher funds under

management and due to scheme support expenses of Rs. 0.92 billion incurred in fiscal 2009.

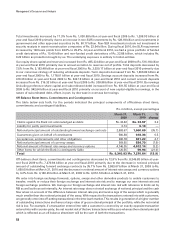

Consolidated assets of the Bank and its subsidiaries and other consolidating entities increased from Rs. 4,826.91

billion at year-end fiscal 2009 to Rs. 4,893.47 billion at year-end fiscal 2010. Consolidated advances of the Bank

and its subsidiaries decreased from Rs. 2,661.30 billion at year-end fiscal 2009 to Rs. 2,257.78 billion at year-end

fiscal 2010.

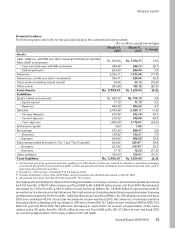

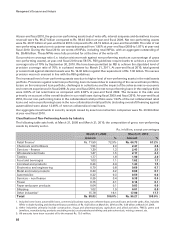

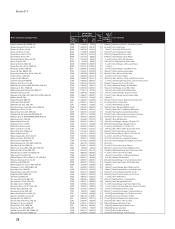

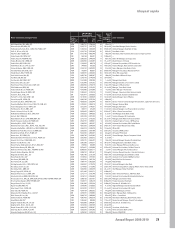

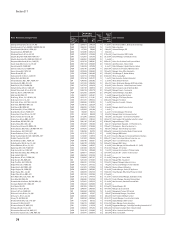

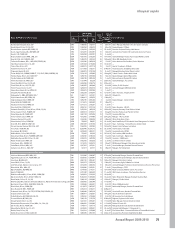

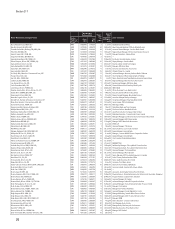

The following table sets forth, for the periods indicated, the profit/(loss) of our principal subsidiaries.

Rs. in billion

Company Fiscal 2009 Fiscal 2010

ICICI Bank UK PLC 0.31 1.76

ICICI Bank Canada 1.39 1.54

ICICI Bank Eurasia Limited Liability Company (0.07) 0.53

ICICI Prudential Life Insurance Company Limited (7.80) 2.58

ICICI Lombard General Insurance Company Limited 0.24 1.44

ICICI Securities Limited 0.04 1.23

ICICI Securities Primary Dealership Limited 2.72 0.85

ICICI Home Finance Company Limited 1.43 1.61

ICICI Prudential Asset Management Company Limited 0.01 1.28

ICICI Venture Funds Management Company Limited 1.48 0.51

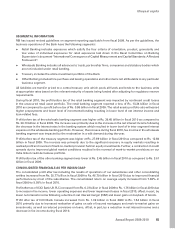

INTERNATIONAL FINANCIAL REPORTING STANDARDS

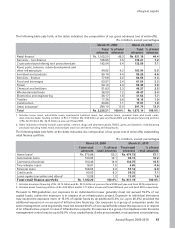

Convergence with International Financial Reporting Standards (IFRS), issued by the International Accounting

Standards Board (IASB) is gaining the attention of companies, regulators and investing communities across

the world. Many countries have adopted IFRS and some of them, including India, are in the process of adopting

the same.

Various Indian regulators in India have laid down a roadmap towards implementation of IFRS in India. Based on

the recommendations of a Core Group set up to facilitate IFRS convergence in India, the Ministry of Corporate

Affairs (MCA), in consultation with RBI, has announced the approach and timelines for achieving convergence by

financial institutions including banks, insurance companies and non-banking finance companies (NBFCs), which

requires a phased approach to achieve convergence for banks. As per the roadmap, all scheduled commercial

banks will convert their opening balance sheet as at April 1, 2013 in compliance with the IFRS converged Indian

Accounting Standards.

RBI in its monetary policy statement for fiscal 2011 has proposed to undertake a study of the implications of the

IFRSs convergence process and also to issue operational guidelines as appropriate and to disseminate information

through learning programmes with a view to preparing banks and other entities to adhere to the roadmap.

66