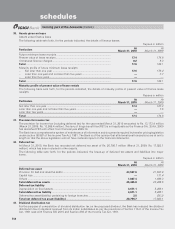

ICICI Bank 2010 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F43

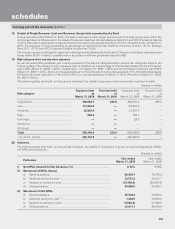

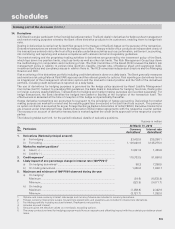

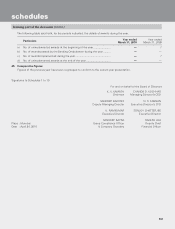

35. Forward rate agreement (FRA)/Interest rate swaps (IRS)

The following table sets forth, for the periods indicated, the details of the forward rate agreements/interest rate swaps.

Rupees in million

Particulars At

March 31, 2010 At

March 31, 2009

i) The notional principal of rupee swap agreements ............................................. 1,870,819.1 1,942,528.9

ii) Losses which would be incurred if all counter parties failed to fulfil their

obligations under the agreement1 ...................................................................... 20,533.2 35,591.8

iii) Collateral required by the Bank upon entering into swaps ................................ ——

iv) Concentration of credit risk arising from the rupee swaps2 ............................... 500.0 919.7

v) The fair value of rupee trading swap book3 ........................................................ (180.5) 622.1

1. For trading portfolio both mark-to-market and accrued interest have been considered and for hedging portfolio, only accrued interest

has been considered.

2. Credit risk concentration is measured as the highest net receivable under swap contracts from a particular counter party.

3. Fair value represents mark-to-market including accrued interest.

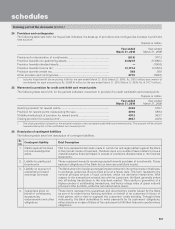

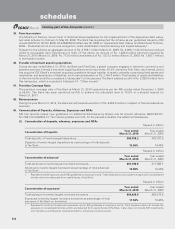

36. Exchange traded interest rate derivatives

The following table sets forth, for the periods indicated, the details of exchange traded interest rate derivatives.

Rupees in million

Particulars At

March 31, 2010 At

March 31, 2009

i) Notional principal amount of exchange traded interest rate derivatives

undertaken during the year (instrument-wise)

a) Euro dollar futures ....................................................................................... ——

b) Treasury note futures – 10 years ................................................................ —7,608.0

c) Treasury note futures – 5 years .................................................................. ——

d) Treasury note futures – 2 years .................................................................. —6,390.7

e) NSE – GOI Bond futures ............................................................................. 0.2 N.A

ii) Notional principal amount of exchange traded interest rate derivatives

outstanding (instrument-wise)

a) Euro dollar futures ....................................................................................... ——

b) Treasury note futures – 10 years ................................................................ ——

c) Treasury note futures – 5 years .................................................................. ——

d) Treasury note futures – 2 years .................................................................. ——

e) NSE – GOI Bond futures ............................................................................ —N.A

iii) Notional principal amount of exchange traded interest rate derivatives

outstanding and not “highly effective ” (instrument-wise) ................................. N.A N.A

iv) Mark-to-market value of exchange traded interest rate derivatives

outstanding and not “highly effective” (instrument-wise) .................................. N.A N.A

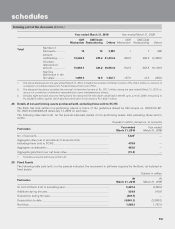

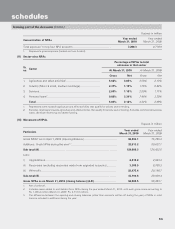

37. Penalties/fines imposed by RBI and other banking regulatory bodies

There was no penalty imposed by RBI and other banking regulatory bodies during the year ended March 31, 2010

(March 31, 2009: Rs. 400).

38. Small and micro enterprises

Under the Micro, Small and Medium Enterprises Development Act, 2006 which came into force from October 2, 2006,

certain disclosures are required to be made relating enterprises covered under the Act. During the year ended

March 31, 2010, the amount paid to vendors registered under the MSMED Act, 2006 after the due date was Rs. 65.2 million

(March 31, 2009: Nil). An amount of Rs. 1.7 million (March 31, 2009: Nil) has been charged to profit & loss account towards

accrual of interest on these delayed payments.

schedules

forming part of the Accounts (Contd.)