ICICI Bank 2010 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F38

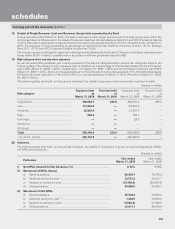

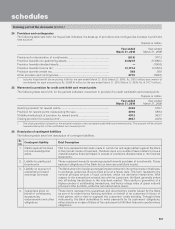

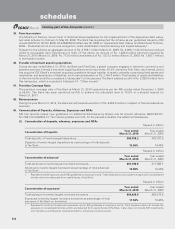

Sr.

no. Contingent liability Brief Description

5. Currency swaps, interest

rate swaps, currency

options and interest rate

futures

This item represents the notional principal amounts of various derivative instruments

which the Bank undertakes in its normal course of business. The Bank offers these

products to its customers to enable them to transfer, modify or reduce their foreign

exchange and interest rate risks. The Bank also undertakes these contracts to manage

its own interest rate and foreign exchange positions. With respect to the transactions

entered into with its customers, the Bank generally enters into off-setting transactions

in the inter-bank market. This results in generation of a higher number of outstanding

transactions, and hence a large value of gross notional principal of the portfolio, while

the net market risk is lower.

6. Other items for which

the Bank is contingently

liable

Other items for which the Bank is contingently liable include primarily the securitisation,

notional principal amounts of credit derivatives and repurchase obligations. The Bank

is also obligated under a number of capital contracts. Capital contracts are job orders

of a capital nature which have been committed.

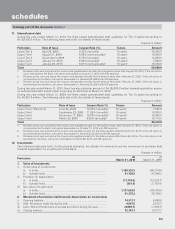

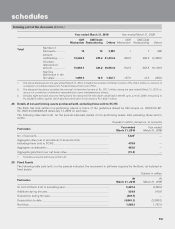

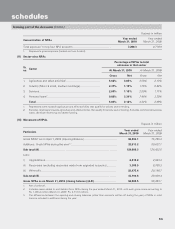

27. Information in respect of restructured assets

The following table sets forth, for the periods indicated, details of loan assets subjected to restructuring.

Rupees in million

Year ended March 31, 2010 Year ended March 31, 2009

CDR

Mechanism SME Debt

Restructuring Others CDR

Mechanism SME Debt

Restructuring Others

Standard advances

restructured3

Number of

Borrowers ............. 11 11 3,806 1 7 937

Amount

outstanding .......... 14,186.6 397.6 40,918.8 928.0 406.4 13,282.7

Of which:

restructured

amount ................. 12,444.3 251.4 39,248.4 912.2 263.9 9,917.5

Sacrifice

(diminution in the

fair value) .............. 1,006.0 4.8 1,406.5 107.0 12.2 196.0

Sub- standard

advances

restructured

Number of

Borrowers ............. 3198——51

Amount

outstanding .......... 640.2 77.8 288.2 — — 213.4

Of which:

restructured

amount ................. 624.3 77.8 244.9 — — 213.4

Sacrifice

(diminution in the

fair value) .............. 80.7 5.9 8.7 — — 12.0

Doubtful advances

restructured Number of

Borrowers ............. ——3———

Amount

outstanding .......... — — 207.2 ———

Of which:

restructured

amount ................. — — 187.8 ———

Sacrifice

(diminution in the

fair value) .............. — — 17.5 ———

schedules

forming part of the Accounts (Contd.)