ICICI Bank 2010 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F44

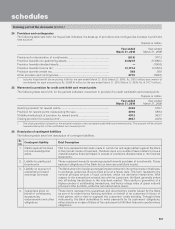

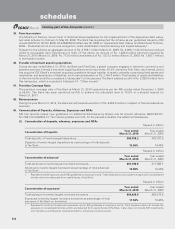

39. Farm loan waiver

The Ministry of Finance, Government of India had issued guidelines for the implementation of the Agriculture debt waiver

and relief scheme for farmers on May 23, 2008. The Bank has implemented the scheme as per guidelines issued by RBI

circular DBOD No. BP.BC.26/21.04.048/2008-09 dated July 30, 2008 on “Agricultural Debt Waiver and Debt Relief Scheme,

2008 – Prudential norms on income recognition, asset classification and provisioning and Capital Adequacy”.

Pursuant to the scheme an aggregate amount of Rs. 2,758.1 million (March 31, 2009: Rs. 2,666.7 million) has been waived

which is recoverable from Government of India. Of the above, an amount of Rs. 1,220.8 million has been received by

March 31, 2010 (March 31, 2009: Rs. 773.0 million) and balance of Rs. 1,537.3 million (March 31, 2009: Rs. 1,893.7 million)

is receivable in future.

40. Transfer of merchant acquiring operations

During the year ended March 31, 2010, the Bank and First Data, a global company engaged in electronic commerce and

payment services, formed a merchant acquiring alliance and a new entity, 81.0% owned by First Data, was formed, which

has acquired ICICI Bank’s merchant acquiring operations through transfer of assets, primarily comprising fixed assets and

receivables, and assumption of liabilities, for a total consideration of Rs. 3,744.0 million. This transfer of assets and liabilities

to the new entity would be considered a ‘slump sale’ for tax purposes. The Bank realised a profit of Rs. 2,029.0 million from

this transaction, which is included in Schedule 14 - “Other income”.

41. Provision Coverage Ratio

The provision coverage ratio of the Bank at March 31, 2010 computed as per the RBI circular dated December 1, 2009

is 59.5%. The Bank has been permitted by RBI to achieve the stipulated level of 70.0% in a phased manner by

March 31, 2011.

42. Bancassurance

During the year March 31, 2010, the Bank earned fees/remuneration of Rs. 2,955.9 million in respect of the bancassurance

business.

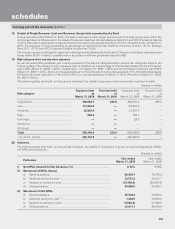

43. Concentration of Deposits, Advances, Exposures and NPAs

RBI has recently issued new guidelines for additional disclosures by Banks vide its circular reference DBOD.BP.BC.

No.79/21.04.018/2009-10. The following tables set forth, for the periods indicated, the additional disclosures.

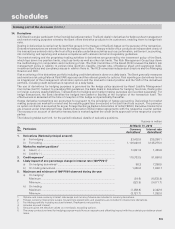

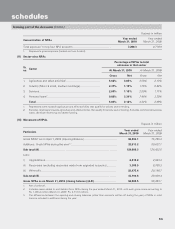

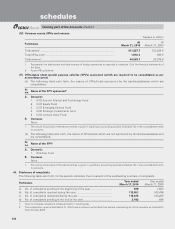

(I) Concentration of deposits, advances, exposures and NPAs

Rupees in million

Concentration of Deposits Year ended

March 31, 2010 Year ended

March 31, 2009

Total deposits of twenty largest depositors ................................................. 304,189.2 424,751.8

Deposits of twenty largest depositors as a percentage of total deposits

of the Bank .................................................................................................... 15.06% 19.45%

Rupees in million

Concentration of advances1Year ended

March 31, 2010 Year ended

March 31, 2009

Total advances to twenty largest non-bank borrowers ................................ 881,190.5 817,692.1

Advances to twenty largest borrowers as percentage of total advances

of the Bank .................................................................................................... 18.09% 15.24%

1. Represents credit exposure as per RBI guidelines on exposure norms. Total advances do not include the exposure to consolidated

entities which are deducted from capital funds of the Bank.

Rupees in million

Concentration of exposures1Year ended

March 31, 2010 Year ended

March 31, 2009

Total exposure to twenty largest non-bank borrowers ................................ 904,426.8 860,515.8

Exposures to twenty largest non-bank borrowers as percentage of total

exposure of the Bank on borrowers. ............................................................ 17.50% 15.42%

1. Represents credit and investment exposures as per RBI guidelines on exposure norms. Total exposure does not include the

exposure to consolidated entities which are deducted from capital funds of the Bank. It also does not include SLR investments

and mandatory contributions towards shortfall in advances to priority sector.

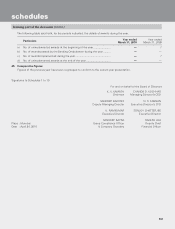

schedules

forming part of the Accounts (Contd.)