ICICI Bank 2010 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F75

schedules

forming part of the Consolidated Accounts (Contd.)

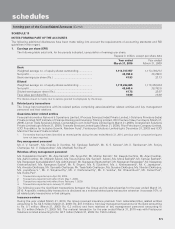

The weighted average fair value of options granted during the year ended March 31, 2010 is Rs. 199.91 (March 31, 2009:

Rs. 331.19)

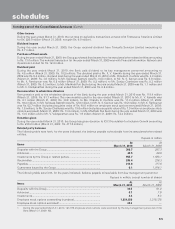

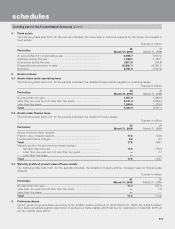

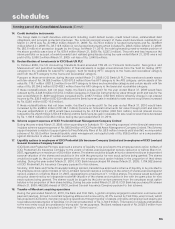

The following table sets forth, for the periods indicated, a summary of the status of the Bank’s stock option plan.

Rupees, except number of options

Stock options outstanding

Year ended March 31, 2010 Year ended March 31, 2009

Particulars Number of

options

Weighted

average

exercise price

Number of

options

Weighted

average

exercise price

Outstanding at the beginning of the year .............. 18,992,504 685.05 15,638,152 596.32

Add: Granted during the year ................................ 1,731,000 434.78 5,640,500 912.30

Less: Lapsed during the year ................................ 365,372 661.78 1,723,001 737.40

Less: Exercised during the year ........................... 1,594,672 366.38 563,147 336.96

Outstanding at the end of the year ........................ 18,763,460 689.50 18,992,504 685.05

Options exercisable ............................................... 10,104,780 609.18 7,188,420 496.10

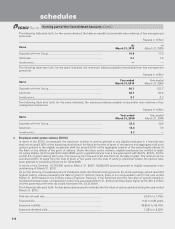

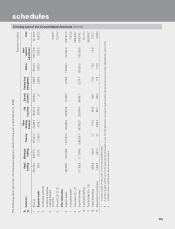

The following table sets forth, summary of stock options outstanding at March 31, 2010.

Range of exercise price

(Rupees per share)

Number of shares

arising out of options

(Number of shares)

Weighted average

exercise price

(Rupees)

Weighted average

remaining contractual life

(Number of years)

105–299 117,601 146.21 2.03

300–599 9,339,639 462.04 6.08

600–999 9,238,220 923.24 7.61

1,000–1,399 68,000 1,114.57 7.65

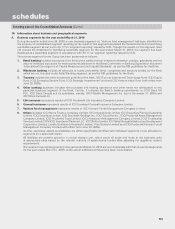

The options were exercised regularly throughout the year and the weighted average share price as per National Stock

Exchange (NSE) price volume data during the year ended March 31, 2010 was Rs. 853.80 (March 31, 2009: Rs. 723.55).

The Finance (No. 2) Act, 2009 has abolished fringe benefit tax and introduced tax on the scheme in the hands of the

employees as perquisites which is computed on the difference between the fair market value on date of exercise and the

exercise price with effect from April 1, 2009.

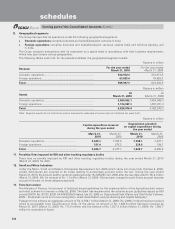

ICICI Prudential Life Insurance Company Limited has formulated various ESOS schemes, namely Founder I, Founder II,

2004-05, 2005-06, 2006-07 and 2007-08.

For ICICI Prudential Life Insurance Company Limited there is no compensation cost for the year ended March 31, 2010

based on the intrinsic value of options. If the entity had used the fair value of options based on the Black-Scholes model,

compensation cost for the year ended March 31, 2010 would have been higher by Rs. 175.1 million (March 31, 2009:

Rs. 359.0 million).

The key assumptions used to estimate the fair value of options are given below.

Risk-free interest rate ............................................................................................... 6.87% – 8.00% p.a.

Expected life ............................................................................................................ 3 – 5 years

Expected volatility .................................................................................................... 28.65% p.a.

Expected dividend yield ........................................................................................... 1.50% p.a.