ICICI Bank 2010 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31Annual Report 2009-2010

khayaal aapka

in a year is limited to 0.05% of ICICI Bank’s issued equity shares at the time of the grant, and the aggregate of

all such options is limited to 5% of ICICI Bank’s issued equity shares on the date of the grant (equivalent to 55.7

million shares at April 24, 2010).

Options granted for fiscal 2003 and earlier years vest in a graded manner over a three-year period, with 20%,

30% and 50% of the grants vesting in each year, commencing not earlier than 12 months from the date of grant.

Options granted for fiscal 2004 to 2008 vest in a graded manner over a four-year period, with 20%, 20%, 30%

and 30% of the grants vesting in each year, commencing not earlier than 12 months from the date of grant.

Options granted in April 2009 vest in a graded manner over a five year period with 20%, 20%, 30% and 30% of

grant vesting each year commencing from the end of 24 months from the date of grant.

On the basis of the recommendation of the Board Governance, Remuneration & Nomination Committee, the

Board at its Meeting held on April 24, 2010 approved a grant of approximately 2.49 million options for fiscal

2010 to eligible employees and wholetime Directors. Each option confers on the employee a right to apply

for one equity share of face value of Rs. 10 of ICICI Bank at Rs. 977.70, which was the closing price on the stock

exchange, which recorded the highest trading volume in ICICI Bank shares on April 23, 2010. These options

would vest over a four year period, with 20%, 20%, 30% and 30% respectively of the grant vesting each year

commencing from the end of 12 months from the date of the grant.

Options can be exercised within 10 years from the date of grant or five years from the date of vesting, whichever

is later. The price of the options granted prior to June 30, 2003 is the closing market price on the stock exchange,

which recorded the highest trading volume on the date of grant. The price for options granted on or after

June 30, 2003 till July 21, 2004 is equal to the average of the high and low market price of the equity shares in the

two week period preceding the date of grant of the options, on the stock exchange which recorded the highest

trading volume during the two week period. The price for options granted on or after July 22, 2004 is equal to

the closing price on the stock exchange which recorded the highest trading volume preceding the date of grant

of options. The above pricing is in line with the SEBI guidelines, as amended from time to time.

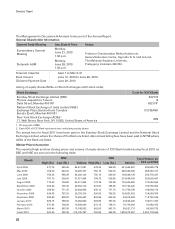

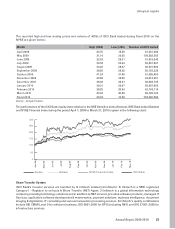

Particulars of options granted by ICICI Bank upto April 24, 2010 are given below:

Options granted155,201,055

Options vested 36,661,828

Options exercised 25,920,074

Number of shares allotted pursuant to exercise of options 25,920,074

Options forfeited/lapsed 8,127,506

Extinguishment or modification of options Nil

Amount realised by exercise of options (Rs.) 5,288,748,500

Total number of options in force 21,153,475

1. Includes options granted to wholetime Directors pending RBI approval.

No employee was granted options during any one year equal to or exceeding 0.05% of the issued equity shares

of ICICI Bank at the time of the grant.

The diluted earnings per share (EPS) pursuant to issue of shares on exercise of options calculated in accordance

with AS-20 was Rs. 35.99 in fiscal 2010 against basic EPS of Rs. 36.14. Since the exercise price of ICICI Bank’s

options is the last closing price on the stock exchange, which recorded the highest trading volume preceding

the date of grant of options, there is no compensation cost in fiscal 2010 based on the intrinsic value of options.

However, if ICICI Bank had used the fair value of options based on the Black-Scholes model, compensation

cost in fiscal 2010 would have been higher by Rs. 901.2 million and proforma profit after tax would have been

Rs. 39.35 billion. On a proforma basis, the Bank’s basic and diluted earnings per share would have been Rs. 35.33