ICICI Bank 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business Overview

Business Overview

ECONOMIC OVERVIEW

During fiscal 2010, India witnessed a significant revival in economic activity following the moderation in fiscal

2009. The economic recovery was evident across a wide range of sectors with the momentum gaining strength in

the second half of fiscal 2010. Industrial activity, as reflected by the Index of Industrial Production (IIP), increased

by 10.4% during fiscal 2010 as against 2.7% in fiscal 2009. During October 2009-March 2010 the IIP increased

by 14.3% compared to 0.6% during the corresponding period in the previous year. The growth in IIP was largely

driven by the manufacturing sector which recorded a growth of 10.9% during fiscal 2010 compared to 3.1% during

the corresponding period in the previous year. Growth in the manufacturing sector accelerated to 15.4% during

October 2009-March 2010 compared to 0.4% during the corresponding period in the previous year. External trade

also revived from the third quarter of fiscal 2010, with growth in exports turning positive from October 2009, after

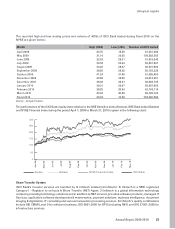

a decline for 12 consecutive months. Equity markets also witnessed strong revival in fiscal 2010 with the BSE

Sensex increasing by 80.5% from 9,709 at March 31, 2009 to 17,528 at March 31, 2010.

The growth in gross domestic product (GDP) during the first half of fiscal 2010 was 7.0% compared to 6.0% during

the second half of fiscal 2009. However, during the third quarter of fiscal 2010, GDP growth moderated to 6.0%

mainly due to a 2.8% decline in agricultural output following below normal monsoons, and moderation in services

sector growth to 6.6%. Reflecting the overall improvement in the economy, the Central Statistical Organisation

(CSO) has placed advance estimates of GDP growth for fiscal 2010 at 7.2%.

Liquidity in the system remained comfortable following the continuation of a relatively accommodative monetary

policy stance for a large part of fiscal 2010. During fiscal 2010, capital flows revived significantly with net foreign

institutional investment inflows of US$ 23.6 billion during April-December 2009 compared to net outflows of

US$ 11.3 billion in the corresponding period of fiscal 2009. Net foreign direct investments at US$ 16.5 billion

during April-December 2009 were also higher as compared to US$ 14.3 billion during the corresponding period

of the previous year. The revival in trade and lower oil prices combined with strong capital inflows improved

India’s balance of payments, which recorded a surplus of US$ 11.3 billion in the first nine months of fiscal 2010

as compared to a deficit of US$ 20.4 billion in the corresponding period of fiscal 2009. The rupee appreciated

by 11.4% against the US dollar from Rs. 51.0 per US dollar at year-end fiscal 2009 to Rs. 45.1 per US dollar at

year-end fiscal 2010.

During the second half of fiscal 2010, inflationary pressures increased driven largely by food price inflation.

Inflation as measured by the Wholesale Price Index increased from a low of –1.0% in June 2009 to 9.9% in March

2010. Following the recovery in economic activity and increased inflationary concerns, the Reserve Bank of India

(RBI) commenced its exit from the monetary policy stance adopted in response to the global financial crisis. RBI

increased the statutory liquidity ratio (SLR) by 100 basis points from 24.0% to 25.0% in October 2009, the cash

reserve ratio (CRR) by 75 basis points to 5.75% in February 2010 and the repo and reverse repo rates by 25 basis

points each to 5.0% and 3.5% respectively in March 2010. RBI, in its annual policy review in April 2010, announced

a further increase of 25 basis points each in CRR to 6.0%, repo rate to 5.25% and reverse repo rate to 3.75%.

In addition to the increase in policy rates, RBI also withdrew the special liquidity support measures instituted in

fiscal 2009 in response to the global financial crisis. As a result of inflationary concerns, increased policy rates

and the large government borrowing programme, the yield on 10-year government securities increased by 81

basis points from 7.01% at March 31, 2009 to 7.82% at March 31, 2010.

The pace of economic recovery in India is reflective of the transitory impact of the global financial crisis on the

Indian economy. India’s strong domestic fundamentals are expected to remain operative over the long-term, with

the twin drivers of consumption and investment supporting sustained high growth for the economy. Over the next

year, while economic recovery is expected to strengthen and assume a broad-based nature, the management of

inflation expectations, the pace of withdrawal of stimulus measures and the management of systemic liquidity in

view of the large government borrowing programme and the impact of volatile global markets on capital flows

will be key factors impacting the economy and financial markets.

FINANCIAL SECTOR OVERVIEW

During fiscal 2010, the year-on-year growth in non-food bank credit declined from 17.8% in March 2009 to 16.9%

in March 2010. Based on data published by RBI, for the period upto February 26, 2010, year-on-year growth in non-

food bank credit was driven primarily by a 24.4% growth in credit to agriculture and allied activities and a 20.1%

growth in credit to the industrial sector. Within the industrial sector, credit to infrastructure grew by 42.3% during

this period. At February 26, 2010, industry accounted for 43.2% of non-food gross bank credit, retail credit for 20.1%,

34