ICICI Bank 2010 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Directors’ Report

14

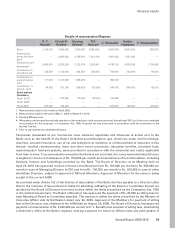

risks and regulatory compliance issues. It reviews key risk indicators covering areas such as credit risk,

interest rate risk, liquidity risk, and foreign exchange risk and the limits framework, including stress test

limits, for various risks. It also carries out an assessment of the capital adequacy based on the risk profile of

the Bank’s balance sheet and reviews the status with respect to implementation of Basel II norms. The Credit

Committee reviews developments in key industrial sectors and Bank’s exposure to these sectors as well as

to large borrower accounts. The Audit Committee provides direction to and also monitors the quality of the

internal audit function. The Asset Liability Management Committee is responsible for managing the balance

sheet and reviewing asset-liability position of the Bank.

• Policies approved from time to time by the Board of Directors/Committees of the Board form the governing

framework for each type of risk. The business activities are undertaken within this policy framework.

• Independent groups and sub-groups have been constituted across the Bank to facilitate independent

evaluation, monitoring and reporting of various risks. These groups function independently of the business

groups/sub-groups.

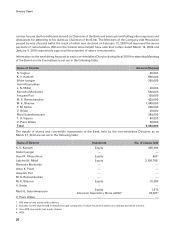

The Bank has dedicated groups namely the Global Risk Management Group (GRMG), Compliance Group, Corporate

Legal Group, Internal Audit Group and the Financial Crime Prevention and Reputation Risk Management Group

(FCPRRMG), with a mandate to identify, assess and monitor all of the Bank’s principal risks in accordance with

well-defined policies and procedures. GRMG is further organised into the Global Credit Risk Management Group,

the Global Market Risk Management Group and the Global Operational Risk Management Group. These groups

are completely independent of all business operations and coordinate with representatives of the business

units to implement ICICI Bank’s risk management methodologies. The internal audit and compliance groups are

responsible to the Audit Committee of the Board.

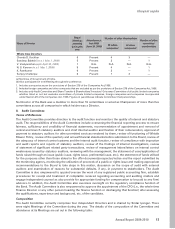

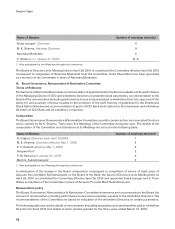

CORPORATE GOVERNANCE

The corporate governance framework in ICICI Bank is based on an effective independent Board, the separation

of the Board’s supervisory role from the executive management and the constitution of Board Committees,

generally comprising a majority of independent Directors and chaired by an independent Director, to oversee

critical areas.

I. Philosophy of Corporate Governance

ICICI Bank’s corporate governance philosophy encompasses not only regulatory and legal requirements, such as

the terms of listing agreements with stock exchanges, but also several voluntary practices aimed at a high level of

business ethics, effective supervision and enhancement of value for all stakeholders. The corporate governance

framework adopted by the Bank already encompasses a significant portion of the recommendations contained

in the Corporate Governance Voluntary Guidelines 2009 issued by the Ministry of Corporate Affairs.

Whistle Blower Policy

ICICI Bank has formulated a Whistle Blower Policy. In terms of this policy, employees of ICICI Bank and its group

companies are free to raise issues, if any, on breach of any law, statute or regulation by the Bank and on the

accounting policies and procedures adopted for any area or item and report them to the Audit Committee through

specified channels. This mechanism has been communicated and posted on the Bank’s intranet.

ICICI Bank Code of Conduct for Prevention of Insider Trading

In accordance with the requirements of the Securities and Exchange Board of India (SEBI) (Prohibition of

Insider Trading) Regulations, 1992, ICICI Bank has instituted a comprehensive code of conduct for prevention of

insider trading.

Group Code of Business Conduct and Ethics

The Board of Directors has approved a Group Code of Business Conduct and Ethics for Directors and

employees of the ICICI Group. The Code aims at ensuring consistent standards of conduct and ethical business

practices across the constituents of the ICICI Group. This Code is also available on the website of the Bank