ICICI Bank 2010 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F93

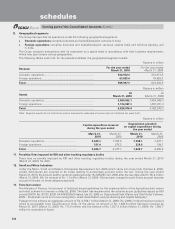

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

z regulatory capital requirements as per the RBI guidelines;

z assessment of material risks and impact of stress testing;

z perception of credit rating agencies, shareholders and investors;

z future strategy with regard to investments or divestments in subsidiaries; and

z evaluation of options to raise capital from domestic and overseas markets, as permitted by RBI from

time to time.

The Bank formulates its internal capital level targets based on the ICAAP and endeavours to maintain its

capital adequacy level in accordance with the targeted levels at all times.

Monitoring and reporting

The Board of Directors of ICICI Bank maintains an active oversight over the Bank’s capital adequacy levels.

On a quarterly basis an analysis of the capital adequacy position and the risk weighted assets and an

assessment of the various aspects of Basel II on capital and risk management as stipulated by RBI, are

reported to the Board. Further, the capital adequacy position of the banking subsidiaries and the significant

non-banking subsidiaries based on the respective host regulatory requirements is also reported to the

Board. In line with the RBI requirements for consolidated prudential report, the capital adequacy position

of the ICICI Group (consolidated) is reported to the Board on a half-yearly basis.

Further, the ICAAP which is an annual process also serves as a mechanism for the Board to assess and

monitor the Bank’s and the Group’s capital adequacy position over a certain time horizon.

Capital adequacy of the subsidiaries

Each subsidiary in the Group assesses the adequate level of capitalisation required to meet its respective

host regulatory requirements and business needs. The Board of each subsidiary maintains oversight over the

capital adequacy framework for the subsidiary either directly or through separately constituted committees.

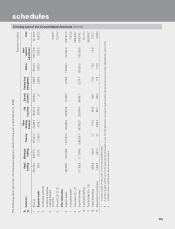

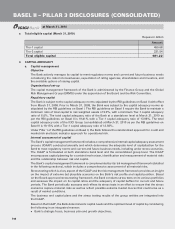

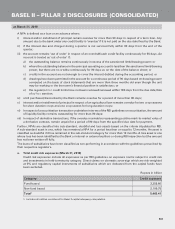

b. Capital requirements for various risk areas (March 31, 2010)

As required by RBI guidelines on Basel II, the Bank’s capital requirements have been computed using the

standardised approach for credit risk, standardised duration method for market risk and basic indicator

approach for operational risk. The minimum capital required to be held at 9.0% for credit, market and

operational risks is given below:

Rupees in billion

Risk area Amount1

Credit risk

Capital required

– for portfolio subject to standardised approach 260.76

– for securitisation exposures 2.05

Market risk

Capital required

– for interest rate risk 25.27

– for foreign exchange (including gold) risk 0.91

– for equity position risk 6.52

Operational risk

Capital required 24.59

Total capital requirement at 9.0% 320.10

Total capital funds of the Bank 681.22

Total risk weighted assets 3,556.62

Capital adequacy ratio 19.15%

1. Includes all entities considered for Basel II capital adequacy computation.

at March 31, 2010