ICICI Bank 2010 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F106

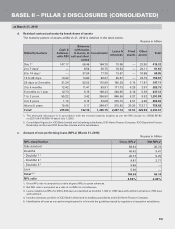

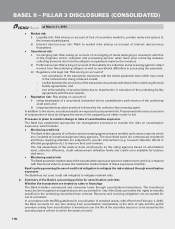

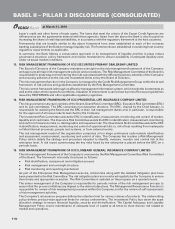

iv) Securitisation exposures retained or purchased (March 31, 2010) Rupees in billion

Exposure type1On-balance sheet Off-balance sheet Total

Vehicle/equipment loans 7.96 11.26 19.22

Home and home equity loans 22.48 0.14 22.62

Personal loans 10.99 7.67 18.66

Corporate loans 4.62 6.61 11.23

Mixed asset pool 6.84 10.90 17.74

Total 52.89 36.58 89.47

1. Securitisation exposures, include, but are not restricted to, liquidity facilities, other commitments and credit enhancements

such as interest only strips, cash collateral accounts and other subordinated assets as well as direct assignments. The amounts

are net of provisions. Credit enhancements have been stated at gross levels and not been adjusted for their utilisation.

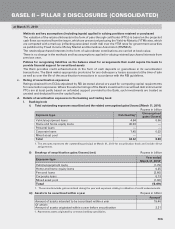

v) Risk weight bands break-up of securitisation exposures retained or purchased (March 31, 2010)

Rupees in billion

Exposure type1<100% risk

weight 100% risk

weight >100% risk

weight Total

Vehicle/equipment loans 5.25 2.38 0.07 7.70

Home and home equity loans 11.19 4.50 — 15.69

Personal loans 3.17 2.16 — 5.33

Corporate loans 3.73 0.41 0.32 4.46

Mixed asset pool 4.17 4.17 0.25 8.59

Total 27.51 13.62 0.64 41.77

Total capital charge 0.63 1.23 0.20 2.06

1. Includes direct assignments.

vi) Securitisation exposures deducted from capital (March 31, 2010) Rupees in billion

Exposure type1

Exposures deducted

entirely from Tier-1

capital

Credit enhancement

(interest only)

deducted from total

capital 2

Other exposures

deducted from

total capital 3

Vehicle/equipment loans — 0.45 11.06

Home and home equity loans — 0.87 7.19

Personal loans — 1.77 11.57

Corporate loans — — 5.64

Mixed asset pool — 1.27 7.88

Total — 4.36 43.34

1. Includes direct assignments.

2. Includes subordinate contribution amount deducted from capital.

3. Includes credit enhancements (excluding interest only strips). Credit enhancements have been stated at gross levels

and not been adjusted for their utilisation.

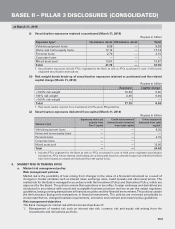

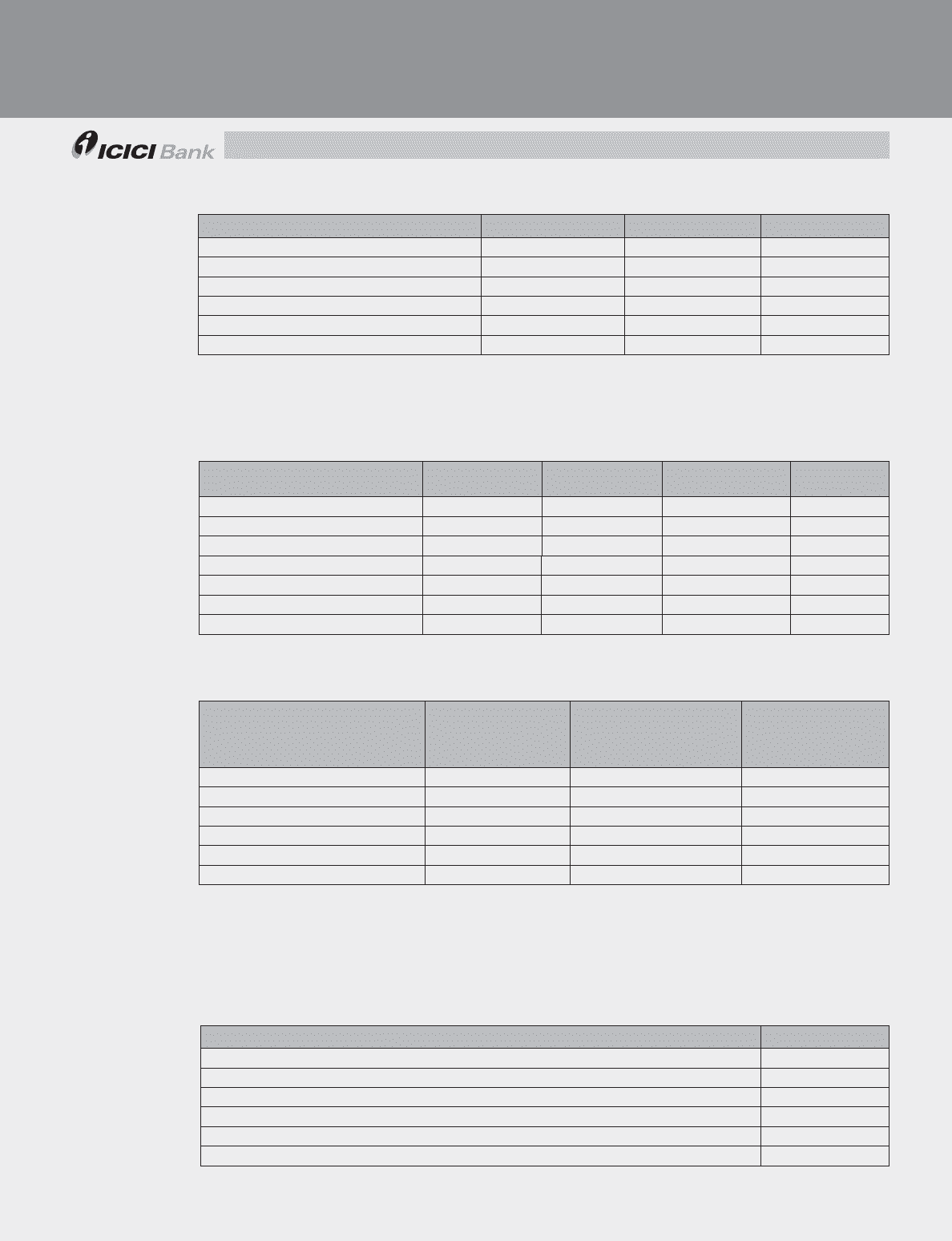

II. Trading book

i) Aggregate amount of exposures securitised for which the Bank has retained some exposures

subject to market risk (March 31, 2010) Rupees in billion

Exposure type Total1

Vehicle/equipment loans 9.56

Home and home equity loans 3.64

Personal loans 3.52

Corporate loans —

Mixed asset pool 16.60

Total 33.32

1. The amounts represent the outstanding principal at March 31, 2010 for securitisation deals.

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2010