ICICI Bank 2010 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F88

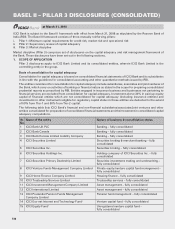

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

ICICI Bank is subject to the Basel II framework with effect from March 31, 2008 as stipulated by the Reserve Bank of

India (RBI). The Basel II framework consists of three-mutually reinforcing pillars:

i. Pillar 1: Minimum capital requirements for credit risk, market risk and operational risk

ii. Pillar 2: Supervisory review of capital adequacy

iii. Pillar 3: Market discipline

Market discipline (Pillar 3) comprises set of disclosures on the capital adequacy and risk management framework of

the Bank. These disclosures have been set out in the following sections.

1. SCOPE OF APPLICATION

Pillar 3 disclosures apply to ICICI Bank Limited and its consolidated entities, wherein ICICI Bank Limited is the

controlling entity in the group.

Basis of consolidation for capital adequacy

Consolidation for capital adequacy is based on consolidated financial statements of ICICI Bank and its subsidiaries

in line with the guidelines for consolidated accounting and other quantitative methods issued by RBI.

The entities considered for consolidation for capital adequacy include subsidiaries, associates and joint ventures of

the Bank, which carry on activities of banking or financial nature as stated in the scope for preparing consolidated

prudential reports as prescribed by RBI. Entities engaged in insurance business and businesses not pertaining to

financial services are excluded from consolidation for capital adequacy. Investment above 30% in paid-up equity

capital of financial entities which are not consolidated for capital adequacy (including insurance entities) and

investments in other instruments eligible for regulatory capital status in those entities are deducted to the extent

of 50% from Tier-1 and 50% from Tier-2 capital.

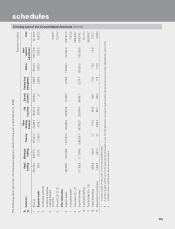

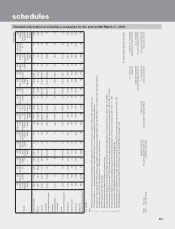

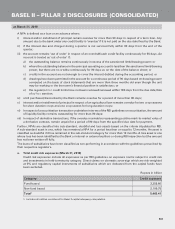

The following table lists ICICI Bank’s financial and non-financial subsidiaries/associates/joint ventures and other

entities consolidated for preparation of consolidated financial statements and their treatment in consolidated capital

adequacy computations.

Sr.

No. Name of the entity Nature of business & consolidation status

1 ICICI Bank UK PLC Banking – fully consolidated

2 ICICI Bank Canada Banking – fully consolidated

3 ICICI Bank Eurasia Limited Liability Company Banking – fully consolidated

4 ICICI Securities Limited Securities broking & merchant banking – fully

consolidated

5 ICICI Securities Inc. Securities broking – fully consolidated

6 ICICI Securities Holdings Inc. Holding company of ICICI Securities Inc. – fully

consolidated

7 ICICI Securities Primary Dealership Limited Securities investment, trading and underwriting –

fully consolidated

8 ICICI Venture Funds Management Company Limited Private equity/venture capital fund management –

fully consolidated

9 ICICI Home Finance Company Limited Housing finance – fully consolidated

10 ICICI Trusteeship Services Limited Trusteeship services – fully consolidated

11 ICICI Investment Management Company Limited Asset management – fully consolidated

12 ICICI International Limited Asset management – fully consolidated

13 ICICI Prudential Pension Funds Management

Company Limited Pension fund management – fully consolidated

14 ICICI Eco-net Internet and Technology Fund1Venture capital fund – fully consolidated

15 ICICI Equity Fund1Unregistered venture capital fund –

fully consolidated

at March 31, 2010