ICICI Bank 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4. Improving access to financial services

To provide access to financial services for low-income and other under-served customer, the ICICI Group

has undertaken a range of initiatives. For ICICI Bank, financial inclusion initiatives have been a part of its

core business strategy, being achieved through different channels and technologies. Financial Innovation

& Network Operations (FINO), a company sponsored by the ICICI Group, is working with a number of

players in the financial sector for customer acquisition and servicing using the smart card model. Total

enrolments of FINO have crossed 14 million covering 233 districts in 21 states, through tie-up with

21 banks, three insurance companies, seven government entities and 20 MFIs. ICICI Bank’s Self Help

Group (SHG) and-micro lending programmes facilitate access to financial services for low-income rural

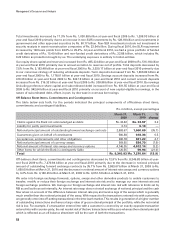

households. With a micro lending book of Rs. 34.17 billion, ICICI Bank’s micro lending initiative reached

more than 4.0 million low-income households in India this year. The Bank’s Small Enterprises Group

reaches out to nearly a million small and medium enterprises across the country, offering solutions

using multiple low cost channels like the Internet, dedicated call center teams, mobile banking, ATMs,

debit and credit cards, as well as branch networks. The Bank met its priority sector lending and direct

agriculture lending targets for fiscal 2010, and at March 26, 2010, total priority sector lending advances

of Rs. 626.98 billion were 51.3% of the residual adjusted net bank credit (RANBC) against the regulatory

target of 50.0% of RANBC, while direct agriculture advances at Rs. 173.29 billion represented 14.2% of

RANBC, higher than the regulatory target of 13.5%.

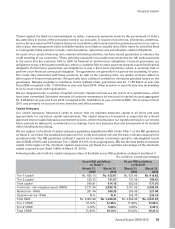

ICICI Prudential Life Insurance Company (ICICI Life) provides micro-insurance to low-income population. Its

micro insurance product for rural population, Sarv Jana Suraksha, provides insurance for a minimal premium

of Rs. 50 per annum. More than 330,000 policies have been issued during fiscal 2010. In collaboration with

the Micro Insurance Innovation Facility of the International Labour Organisation, ICICI Life has adopted

a multi-pronged approach to address financial inclusion among the tea labour community in Assam. It

developed and launched Anmol Nivesh, a unique savings cum insurance debt linked product with special

features like flexibility in premiums, a customised delivery model and innovative consumer education.

ICICI Lombard General Insurance Company (ICICI General) has partnered with various central and state

government ministries/agencies to offer insurance coverage under schemes like the Rashtriya Swasthya

Bima Yojana (RSBY) for below poverty line workers in the unorganised sector; insurance scheme for

weavers; and the Rajiv Gandhi Shilpi Swasthya Bima Yojana for handicraft artisans. The company has

covered over 8.0 million families under these schemes. ICICI General has pioneered the introduction of

weather insurance in India and works with a number of financial intermediaries to deliver weather insurance

in 14 states.

5. Protecting the environment

i. Clean technology initiatives

ICICI Bank’s Technology Finance Group (TFG) implements programmes for multilateral agencies in areas

of collaborative research and development (R&D), energy, environment and healthcare. TFG’s initiatives

include efforts to attract and channel private financing into cleaner technologies, to create public-private

partnerships to mitigate greenhouse gas emissions through energy efficiency and to promote sustainable

development.

TFG assisted in the introduction of codes of environmental management (ISO 14000) to the country.

It also supported clean coal concepts like coal washeries and coal bed methane for the first time in

the country. TFG supported the first passenger electric car in India (Reva), currently being exported to

the UK and 17 other countries. It also supported the introduction of municipal shared savings concept

through the energy service company (ESCO) route, which help save expenditure for street lighting and

water pumping. Another significant initiative was the introduction of green rating of buildings through

setting up of CII’s Green Business Centre (GBC). The GBC now has 350 million square feet of floor space

registered for green rating that will save energy, water and emissions.

49

Annual Report 2009-2010

khayaal aapka