ICICI Bank 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

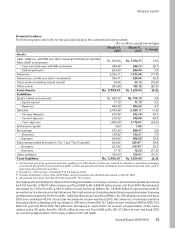

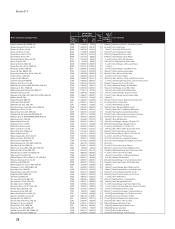

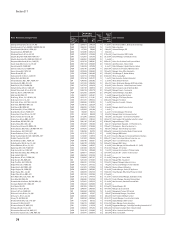

SEGMENTAL INFORMATION

RBI has issued revised guidelines on segment reporting applicable from fiscal 2008. As per the guidelines, the

business operations of the Bank have the following segments:

zRetail Banking includes exposures which satisfy the four criteria of orientation, product, granularity and

low value of individual exposures for retail exposures laid down in the Basel Committee on Banking

Supervision’s document “International Convergence of Capital Measurement and Capital Standards: A Revised

Framework”.

zWholesale Banking includes all advances to trusts, partnership firms, companies and statutory bodies which

are not included under retail banking.

zTreasury includes the entire investment portfolio of the Bank.

zOther Banking includes hire purchase and leasing operations and other items not attributable to any particular

business segment.

All liabilities are transfer priced to a central treasury unit, which pools all funds and lends to the business units

at appropriate rates based on the relevant maturity of assets being funded after adjusting for regulatory reserve

requirements.

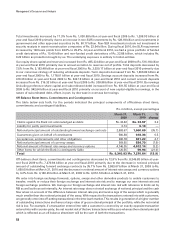

During fiscal 2010, the profit before tax of the retail banking segment was impacted by continued credit losses

in the unsecured retail asset portfolio. The retail banking segment reported a loss of Rs. 13.34 billion in fiscal

2010 as compared to a profit before tax of Rs. 0.58 billion in fiscal 2009. The retail assets portfolio also witnessed

higher prepayments and lower level of incremental lending resulting in lower level of net interest income and

loan-related fees.

Profit before tax of the wholesale banking segment was higher at Rs. 36.45 billion in fiscal 2010 as compared to

Rs. 34.13 billion in fiscal 2009. The increase was primarily due to the increase in the net interest income following

the decrease in the interest rates in the banking system which resulted in lower level of in inter-segment interest

expense on the wholesale banking portfolio. However, the increase during fiscal 2010, fee income in the wholesale

banking segment was impacted by the moderation in credit demand during the year.

Profit before tax of the treasury segment was higher at Rs. 27.89 billion in fiscal 2010 as compared to Rs. 12.84

billion in fiscal 2009. The increase was primarily due to the significant recovery in equity markets resulting in

realised profit and reversal of mark-to-market provision held on equity investments. Further, a contraction in credit

spreads due to improved global market conditions resulted in the reversal of mark-to-market provisions on our

India linked credit derivatives portfolio.

Profit before tax of the other banking segment was lower at Rs. 2.45 billion in fiscal 2010 as compared to Rs. 3.61

billion in fiscal 2009.

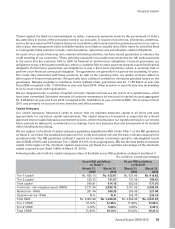

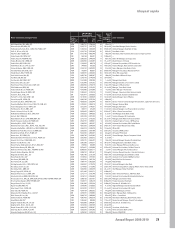

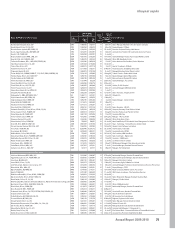

CONSOLIDATED FINANCIALS AS PER INDIAN GAAP

The consolidated profit after tax including the results of operations of our subsidiaries and other consolidating

entities increased from Rs. 35.77 billion in fiscal 2009 to Rs. 46.70 billion in fiscal 2010 due to improved financial

performance by most of the subsidiaries. The consolidated return on average equity increased from 7.83% in

fiscal 2009 to 9.59% in fiscal 2010.

Profit after tax of ICICI Bank UK PLC increased from Rs. 0.31 billion in fiscal 2009 to Rs. 1.76 billion in fiscal 2010 due

to increase in fee income, lower operating expenses and lower impairment losses in fiscal 2010, offset, in part, by

lower net interest income following a decline in net interest margin (NIM) and lower gains on buyback of bonds.

Profit after tax of ICICI Bank Canada increased from Rs. 1.39 billion in fiscal 2009 to Rs. 1.54 billion in fiscal

2010 primarily due to increased realisation of gains on sale of insured mortgages and mark-to-market gains on

investments, as well as reduced provisions on loans, offset, in part, by a reduction in net interest income and a

decrease in fee income during fiscal 2010.

65

Annual Report 2009-2010

khayaal aapka