ICICI Bank 2010 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196

|

|

F98

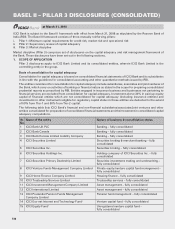

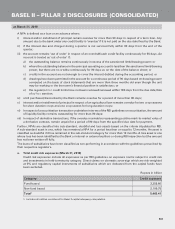

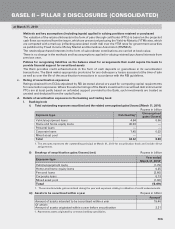

b. Geographic distribution of exposures (March 31, 2010)

Rupees in billion

Category Fund-based Non-fund based

Domestic 2,385.56 1,846.63

Overseas 970.10 263.12

Total13,355.66 2,109.75

1. Includes all entities considered for Basel II capital adequacy computation.

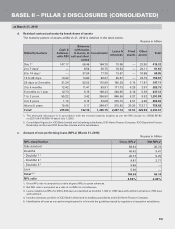

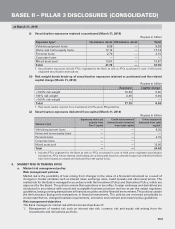

c. Industry-wise distribution of exposures (March 31, 2010)

Rupees in billion

Industry Fund-based Non-fund based

Retail finance11,135.91 32.35

Banks2215.22 296.36

Electronics and engineering 74.24 312.59

Crude petroleum/refining and petrochemicals 157.59 218.63

Services – non-finance 243.35 132.31

Services - finance 246.74 95.85

Road, port, telecom, urban development and other infrastructure 121.89 214.17

Iron/steel and products 114.06 122.64

Power 111.26 111.50

Metal and products (excluding iron and steel) 48.65 125.95

Construction 28.14 122.92

Food and beverages 121.57 29.40

Mutual funds 128.97 0.83

Wholesale/retail trade 73.62 46.11

Chemical and fertilisers 78.77 37.38

Drugs and pharmaceuticals 36.92 21.66

Cement 32.36 23.23

Shipping 23.38 31.25

Automobiles 27.60 26.69

Gems and jewellery 30.76 13.35

Manufacturing products (excluding metals) 30.37 12.46

Textiles 29.76 8.27

Mining 28.23 8.82

FMCG 22.19 2.33

Venture capital funds 2.61 0.06

Other industries 191.50 62.64

Total33,355.66 2,109.75

1. Includes home loans, automobile loans, commercial business loans, two wheeler loans, personal loans, credit cards, dealer

funding (Rs. 11.60 billion) and developer financing (Rs. 55.31 billion).

2. Includes balances with banks.

3. Includes all entities considered for Basel II capital adequacy computation.

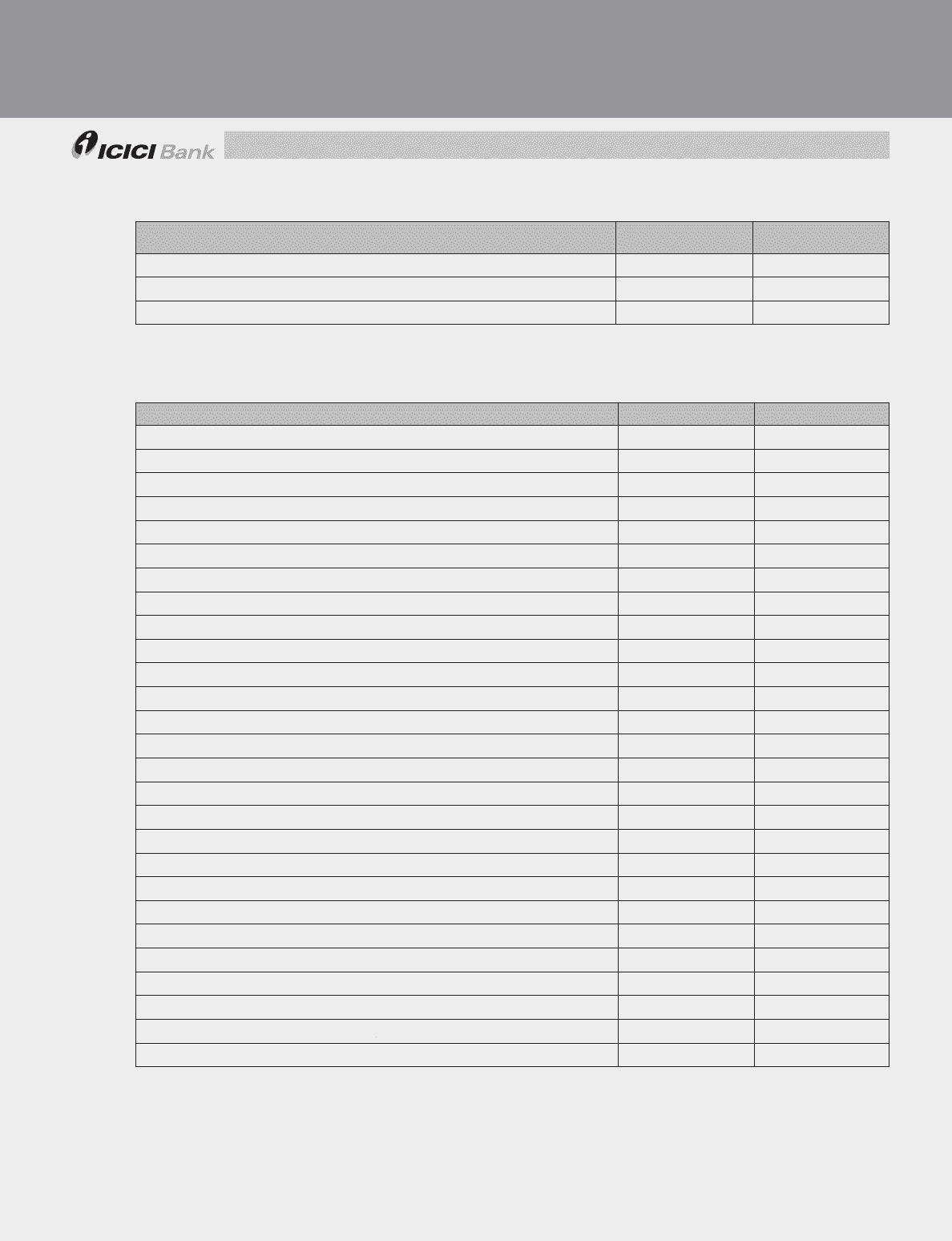

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2010